In the previous post I showed you what had caused the big losses at Fannie and Freddie to date. In short it was mark-to-market securities (on private label securities and the like) and interest rate hedging instruments that collapsed in value as interest rates went to zero.

I also showed that these losses were not likely to continue to be a drain on Fannie or Freddie.

What matters now is the vast (multi-trillion dollar) books of traditional business that they guarantee – mom and pop mortgages by people with good credit and no fancy mortgage terms or liars loans. These have not caused many actual losses to date (less than $6 billion at each company) but the provisions for losses from this business are large and getting larger.

It’s the future losses we need to worry about. And so now – unlike in the last post – I need to make estimates about the future to see what losses will be. Casey Stengel argued you should “never make predictions, especially about the future”. At the risk of being exposed as a fool I am going to breach Mr Stengel’s advice.

However I have some tools for making these predictions. The purpose of this post is to introduce readers to the tools…

Default curves that point to the sky

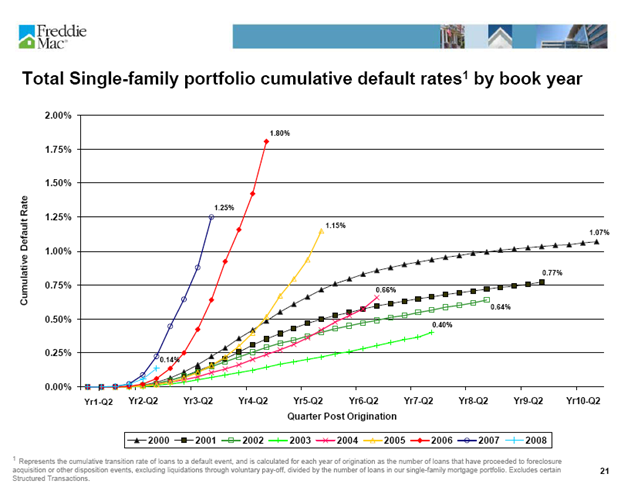

Both Fannie and Freddie publish default curves by vintage. Here is the Freddie Mac curve from the last quarterly results…

And here is the Fannie Mae curve from the last quarterly…

(click these pictures for more detail… you can find originals in the credit supplements both companies release…)

These curves show the cumulative default of a pool of mortgages (as a percentage of the original pool balance) over time.

Note that Freddie Mac defaults are lower in all recent vintages than Fannie Mae. I posted on that on this blog and asked for explanations. The correct explanation was given (and I have since checked it). Almost the entire difference is that Fannie Mae did considerably more business with Countrywide and IndyMac – and hence has a worse book of business in aggregate.

Also note that the curves for the 2006 and 2007 years in particular are very sour at both companies. 2005 is a bad year (but probably manageable) and 2004 and prior years will cause few problems.

Default not loss curves

These are default curves not loss curves. To turn them into loss curves you would need to know the severity by vintage and neither Fannie nor Freddie publish enough information to work that out (though you can get some reasonable estimates from the published data).

Take again the Freddie data. The 2000 vintage pool (meaning all the mortgages guaranteed by Freddie Mac in 2000) has had a cumulative default of about 1.07 percent. That means that 1.07 percent of the mortgages written in that year defaulted. Prior to the current mortgage bust 2000 was considered a bad year of business.

Nonetheless 1.07 percent default did not cause any problems for Freddie because the severity (loss given default) was less than 10 percent. The 1.1 percent default caused about 10 basis points of loss over a decade. Given the guarantee fees were almost 20 basis points per year this pool of business was profitable.

The problem with the 2006 and 2007 vintages is not only is the cumulative default quite large but the severity will also be very high. Fannie Mae severity during the last quarter was over 45 percent. High defaults multiplied by high losses given defaults means big problems.

How big – and how you might model them is the subject of the next post.

7 comments:

As you admit, numerical extrapolation is a fools game. Even knowing a lot about a function and all its derivatives (Tailor series expansion), the error outside of an interval can be very high.

That said, you are mainstream/practical enough to ignore the case where pre 2004 starts up-sloping. Many of these might have been refinanced and what is refinanced can't default.

Then again a graph like

http://www.calculatedriskblog.com/2009/08/american-corelogic-more-than-152.html

shows us that a lot of expensive places are underwater. I keep telling my colleagues that they were given a free option to walk. (Non-recourse loans.) So far they insisted that I am talking crazy. But just today one of them whined about him not wanting to pay that much for his house. I read more of such mind changes across the country.

Just saying, you have not modeled the cost of the walk away option yet. It is very non-linear and I doubt you can predict it by simple extrapolation.

I am aware how non-linear the walk-away option is...

But then the 2004 pool has only 175 billion in it and less than 2 percent delinquency.

Its just not going to hurt us. Simply a non-starter as an issue.

By contrast - the 2007 pool - which is as scary as anything - has 307 billion left and 6.8 percent delinquency.

That can hurt us. If I had really good loan-by-loan data on the 2007 and 2006 pool I think I could get myself really comfortable..

But yes - I worry terribly about my 2006 and 2007 year estimates - and I cover those things off mainly in Part VII...

J

Oh, the expensive places being underwater doesnt matter. None of the mrotgages in the trad book are abvoe 330K. If a million dollar house with 500K in mortgages sells for 400K then Fannie or Freddie loss equals zero.

J

Excellent analysis. The best I have read so far, or shall we say, there are not really any analysis out there, but anyway, this is good.

I look forward to reading more, and could you please advice me where I could find more information on your Fund?

I think if you could explore further two issues, that are very important.

Underwater mortgages are 400 BUSD at FNM and 350 at FRE as of June 30 2009. In the latest report FNM states that of these 150 is currently estimated to be underwater with more than 125%

Now they had Dec 31 2008 a serious delinquency rate on this part of 18%, or around 28 BUSD. In June 30 they had 25% delinquencies on about the same amount, that is around 38 BUSD.

Now we know NOTHING about HOW much above 125% these mortgagees are. What we know is that Fannie and Freddie, when they bought private label, or other than conforming loans, they bought the highest rated tranches.

I look at the report some years back, and the Alt-A portfolio then around 300 BUSD had an average FICO above 720 and a M2M LTV at that time of an average 57%. To me is sounds like this actually is the best tranche.

I assume that when they bought these AAA tranche, most mortgages actually were originated with low LTV and high FICO scorses, otherwise they would not have been in the tranche. The info about Alt-A given also supports this.

Do you have any other information you could combine with this to try to find out amount between 125-135, 135-145, etc.

I think, logically, FNM and FRE would have very few mortgages deep underwater. Since it mathematically impossible if they should have it, starting out with very low LTV 2,5 years ago.

I think the answer is very important since it will be from this 150 BUSD (FNM) that most of the credit loan losses will come.

The other thing which hurts especially FNM is the NPL's in that the forgone income stream from the mortgages is very costly. With a total of 177 BSUD of NPL's FNM on a rolling y-o-y basis is currently loosing, say, 8-10 BUSD in revenues, but still has the cost to finance these mortgages.

FRE 77 BUSD is in this respect better, even though they have about the same underwater delinquent mortgages, FRE overall NPL's are lower, which is good for its revenue.

I note that, still, 140 BUSD of these 177 BUSD FNM are above or not more than 120% underwater. I'm a little bit confused about this, since on one hand this means the borrower should have a high incentive to start paying again, or risk loosing the house that are currently not or only somewhat underwater, but on the other hand it also points to the fact the FNM does not foreclose even though they loose a lot of money holding above water mortgages.

Could you say anything about this?

Thanks in advance, will read your blog daily from now on.

The FT published a similar Moody's chart for Spain a few months ago. The similarities are evident. But they also provided a line, described as an 'index', that probably shows (assuming some kind of weighting) how badly hooked the banks and cajas are to post-2005 loans. Also of interest in both the U.S. ad here is the rapidity with which the 2008 vintage got airborne.

http://ftalphaville.ft.com/blog/2009/05/18/55898/the-pain-in-spain-will-be-felt-mostly-by-the-banks/?source=rss

or (if trolling is acceptable)

http://ibexsalad.blogspot.com/2009/05/how-to-rescue-cartel.html

I thought about it and you are probably right with regards to the older limits. That said my colleague bought his town house beginning of 2008 (!) for half a million from the developer using a 500 dollar (sic) down payment. Well, nothing like coming out of college and getting your first paycheck! At that time he told me he stole one from the developer.

In any case, this anecdote reminds me that you don't show graphs for 2008 and 2009. One would have expected more prudence, but this and the recent buying frenzy in the "low end" (<700k) tells me that the government took over the easy credit business.

I apologize for looking for holes in your arguments and giving you a hard time. In general I really like your articles.

go on Jono go on to your series

distract mildly..

Post a Comment