Advance apology – this is the most complicated post in the entire series… I promise if you persevere through this post you will find the rest of the series easier going… also – to state the obvious – it helps if you start with Part I.

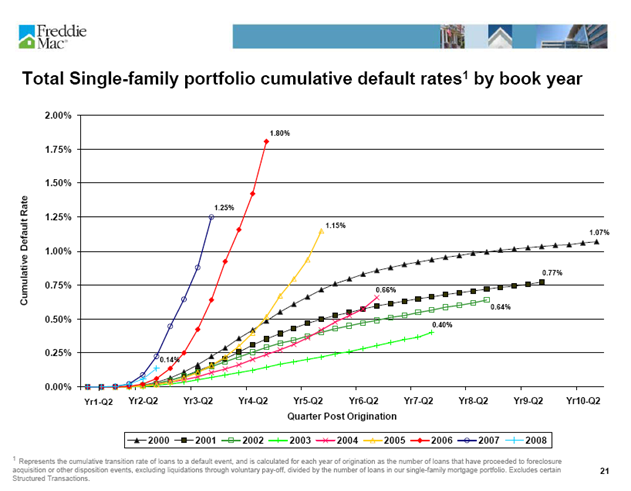

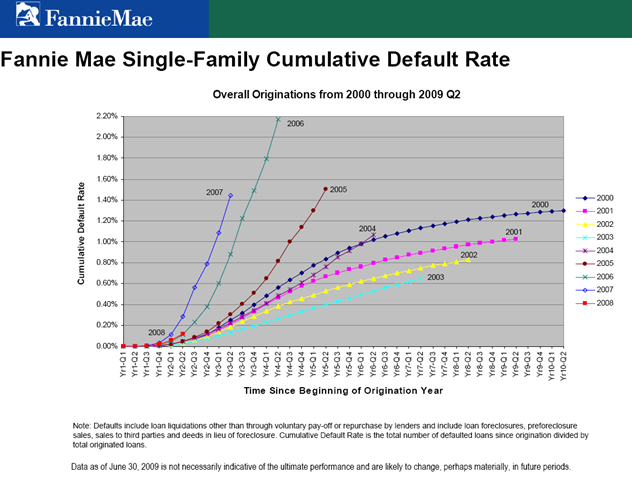

This post is entirely about the losses that Fannie Mae and Freddie Mac have realised to date. It is not about the losses that they will realise in the future. Models of those losses will be provided in Part IV in which I model the traditional guarantee business.

Background

In the previous post I demonstrated (at least for Freddie Mac) that the vast bulk of the losses realised to date by the GSEs have not come from the traditional guarantee business. In this post I promised to explain where they did come from. For that I need to explain what else Fannie and Freddie do.

In short Fannie and Freddie not only guarantee mortgages – but they own mortgages and mortgage related securities. It is in the owning of mortgages and mortgage related securities that the vast bulk of the problems arose to date.

When the GSEs buy a mortgage they finance it by issuing debt. This is different from the “traditional guarantee business”. In the traditional guarantee business the GSEs take only credit risk.

When they buy mortgages and hold them they bear many types of risk. These are:

(a) refinance risk in that they might not be able to continue to borrow money – especially short term money – but they own long dated mortgages. If they cannot maintain access to borrowing they will fail.

(b) Mark-to-market risk – because some of what they own is not mortgages but mortgage related securities which are marked to market and derivatives which are marked-to-market,

(c) Credit risk as some of the mortgages they own might default, and

(d) Interest rate risk – because the term of the mortgages they hold will differ from the term of the borrowings they make – and if interest rates change they might wind up with a mismatch in their book of business (say owning 6% yielding mortgages when short term rates have risen to 11 percent).

All of these risks have caused problems for Fannie and Freddie at various times.

Refinance risk – the cause of the conservatorship

In the lead-up to September last year the spreads on Fannie Mae and Freddie Mac debt widened. The US Government refused to explicitly guarantee Fannie and Freddie debt and there was a period when Fannie and Freddie could not roll their debt.

This was a crisis. Fannie and Freddie own long dated mortgages and issue (some) short dated debt. If they could not roll their debt (ie borrow to replace maturing short-dated borrowings) then they would fail.

Mr Paulson put them in conservatorship. Neither Fannie nor Freddie breached their capital adequacy standards when taken over (though both would eventually have breached them).

Failure to roll debt in a crisis is not normally grounds for taking over a bank (though many argue it should be). Every large bank in the world could not roll its debt without explicit government support by December. Even the mighty vampire squid (Goldman Sachs) issued government guaranteed debt.

That said – if you can’t roll your debt you either fail or need government intervention and intervention was an understandable choice (though one both this administration and the previous was not prepared to make more broadly).

Once the government guarantee came the Fannie and Freddie refinance problem went away – and bad deals done during the pre-conservatorship stress are only a small part of the realised losses of either Fannie or Freddie.

Problems caused by mark to market risk

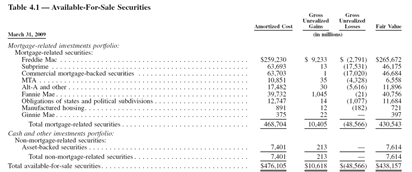

Mark-to-market risk on mortgage securities has been the biggest cause of losses at Fannie and Freddie to date. Fannie and Freddie not only insured the (relatively) conservative traditional business but they purchased senior tranches (usually rated AAA) of securities backed by non-GSE mortgages including subprime, alt-a and other toxic dross. This drift outside their traditional domain (sometimes justified by their “housing mission”) is the core thing that blew these companies apart.

The losses on these have been extraordinary – and these losses, rather than being provided for over time, are run straight through the balance sheet. When you provision for losses you tend to provision for the losses over time against your ordinary operating income. [Bank of America seems to produce provisions roughly equating to its operating income each quarter.] Mark to market losses by contrast come when the market tells you they are there.

During the first quarter of this year the quotes in the markets for such mortgage paper got very wide. A lot of paper was bid 20, offer 80 – meaning the seller wants 80c in the dollar and the buyer is only prepared to pay 20 cents. In reality the market was there in the first quarter – and the real price was at the bottom end of that range though many subject to mark-to-market accounting refused to acknowledge where the market really was trading.

At the time there were massive squeals about the irrational market in this paper - with the accounting authorities eventually granting lenience. Nonetheless misrepresentation about the value of the paper was the norm. There were plenty of instances where the paper was bid 20, offer 80 and marked at 85. Companies that marked their securities that way have not (at least in their measured accounting) benefited from the massive bounce in the markets since March.

Freddie Mac however marked its securities as harshly (or more harshly) than any major financial institution I follow.

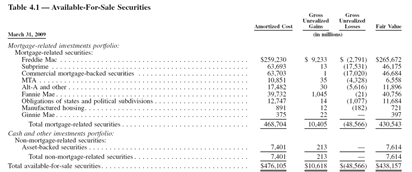

Here are the marks as presented in the Freddie Mac first quarter SEC filing.

(please click for more detail).

These marks are extremely harsh. For instance the subprime has (mostly) about 20 percent excess collateral – so the $63,693 million of subprime securities held are backed by roughly 80 billion in mortgages. For this to be worth only $46 billion (as marked) the losses had to represent 42 percent of the outstanding pool. That might be possible – but it requires say 60 percent defaults with mortgage recoveries of 30 cents in the dollar.

There are some pools of mortgages that are behaving that badly – and a few pools which are behaving worse. However I went and looked at a bunch of mortgages that backed pools owned by Freddie Mac – and whilst they were behaving badly they were not behaving quite that badly.

That said these loss estimates are not absurdly high either. The delinquency on the first-liens mortgage backing the subprime part of this book seems to have stabilised over 40 percent.

Nonetheless Freddie classified the $48.6 billion of losses as either “temporary” (where they thought the market losses would reverse) or “other than temporary” where they thought the losses reflected in market price would be made permanent by actual default. They thought that 13.8 billion would be “recovered” at the end of the first quarter and they seem to have increased their recovery estimate. They seem justified in this because they received $10 billion in principal payments on the suspect categories of loans during the last quarter – and defaults are (of course) impossible after the principal payment has been received.

Anyway it is clear that the biggest losses for the GSEs came from the private label securities – the stuff that was outside the original GSE business. The end point of these losses is unknowable – but in the case of Freddie Mac at least – the estimates made in March seem on the harsh side. [I expect recoveries – albeit smaller recoveries – against the estimates made by Fannie Mae as well.]

Fannie Mae has published the performance of private label securities owned by Fannie versus the average private label mortgage security in the market. The ones owned by Fannie are performing substantially better than the market. There is some evidence that better-than-average buying of dross is a character of Freddie Mac too. They purchased the best bad mortgages!

If this is the case then the marks (and the losses) shown in the above table are gross over-estimates.

I have to make the obvious observation here. The biggest losses for the GSEs were cane from owning non-GSE mortgages – ones originated entirely outside the government system. Cynically I have heard supporters of the GSE mission state (and for good reason) that it wasn’t our (meaning "traditional") GSE mortgages – it was the free-market mortgages that killed the GSEs. Said to the Republicans: “your guys did it”. Of course nobody forced the GSEs to commit hari-kari by stepping outside their remit of conservative mortgages. Nonetheless we should nail down clearly what killed the GSEs – and it wasn’t the traditional GSE business.

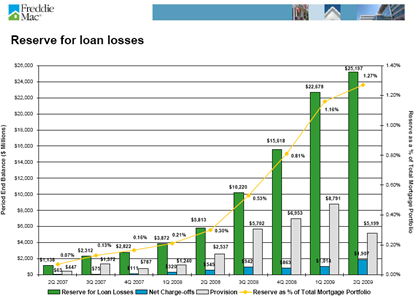

Problems caused by credit on owned mortgages

A mortgage that Fannie or Freddie owns can cause it credit losses just as surely as a mortgage that Fannie or Freddie guarantees. The mark-to-market losses in the last section will either reverse or eventually become credit losses (when the loans do not repay). Indeed mark-to-market is (in large part) the market’s estimate of future credit losses.

There will be credit losses on the private label securities that Fannie and Freddie own. Huge credit losses. It is my view (backed by the market movement of recent months but not always backed by market movement) that the mark-to-market losses overstate the end losses somewhat. Freddie thought at the end of the first quarter that the mark-to-market losses overstated end losses by the above mentioned 13.8 billion. They think the overstatement is even larger now…

Problems caused by interest rate risk

Interest rate risk has caused the bulk of Fannie and Freddie’s past problems. The hedges for interest rate risk are an issue this cycle too.

Fannie and Freddie have enormously complicated interest rate risk management issues. The reason is that nobody knows how long a mortgage will be owned for. The borrower can repay the mortgage at almost any time, usually with little or no penalty.

This makes it very hard to match the financing to the mortgage. For instance if you think the mortgage will last ten years you might choose long dated finance. If rates fall sharply the long dated finance will remain outstanding (costing you a high rate) but the mortgage will refinance to a low rate. The GSEs face what is known in finance circles as “negative convexity”. I see no reason to go into the nuance of this – but suffice to say that the GSEs have large and complex derivative books to deal with this "duration" issue.

The accounting for those derivative books is problematic. Sometimes the derivatives need to be marked to market. Sometimes they can be hedge accounted. It was the accounting for these derivative books which caused the scandals at Fannie Mae and Freddie Mac in 2004-2005.

Strangely the derivative accounting caused some losses at both Fannie Mae and Freddie Mac when they went into conservatorship – caused by the conservatorship.

This needs explaining though be warned that the explanation marks me as a wonky nerd who reads GSE accounts for fun.

Fannie and Freddie owned mortgages (fixed rate) and financed with shorter-dated floating rate paper. They were at risk if interest rates rose – in that they would not be able to maintain their cheap borrowing. To hedge this they purchased “pay fixed swaptions”. This is terrible jargon – but a swaption is an option over an interest rate swap. A pay-fixed swaption is an option to fix your interest rate (with a swap) at some stage in the future.

Pay fixed swaptions would be worth more if interest rates rose (as the right to fix your interest rate at some level is worth more when interest rates are high). Pay fixed swaptions were worth less if rates fall because the option to fix your rates at some pre-determined level is not attractive when rates are low.

If the swaptions were marked-to-market through the accounts it would make Fannie and Freddie’s accounts very volatile. Instead though Fannie and Freddie used hedge accounting – where they spread the cost of that swaption over the period of the mortgages which it was meant to hedge and ignored the mark-to-market considerations. That is reasonable enough accounting.

When the companies went into conservatorship though it was not certain that they would be allowed to continue to hold the mortgages which the swaptions hedged. This made the hedges “ineffective” under accounting standards and meant that the hedges needed to be marked to market immediately.

As interest rates collapsed at around the time of the conservatorship the marks on the swaptions were large and negative. Going into conservatorship caused over $10 billion in accounting charges at Fannie and I believe even larger charges at Freddie.

It is easy to overstate this problem though. Many of the items that were hedged transited to mark-to-market accounting. That would have been fine except at the time the mark on many of the mortgage assets that transited was very poor. One expert on Fannie accounting tells me that this is theoretically a non-issue though it is a practical issue with respect to at least part of the book. I do not know the net effect on Fannie and Freddie accounting of this issue but it is almost certainly less than the $10 billion mentioned in the last paragraph – possibly much less. The $9233 unrealised gains on Freddie Mac securities disclosed in the above table is (I gather) part of the partial offset.

These accounting charges are temporary. Fannie and Freddie still own mortgages that yield (say) 6 percent. They are now financing some of those mortgages at very low rates and the spread is higher-than-it-would otherwise be. Usually those high spreads would be offset by the losses on the hedge instruments as the swaptions expired worthless. However those swaptions have already been written to near zero. Fannie and Freddie are reversing those accounting charges through the net interest income line. If you don’t believe me have a look – the net interest income of Freddie Mac was $1.5 billion in the second quarter of last year and $4.3 billion this year. That is enormous…

Not all of that gain is reversing previous charges – a fair bit is simply the reduction of competition in the aftermath of the financial crisis. But the much higher operating income of Fannie and Freddie will go some way to reducing government exposure.

Tax effects

It is trite to note that Fannie and Freddie have taken huge charges against tax assets. That is inevitable when the government has not made clear its policy and hence Freddie and Fannie cannot even be assured that they will exist to earn income to offset losses.

Summary

It is in the non-traditional guarantee business that Fannie Mae and Freddie Mac have reported the huge losses which leave them in such a precarious position. Some of those losses (particularly the losses on the hedging book caused by the conservatorship) will reverse. Some (end credit losses on junky subprime mortgage securities) will not.

That said – none of these loss categories is likely to expand in the future. If the GSEs wind up being a toxic mess for the government it won’t be on the losses already incurred – it will be on future losses.

And that leads us to the traditional GSE business of guaranteeing ordinary qualifying mortgages.

The next post will introduce the tools for modelling that business – and the two posts after that will actually do the model.

Thanks for following this far. I know it is complicated. The next post is easier …