I purchased preferred shares in Washington Mutual when it was in distress and lost money when it was confiscated by Sheila Bair. I have argued that it was the most extraordinary action made by government during this crisis and that an essentially solvent bank was confiscated.

In anger I posted

my response to the WaMu takeover the day after it happened. I also purchased adwords on Google so that when you google Sheila Bair’s name you will get an advert linking to my blog and explaining why she should resign. It is no secret I dislike Sheila Bair.

Moreover there are

law suits (whose basic premise I agree with) that JP Morgan whilst doing due diligence on Washington Mutual was also badmouthing them in the press and encouraging the regulator to take them over. [It is easier to sue JPM than the Federal Government.]

That said – we have a fairly comprehensive proof that JP Morgan did lie to regulators. The only issue is did they lie to regulators when encouraging them to confiscate Washington Mutual or did they lie when they were conducting the stress test? If they lied to Sheila Bair to get them to confiscate WaMu and she believed them then she must resign. But the alternatives I see are worse.

Detailing the JP Morgan lies

First you need to look at

the document that JPM released when it took over WaMu.

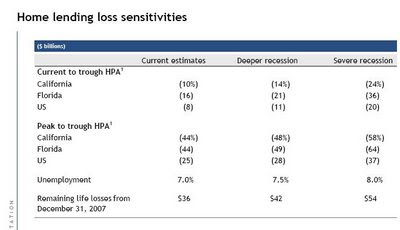

Here is – with what they think the losses will be in the various stress scenarios.

JP Morgan is predicting $36 billion in losses in WaMu's book in their base case and $54 billion in the "severe recession" case.

These losses are measured since December 31 2007. The losses as estimated in the stress test are from the end of 2008 – and to get the numbers consistent you need to take about 8 billion dollars off these numbers as about 8 billion in losses were realised during 2007.

It already looks like we are in the severe recession. Unemployment is well over 8 percent. On these numbers – numbers that were presented by JP Morgan to the market and to regulators – JPM has to take a further $46 billion in losses on the Washington Mutual book alone. (46=54-8).

Almost all of these losses come from mortgages. Indeed in the presentation JP Morgan made when it merged with Washington Mutual all the losses except about a billion dollars came from the mortgage book.

The only problem is that the losses estimated on mortgages by the regulators (including Sheila Bair) in the stress test include only $39 billion in losses – being 12 percent of the entire mortgage book. Here are the results of the stress test on JPMorgan.

The implication is that there are negative losses in the rest of JP Morgans very large book. This is unlikely.

So we are left with two possibilities both of which involve JP Morgan telling porkys:

- The losses as estimated by the JP Morgan and told to regulators when they were manipulating Sheila Bair into confiscating Washington Mutual were lies – indeed were so grotesquely over-estimated as to be absurd criminal lies or

- The losses as estimated by JP Morgan and the regulators in the stress test are grotesque under-estimates – which – in order to be that grotesquely wrong had to involve major misrepresentations of their book by JP Morgan.

It is possible that both sets of losses were grotesquely mis-estimated - though the differences here are so stark that a simple and honest "bit of both" is not possible.

I prefer the first choice. The losses at WaMu as suggested by JPM never made any sense – and I prefer the idea that – encouraged by JPM’s lying – Sheila Bair confiscated a solvent bank.

The second choice suggests the stress tests were totally phoney and allowed JP Morgan to lie at will. If that is correct the regulators have a duty to confiscate JPMorgan as its embedded losses (using similar ratios as they used in arguing for the Washington Mutual takeover) leave it desperately and diabolically insolvent.

The idea that Sheila Bair confiscated a solvent bank encouraged by lying bankers should not surprise anyone familiar with big-bank lobbying prowess. Most the bears in the blogosphere would prefer believe the stress test was phoney without any real assessemnt of likely losses.

John

Technical accounting note the losses in the stress test page were before 20 billion in purchasing adjustments. Those purchasing adjustments were JPMorgan over-estimating the losses at WaMu so - as the loans come in a little better than expected JPM shows better-than-real earnings.

POST SCRIPTS: The first response I got to this suggests a third possibility - that JP Morgan (and presumably all the other banks) were ASKED to give the regulators the information that they wanted to hear for the stress test - that they were asked to lie. That I suspect stretches reality. It is hard to keep things like that quiet - and also some banks (notably Wells Fargo) are very unhappy.

20 comments:

What is wrong with the possibility that in alternative 2, JPM gave the regulators whatever information they asked for, and the regulators, not wanting it to look too bad for Citibank, BAC and WFC, adjusted all the numbers to show that losses would be low across the board? I think you are taking for granted the statement that for JPM to have done so well in teh stresss test, they must have lied. In other words, when AM was examined, the FDIC was serious, and the sttress tests were not serious. P.S. I also lost monmey in WM, and had the double misfortune to have sold at teh bottom after the first announcement.

Can Wells Fargo's stress test result help interpret who is lying? According to this Marketwatch article

"In a presentation on its WaMu acquisition, J.P. Morgan forecast a 58% peak-to-trough slump in California home prices if the U.S. enters a severe recession. In Florida, house prices could fall 64% in such a scenario, while nationwide prices could drop 37%, the bank said.

J.P. Morgan also immediately wrote down the value of WaMu's assets by more than $30 billion, mainly because the giant bank expects losses on the thrift's mortgage holdings to be higher than previous expectations.

The write-downs assume that cumulative losses on WaMu's $51 billion option adjustable-rate mortgage portfolio will reach 20%.

That's a lot higher than the 12% cumulative losses that Fred Cannon, an analyst at Keefe, Bruyette & Woods, was expecting.

Wachovia has more than $100 billion of option ARMs."

http://www.marketwatch.com/news/story/jp-morgans-wamu-deal-sparks/story.aspx?guid=%7BAEDF6391-5116-4CD7-88E4-ADAB31A67EF6%7D&dist=msr_1

TIA

*imho*

""According to one banking source not involved in the sale process, any buyer would face immediate mark-to-market pressures from WaMu's mortgage portfolio. Noting that purchase accounting rules would force a buyer to immediately mark the portfolio to market prices, the banker said that the hole in WaMu's balance sheet upon purchase could be as high as $52 billion. On the other hand, if the bank was not sold, but recapitalized, the hole would be anywhere from $12 billion to $19 billion."

http://www.thedeal.com/dealscape/2009/03/wamu_zombies_arguments_on_the_rise.php

"JPM's presentation says they are acquiring the assets at fair value. So...it appears the regulators forced the bank to revalue its portfolio today to JPM's taste, whereupon the bank was immediately declared insolvent. Cute trick, that couldn't be done with Bear, because the bankruptcy laws differ of course from the insolvency laws for thrifts and banks."

http://www.nakedcapitalism.com/2008/09/cnbc-jp-morgan-to-acquire-wamus.html

Wells Fargo SAYS they're unhappy. But that could all be posturing for the shareholders.

Sunlight Is a Powerful Disinfectant

The Washington Mutual “sham” or “confiscation” theory isn’t just for columnist and angry shareholders anymore. Quinn (Co-counsel with Weil for WMI) filed a motion of discovery on May 1st that would be in the envy of most movie script writers.

In its lengthy motion, Quinn is asking Judge Walrath for full disclosure of all documents between FDIC, JPM with respect to WaMu. Quinn has laid out a series of suspicious events that are at a minimum accusing JPM of shorting for the purpose of devaluing, withholding deposits, planting moles in the WaMu organization, pre-arranged bidding for WaMu and downright collusion between the FDIC (Bair) and JPMc and breach of confidentiality agreements.

Quinn has requested some 54+ production request for documents which leads many WMI shareholders to believe that Quinn has the ‘smoking gun’ but wants to see if JPMc will produce the gun under orders from Judge Walrath, of course – Quinn will win either way as JPMc nor the FDIC will allow themselves to be the subject of court deposition or JPMc/FDIC will attempt to parlay its position in court and fail in its attempt to pull the wool over Judge Walraths and the public’s eye.

To quote a WMI shareholder “Sunlight is a powerful disinfectant…” and Quinn’s motion is going to test that axiom. And let’s not forget that an entire crew of dedicated and motivated WMI shareholders have found suspicious connections with respect to FDIC and JPM, to include JPM being given 3 weeks notice that a Bid for WaMu assets would take place, refused bids the night of the FDIC’s receivership by other banks by FDIC’s premise that the bids were non-conforming, OTS guidelines stated that WaMu was well capitalized - all finalizing in the minds of many WMI shareholders that the receivership of WaMu was planned and executed by parties with unclean hands.

Quinn’s motion will be ruled on by Judge Walrath on May 20th, 2009.

Link to motion: http://www.kccllc.net/documents/0812229/0812229090501000000000002.pdf

How about "a lot of both"?

Isn't it clear that the stress test was an elaborate advertising campaign to help the banks raise capital? They get a government imprimatur that their survival is assured and investment prospects sound, and they go to market that day, selling common stock at 10%+ off the market price.

With all the government guarantees, every dollar of private capital raised is one less dollar of government losses. The government was fully engaged in trying to pretty up the banks.

Keep fighting the good fight man.

John:

the stress tests losses are for TWO years, 2009 and 2010, and the JPM predicted WaMu losses are for "remaining (loan) life."

WFC complained about that for their own case since they took "remaining life" losses earlier on some loans and were not given a capital adjustment for the fact the stress test is for 2 years, hence were asked to put more capital than necessary.

for all your American readers: 'porkys' = lies.

I realise the WaMu losses were life of loan - but the stress test includes required reserves at year end 2010.

This will be a good 95% of life of loan losses as you need to embed losses that will be realised over the remaining life in those reserves.

J

Why should this be a surprise? JP Morgan also said they have been lending. To whom I am not sure, but obviously not to small business clients of Wamu.

This is the result of Sheila Bair's decision to kill a MAIN STREET BANK

Small business owners can now also thank FDIC for destroying their life line:

"For small business owners, a line of credit can be a lifesaver, giving them a buffer against cash-flow problems and enabling them to handle regular expenses such as payroll. But beginning in March, according to documents obtained by BusinessWeek, JPMorgan Chase suspended credit lines for a large number of business owners. According to someone familiar with the matter, the move affected thousands of businesses. They had been clients of Washington Mutual before Chase bought the ailing bank in September 2008. "

http://finance.yahoo.com/loans/article/107054/Snipping-Credit-Lines-for-Small-Businesses?sec=topStories&pos=9&asset=&ccode

*imho*

How did Wamu fail? What am I missing here? It had a tier I capital ratio, and "[r]ight before Washington Mutual failed, its TCE ratio was 7.8%"

http://www.cfo.com/article.cfm/13526111?f=singlepage

"Investment banks Goldman Sachs (6.19) and Morgan Stanley (4.33) actually strengthened their TCE ratios in 2008"

http://www.fool.com/investing/dividends-income/2009/02/12/which-banks-might-fail-the-stress-test.aspx

*imho*

John, Sorry to hear that you lost money on WaMu. However, I have to say that given the condition then and the alternative option of risking WaMu's fate, I would have gone with Sheila Bair, and I suspect the majority of this country. Even if it had been totally illegal. Get over it. Now onto Bank of America. Given the prognosis of the US economy for the next a few years is not good at all, well, I have been generous, it is dreadful for the ones in the know. Why are you still dabbling on the US financials; the risk/benefit margin is too high. Best for you, as a professional to get into food commodities, where the opportunities seem still vast. Hope that can make up several folds of your WaMu losses.

John... we have two things we know about I used to work at 650 5th av, and love Bronte to surf on. As far as wamu is concerned it had a single regulator in SFO for the entire country and she was not in most of the time, it engaged in what ever it could do to make a buck such as false swaring on legal papers.. so why not JP Morgan..masters at trying to change the old saw "there are no pigs on wall street", kind of like a fund reporting gains with out currency attribution know that one?

John

you said

"This will be a good 95% of life of loan losses as you need to embed losses that will be realised over the remaining life in those reserves."

Not quite.

This is from the document that explains the stress test methodology (the bold is mine) :

"The firms were asked to project their credit losses and revenues for the two years 2009 and 2010, including the level of reserves that would be needed at the end of 2010 to cover expected losses in 2011 , under two alternative economic scenarios"

the banks were explicitly asked to not project their losses until the end of the loan but just for the year 2011. This is consistent with Summers's strategy which consists of giving a pass to banks regarding prudent accounting principles so that they could earn their way out of trouble. And believe me, Banks are going to use this facility : I bet that loan reserves for year X+1 in the future will more or less match net revenues for year X. Welcome in Japan !

Charles - sorry. These are loans that existed at the end of 2007. The loan losses of the 2006 pool are stabilising everywhere now (not the 07 pool).

To suggest that there are substantial loan losses from the 2006 pool in 2012 and beyond just stretches reality.

J

John:

http://files.shareholder.com/downloads/ONE/639644400x0x236706/a742ea73-1b31-4a49-9112-03f08ab03a20/JPM_WM%20analyst%20presentation.pdf

take a look at page 17. It looks like they took $30 billion @ 9/30.

Basically, they assumed the assets and some of the liabilities (wiping out the common and a bunch of preferred/debt), which gave them $30 billion to write down loans.

They didn't book a profit in 3Q, so they had to use the $30 billion to write down the loans.

These financial statements are a real bitch, but I'm sure that if you looked, you could see exactly how they did it.

It's not that I'm not sympathetic to your cause. I've been on the wrong side pre TARP when the idea was "tough love."

It may seem surprising that in at least 3 cases, (WM, WB, CW) the needed writedowns were essentially exactly what was available after wiping out the common and the varying levels of debt (each was different).

It isn't so surprising when you think about the fact that they all wanted to do a deal, couldn't really book a profit at the time of purchase, and therefore booked exactly what was "available."

You could also look at page 20 of http://files.shareholder.com/downloads/ONE/639644400x0x240955/9a26da0d-de3d-4ceb-b303-ebff5b17f8ea/3Q08EarningsInvestorPresentation.pdf

This stuff would have to tie out to the 10Q, but they are very time consuming to read.

I can't explain all the details -- but think that they booked $30 of the problem stuff @ 3Q. That means that if you move to their more severe case they have more to go.

They also show a big number for purchase accounting adjustments (memo item) -- so I'm not sure how they are accounting for it, exactly.

Cap Vandal - the stress test was done on GROSS LOANS and then the purcahsing adjustments (19.9 billion if you look at the page) were removed later.

I checked what you are saying. I am fine.

J

JPM is viewed 180 degrees from its actions

It will be interesting to see what lies ahead

Post a Comment