One of the biggest benefits I get from writing this blog is that sometimes some very smart people disagree with me. In the investing business you will be wrong often. The earlier you realize that you are wrong the smaller (on average) your losses will be. I don’t think the blog can move markets through talking my book. (I disclosed a good argument for shorting First Solar and the stock went up!) But I do think that kick-back from smart people can help reduce my losses when I am wrong. Believe me that is often enough! If all that the blog delivers me is smart people who disagree with me then I will wind up being a well-paid blogger (and my clients will be grateful)!

I got a lot of kick-back on my First Solar piece – some of which makes me more nervous about the short – and some of the kick-back is from people who are very smart. I thought I ought to lay this kick-back out at least in part to get my own thoughts straight.

One of the solar industry trade publications asked my permission to republish the piece – which I have granted. They also warned that they might have a follow-up piece titled: “Why I am short Bronte Capital”. That ought to put us in our place! I have yet to see that piece – but honestly I look forward to it (even though reading it will be painful). It may convince me that I am wrong – in which case I will cover my short forthwith!

The basis for the kickback I have received

The core to my argument was that First Solar has disadvantages (notably lower conversion efficiency) offset by a couple of advantages – notably keeping higher generation in low light, less sensitivity to angle of light – and most importantly – lower cost.

My view was that lower cost would determine almost everything. Solar modules are fundamentally a commodity – and whilst the low-light advantages were real – they could easily be overwhelmed by cost.

I then made an assertion – which I did not back – that the cost structure of wafer-based cells will be competitive against CdTe (First Solar) cells when the polysilicon price gets low enough.

Most – but not all – of the kick-back I have received is based around this cost structure issue. This falls into two camps. Firstly they assert that I have the cost structures of the competitors wrong. Secondly they asset that First Solar will reduce costs enough to offset the advantage that wafer-module-manufacturers get from lower silicon prices.

The other kick-back I have received is on the sales-and-marketing department. First Solar has – according to customers – by far the best sales force. “They are a machine!” First Solar they think that this will allow First Solar to travel well for longer than I might anticipate. Moreover they thought First Solar’s average selling price would remain high because FSLR has presold a lot of modules to solvent utility scale operators – notably EDF in France.

In this post I examine these issues with the aim of getting my own thoughts straight (and hopefully invoking more kick-back from more people that are smarter than me).

A cost model for polysilicon producers

Polysilicon has several disadvantages vis CdTe technology. First the materials are more expensive (wafers are thicker than thin film) – but just as importantly the manufacturing process is much more complicated. At First Solar glass goes into the plant and comes out – about three hours later – as an almost complete module. Human involvement is minimal. Wafers however require more manufacturing – they are sawn – they have breakage rates – they are laced with wires to conduct the electricity away – and they are “assembled”. Manufacturing cost are higher.

That said we can construct a simple cost model for wafer manufacturing from comments made by competitors. YingLi – a Chinese module maker – made the following comment in their fourth quarter conference call:

In the fourth quarter, our non-polysilicon costs including depreciation further decreased to $0.76 per watt from $0.81 per watt in the third quarter and $0.86 per watt in the second quarter and $0.90 per watt in the first quarter of 2009. This decrease demonstrates our strong R&D capabilities, and execution capabilities to continuously improve the yield rate, field conversion efficiency rate and operational efficiency.

The blended cost of polysilicon continuously decreased by the mid-teens in the fourth quarter. I would like to emphasize again that Yingli has now provided long-term (inaudible) provisions to write-down inventory costs or polysilicon prepayments the challenging fourth quarter of 2008.

Now YingLi is a good (meaning low cost) Chinese producer. It has terrible blended costs – but that is because it purchased silicon at high prices and its blended silicon costs are too high. But these costs do not seem wrong relative to competitors. [Inventory problems are surprisingly common in the industry as people hoarded polysilicon to avoid excessively high spot prices and wound up with huge inventories as the price collapsed.] The thing that is most notable about this is how fast the non-silicon costs have been falling – the sequence by quarter is 90c, 86c, 81c, 76c. This is roughly 4c per watt per quarter. It is of course impossible to know how far this will continue to fall – diminishing returns to technology and manufacturing reports will eventually occur. But for the moment we can take 76c and falling fairly fast (roughly 4c per quarter) as the non-silicon costs for various manufacturers. [Contra: slide 8 in Suntech’s latest quarterly presentation gives a much lower non-silicon price. That slide is so “out-there” different I tend to dismiss it – though if anyone has a clear explanation I would like it.]

Solar wafers used to require 7 grams of silicon per watt. Some manufacturers run at about 6.2 grams of silicon per watt – with 180 micron silicon. Applied Materials talk about 80 micron thick silicon wafers – though silicon use for those wafers is not reduced by 80/140 because wire saw (kern) losses are similar regardless of wafer thickness. Also as wafers get thinner they have higher breakage rates (and the incentive to cut wafers thinner is lower as silicon prices fall).

Its probably fair enough to use 6.5 grams of silicon per watt as the right number for modeling a silicon wafer module producer. The 6.5 grams is falling and in five years it may be 5 grams (if AMAT manages to sell more of their kit). Ok – but at 6.5g (or 0.0065 kg) per watt then the cost structure is easy to model…

YingLi cost per watt (in cents) = 76 (less any efficiency they get from manufacturing improvements) plus silicon price (in cents per kg) * 0.0065.

Now I am going to take a wild stab at what the number will be by June 30. My guess is that spot silicon will be $40 per kg and the 76c will be reduced to say 71 cents (which is still falling but by less than the 4c per quarter which the cost has fallen). This gives a cost per watt by the middle of this year of 97 cents. Polysilicon costs go below the magic dollar per watt!

Obviously this is highly dependent on the silicon price – a $20 silicon price would make the cost 13c per watt cheaper – say 84 cents per watt. A $100 silicon price takes cost per watt to $1.41.

Cost is also dependent on YingLi (and presumably the other commodity panel makers) getting efficiencies in the production of modules although at a reasonable clip – though as noted, I model a rate below the historic rate of cost improvement.

[I should observe here that Trina Solar – another Chinese manufacturer – gives their non-silicon costs at 78c per watt – 2c more expensive than YingLi in the fourth quarter. Trina’s cost reductions are also about 4c per quarter… See page 8 of their quarterly presentation.]

This cost model is fraught. The accounting of many of the Chinese players is difficult to decipher. One person I have talked to suggests that most other players are way above 78c per watt in non-silicon costs (although competition will get them there or force them out of business replaced by people who are at that level). They thought YingLi would be at 70c by the end of 2010. Against this the same person thought my grams per watt was too high (suggesting 6 grams per watt based on 180 micron thick wafers) and they thought that YingLi would be at 5.5 grams per watt by the end of the year. This is more or less a wash – with wafer costs a little lower than my estimate but base costs winding up a bit higher. Again all of this stuff is fraught – and although these broad numbers are not controversial the end competitiveness of First Solar is surprisingly sensitive to fine differences in base cost and silicon costs of their competitors.

What is the cost structure of First Solar?

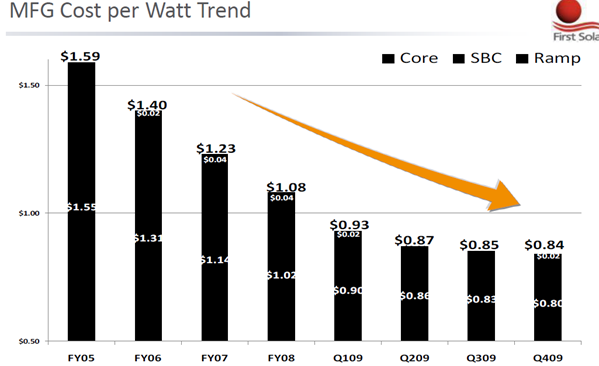

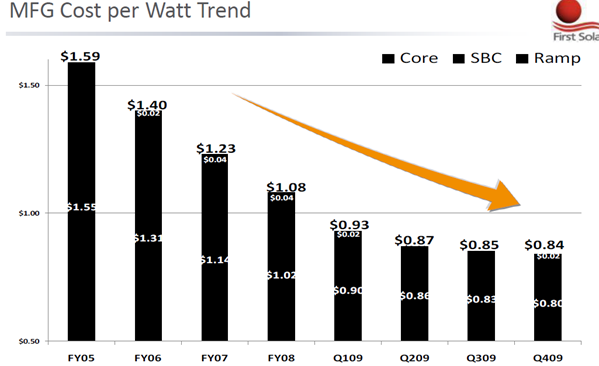

First Solar has laid out ambitious plans to increase the efficiency of their cells and to further reduce costs. I do not want to go through those in detail – but I think we can extract two key charts from the last presentation. First slide 13 – which has the cost per watt falling still – but at decreasing rates. The cost-per-watt has fallen by 1-2 cents per quarter for the last couple of quarters (versus 3-5 cents for the non-silicon costs at YingLi).

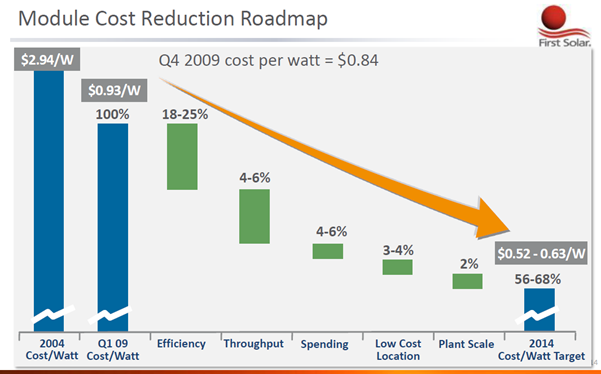

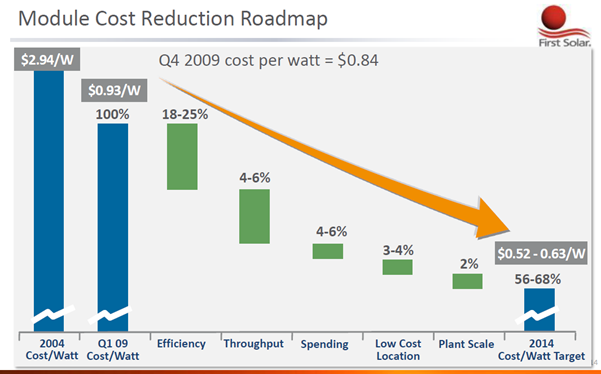

Then there is the less-specific presentation from their “roadmap” (see slide 14) which shows their 2014 target cost per watt.

I wish I understood how all of these gains were likely to be achieved – but they think they can get to 52-63 cents per watt by the end of 2014. However – for the moment I assume that they can meet their cost target and get to 58c per watt (a reasonable midpoint) by the end of 2014.

That cost per watt reduction is 26c over 16 quarters – or 1.625 cents per quarter – roughly the rate at which costs have been falling historically.

Figuring that the were at 84c per watt during the fourth quarter of 2009 – and they are reducing costs by 2c per watt per quarter (that is a little faster than historic and slightly faster than their roadmap) costs will be about 80c per watt per quarter by the June quarter of this year.

A raw cost comparison – with the price of silicon being the main variable

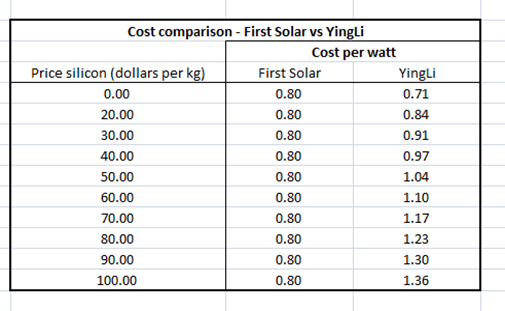

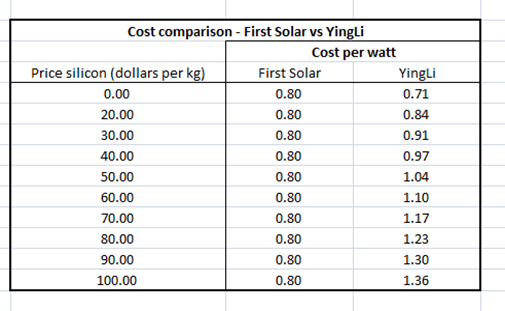

With the trusty spreadsheet I can produce a reasonable cost-per-watt comparison…

On this cost structure the YingLi panels have higher production costs unless the silicon price is very low. That sort of makes sense. YingLi panels have higher production costs (the process for making them is more complicated) offset by lower non-silicon materials costs (they are more efficient and hence use less glass, backing wire etc). The swing factor is silicon.

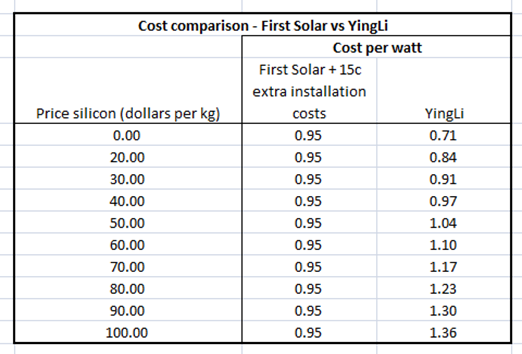

This table however leaves off the single most important swing factor – which is that the YingLi panels are smaller per watt of output. (Remember my whole argument is dependent on the higher conversion efficiency of the polysilicon wafer modules.) There are wildly different versions of how much the installation cost advantage is. The advantage comes about because you need less cells, less land, less brackets and less converters to generate the same amount of energy.

This paper from the National Renewable Energy Laboratory has been my guide. This paper suggests that First Solar modules need to be priced 25-30 cents below c-Si modules to generate equivalent project returns (see page 26). Some people think this far too high. For instance Stephen Simko (an analyst from Morningstar who disagrees with me) thinks a 10 percent penalty (roughly 7c per watt) will do the trick. I for the life of me do not understand why this is a percentage (there is limited evidence that installation costs are falling at the same rate as manufacturing costs). 7 cents per watt is very different from 25-30 cents.

I would really like people to detail what the cost difference is. (If informed people send me emails I will be grateful…) I suspect it depends on all sorts of things like labor costs, brackets, land availability and things you would not expect like wind levels (wind requiring better anchoring for the panels).

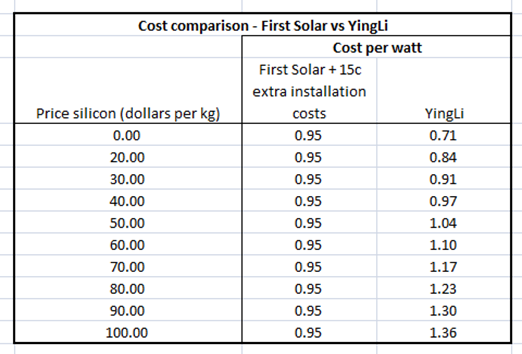

For the moment I use 15c per watt (a number my research indicates is too low – but which Stephen Simko thinks is too high). At this point my cost table needs to be adjusted…

Now at this point the First Solar cells are about cost-competitive at a $40 silicon price. If silicon prices go as low as $20 per kg then the Chinese polysilicon makers (represented by YingLi) have the goods by a long margin.

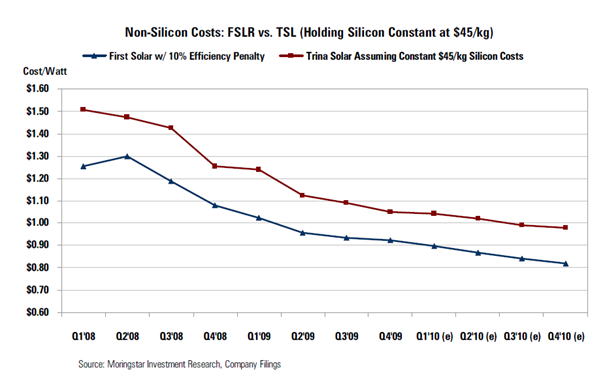

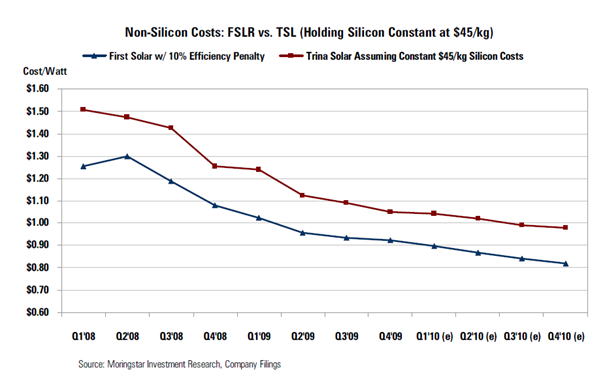

I should note that this cost structure does not match the cost structure as presented by several people bullish First Solar… Here is a cost structure as presented by Stephen Simko comparing First Solar to Trina Solar (yet another Chinese wafer-module maker). In it however he keeps the silicon price constant at $45.

You can see the difference between Simko’s estimates and mine. I have Q2’10 costs for the wafer manufacturer a few pennies (say 3c) lower than Simko. Simko has the cost structure of First Solar falling about 3c per quarter (versus my 1.5 cents per quarter and adding up to a further 3c cost advantage) and he has an efficiency penalty of about 8c versus my 15c (or another 7c of cost advantage). He thus has First Solar maintaining a cost advantage of about 15-18c per watt over the next twelve months whereas the extra costs I suggest wipe most of that advantage.

At a $20 silicon price even with Simko’s cost estimates First Solar’s cost advantage disappears. This of course led Stephen Simko and me to a discussion of what drives polysilicon ingot prices. In that he changed my mind somewhat…

What drives the polysilicon price?

Polysilicon is a commodity. Sure there is better quality stuff (which makes more efficient wafers) but it is still a commodity. Usually with a commodity – when there is spare capacity in the system – the commodity is priced at the cash running costs of the highest price operational plant. When the world runs out of capacity the commodity disconnects from its “cost curve” and is priced at whatever the market can bear. At that point being a commodity maker is frightfully profitable. That profit attracts new entrants and new capacity. Eventually there is enough supply and the commodity price reconnects to the cost curve. (This pattern is familiar to anyone who has – for instance – studied metal prices generally. The pattern drives much of the Australian economy.)

As the solar industry ramped up polysilicon prices disconnected from their cost curves. Spot prices of $450 were not unknown. The NREL paper cited above mentions spot prices higher than that. The spot price however was rarely paid – because most wafer makers purchased large inventories and entered into forward contracts. Some solar-cell makers have got themselves knotted up financially because they have purchased thousands of tons of polysilicon inventory at prices that are well above current prices and which prohibit them from making profits.

The excessive profits made by the ingot makers introduced many new suppliers to the industry. One source suggested that we have gone from six suppliers (and a cozy oligopoly) to 26 suppliers (who will cut each other’s throats). This market is becoming very glutted very fast. That means that the poly price will go to marginal cash cost. So what is that cost?

Well I started with the big players – and they have cash costs in the low 20s. I thought the polysilicon price would thus go to the low 20s. That would settle the issue because – even on the Stephen Simko’s numbers – the Chinese-wafer-based modules will have lower costs than First Solar at a $20 polysilicon price.

So – without stating it so clearly – I thought that the poly price would wind up closer to $20 per kg than the $45-55 modeled by most First Solar bulls.

Stephen Simko disabused me of this notion – and this time I am fairly convinced by his explanation. During the boom the most insane polysilicon manufactures built plants and with very different cash costs to the established (and presumably knowledgeable) players. He thinks the cash cost outside the established players is considerably higher than the cash costs of the established players. He points to a presentation by REC Silicon. Slide 45 of the presentation gives what REC purports is an industry cash-cost curve and whilst the Y-axis is not labeled the bottom of the curve represents about $20 a kg – and the top of the curve represents – well – who knows what? Here is the slide:

If this curve is correct the polysilicon price is unlikely to get to $20 because the marginal players will have costs substantially higher than $20.

The issue comes down to how flat is the cost curve? It strikes me – intuitively – as being likely to be very flat as the equipment to make silicon is pretty well understood – but if anyone is genuinely expert in this then I would love them to contact me. [The cost curve REC/Simko showed me however is emphatically not flat…]

This REC graph however has given me pause – because the really brutal outcomes for First Solar were dependent on a very low silicon price. If the silicon price were really to go to $20 and my cost numbers (somewhat more brutal than Simko and other bulls) are right then First Solar will wind up with no reason to exist – and the stock will go below $10 (currently about $130). If the poly price does not go below $45 and Simko’s numbers are right then First Solar will keep a cost advantage – and that cost advantage is sustainable – at least until a better technology comes along or First Solar’s patents run out. First Solar earnings might be difficult – but the business has a reason to exist.

Funny – I have not mentioned profitability

So far – in neither of my notes – I have not made a profit estimate for First Solar or any of the competitors. I have modeled cost – but thus far have not modeled selling price. Once we have a reasonable estimate of selling price and a reasonable estimate of cost we should be able to model profits give or take some things. [The main things we would need to give-or-take are inventory losses for the silicon manufacturers – some of whom have thousands of tons of overpriced silicon inventory, and the project gains and losses for First Solar which is an investor in utility scale solar projects.]

Looking at the current price for modules is not going to help you much. Many companies have both purchased silicon at fixed rates and pre-sold panels at fixed rates. First Solar locked in lots of fixed rate contracts – some with good solvent parties (for example EDF) – some with parties that are more questionable. The current prices realized by the solar manufacturers depend more on the contracts that they entered into (both price and solvency of the counterparty) and less on spot price for panels than a first glance might look.

There are disclosures in First Solar’s 10K which illustrate the problem. These disclosures can be read as “red flags” though I prefer to keep more neutral about their content.

During the first quarter of 2009, we amended our Long-Term Supply Contracts with certain customers to further reduce the sales price per watt under these contracts in 2009 and 2010 in exchange for increases in the volume of solar modules to be delivered under the contracts. We also extended the payment terms for certain customers under these contracts from net 10 days to net 45 days to increase liquidity in our sales channel and to reflect longer module shipment times from our manufacturing plants in Malaysia. During the third quarter of 2009, we amended our Long-Term Supply Contracts with certain of our customers to implement a program which extends a price rebate to certain of these customers for solar modules purchased from us and installed in Germany. The intent of this program is to enable our customers to successfully compete in our core segments in Germany. The rebate program applies a specified rebate rate to solar modules sold for solar power projects in Germany at the beginning of each quarter for the upcoming quarter. The rebate program is subject to periodic review and we adjust the rebate rate quarterly upward or downward as appropriate. The rebate period commenced during the third quarter of 2009 and terminates at the end of the fourth quarter of 2010. Customers need to meet certain requirements in order to be eligible for and benefit from this program.

Essentially the customers or sales channel was liquidity constrained – so terms needed to be made more generous (45 days versus 10 days). Moreover we needed to offer a price rebate (presumably a rebate on our fixed price contract) to enable customers to compete. Those rebates were subject to certain tests (presumably solvency tests but we do not know the content of those tests). Some of these contract changes exchanged smaller fixed price contracts for higher volumes at lower fixed prices.

Whatever – the industry is rife with fixed price contracts. Spot prices are below the fixed price contracts. One day these fixed price contracts will roll off – and new fixed price contracts will struck at considerably lower prices. As we do not know the duration of the fixed price contracts – and even if we did that duration keeps getting extended in exchange for lower prices – we can’t really tell the path of the selling price.

But I have a method which should be familiar to any economist – and I think works for working out where the long term selling price will wind up. It is simple really. The Chinese competitors are numerous and very hard to pick apart from each other. Some are ultimately going to be pennies per watt better than others – but because they are numerous and in fierce competition they will drive the price. This should be bleatingly obvious – anyone who has competed with numerous Chinese manufacturers by now would know that the price is driven down to the price where the Chinese manufacturers make a mid single-digit ROE.

That price however is much lower than the current selling price and probably much lower than the selling price First Solar will realize in 2010.

Moreover the price should be fairly easy to determine: I will just do it for one manufacturer. At year end Trina Solar had book value of $677 million. Some of that value was inflated because they were carrying some high-cost silicon inventory. They had output ability of about 550 megawatts per year (averaging 600 in panels and 500 in wafers). To earn 15 percent pre tax on that equity they need to make roughly 100 million per annum or they need a margin of 18c per watt sold. The first-cut estimate of the long term price of these things is thus – and I am being very simplistic here – whatever the Chinese manufacturers cost plus 18c per watt.

This first cut however is a sharp over-estimate. The equity I am including is too high because of overpriced inventory. The ROE I am demanding is too high too (Chinese competitive manufacturers make far less than that!) The industry is continuing to get efficiencies – and they will be competed away – so the margin per watt will come down for that reason too. You do not need to make any unreasonable assumptions for the right margin per watt over the cost for the Chinese manufacturers to be 10c.

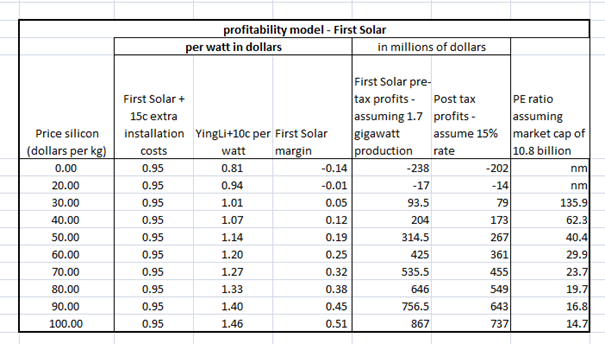

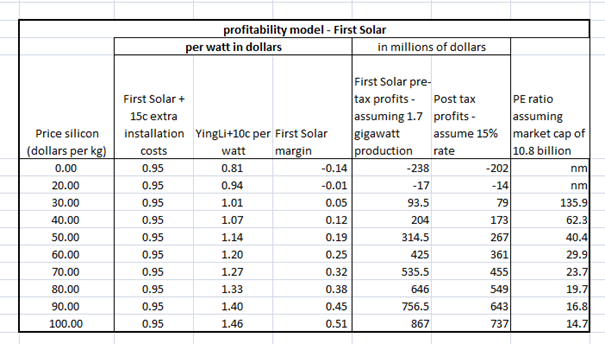

From here an earnings model is easy… First Solar will produce (on their guidance) about 1.7 gigawatts this year and 2 gigawatts next year. The selling price will be whatever YingLi’s cost is plus 10c… You can work out the margins using either mine or a bull’s cost estimates (I use mine). Multiply margin by wattage and you get pre-tax profit – give or take a little bit. I do this below.

Now – using numbers I think are inherently likely – I get earnings falling sharply. If we take the silicon price to $20 then First Solar has no earnings. If we think the installation penalty is 25c rather than 15c as per the NREL paper earnings go away up to a silicon price of about $40.

Now Mr Simko reckons that the cost advantage of First Solar is about 13 cents per watt better than my number. [He has an 8c installation cost rather than my 15 etc…] 13c per watt equates to $20 per kg on the silicon price (remember we are assuming 6.5 grams of silicon per watt). In other words if you use Simko’s numbers then take my silicon price estimate and add $20 (say $60 instead of $40) to read the earnings numbers. Even on Mr Simko’s numbers First Solar’s earnings fall fairly sharply when the competition amongst Chinese manufacturers drives their ROE down to normal Chinese levels. That makes me more comfortable with my short. First Solar may not be a devastating failure but earnings will fall sharply and the stock starts with a teens PE ratio…

Innovation and the long-term future of First Solar

So far my argument has been predicated on the silicon price falling. At low silicon prices First Solar becomes uncompetitive. The only real question being how low is low?

But First Solar can become more or less competitive depending on how much they can reduce costs or increase efficiency versus their Chinese wafer-based competitors. First Solar has an ambitious target of reducing costs over the next four years. I want to repeat the slide on that cost reduction strategy.

Now I know you have seen this slide before… what you probably did not notice is that it is not drawn to scale. The company plans to get 18-25 percent cost-per-watt reduction via efficiency – and and only 15 or so percent cost-per-watt reduction through everything else (plant utilization, scale etc). That makes sense because First Solar plants are already highly automated. Glass goes in one end and almost-complete modules come out the other end with little human intervention. It is almost impossible to improve that manufacturing because it is already almost perfect!

So the only place they can get their cost-per-watt down is by getting more watts-per-glass-sheet – that is improving efficiency. Efficiency is the core to First Solar’s roadmap to lower costs.

I will be blunt. I do not think they can do it. Efficiency is already 11.1 percent. If they get 21 percent out of efficiency – something like a midpoint of their 18-25 – then they need to get efficiency to 13.4 percent – and they need to do it over 16 quarters. Efficiency must improve almost 15 bps per quarter. Efficiency for the last six quarters was 10.7, 10.8, 10.9, 10.9, 11.0, 11.1 percent – something less than 10bps improvement per quarter. This is something which should asymptotically approach a theoretical limit – and yet First Solar is modeling that the rate at which they improve efficiency will increase for the next four years. Maybe they can do it – but trees do not grow to the sky.

Against this – what is driving the Chinese manufacturers is manufacturing efficiency as well as conversion efficiency. The Chinese processes are difficult – involving sawing, lacing wires on wafers and assembly. There are many more and difficult steps than First Solar’s thin film process. That is bad for them now but provides opportunity. Chinese manufacturers are – if we know anything about them – relentless in taking out costs.

So my guess is cost-per-watt will fall faster in the Chinese silicon manufacturers than in First Solar precisely because there are more opportunities for manufacturing improvement.

Stephen Simko had the opposite view. He figured that thin film is a new technology whereas wafers have been around for a long time. That means that there are more opportunities for conversion efficiency improvement in thin film than wafers – and he thought that would drive costs over time. I have an answer to that – 10.7, 10.8, 10.9, 10.9, 11.0, 11.1. But really to get comfortable with that I want to talk with a particle physicist who knows a lot about semiconductors. My knowledge of (low energy) particle physics (and hence the mechanism by which a thin film semiconductor might work) is not much more than you can garner from Brian Cox’s excellent mass market book on Einstein and the Standard Model and a few other populist things (many from Mr Cox). On the interaction between atomic sized gates and the efficiency at which electrons can be forced across a thin-film semiconductor layer I am – as you might expect – totally out of my depth…

So there you have it – the whole First Solar thing modeled out. I think I am right – but sensible people take the opposite view – and one industry publication wants to write a piece about why they are short Bronte Capital. If anyone tells you this investing game is easy ignore them. This is tough – and the bets we take occasionally fill us with angst.

John

![[image9.png]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi3flsXG2ayc8ArmLywuvFDm5SffCVUAESKHWr-z3kKiRzGy8p_s7fexEJGARcVx8hI-UY1sYOXFzX0I_YC-8FVMXN8h5R0Mpb4xhZmFpwWcNRYOcbsOHuzRFXsI3CDhXk4BQktPL51sXY/s1600/image9.png)