In Mid September I wrote a letter to Australian regulators which detailed my concerns about a fund manager in Australia known as the Astarra Strategic Fund – formerly known as Absolute Alpha. This letter resulted in regulatory action against a cluster of related funds (almost twenty), however my letter was almost entirely about only one fund in the group. I did not make any major suggestions in the letter about other funds in the Astarra complex. My involvement was detailed today in the Sydney Morning Herald (see stories here, here and here, with the first story on the front page below the fold). There was no genius in my letter – everything could be found (fairly easily) on the internet – and the original tip-off came from a reader of my blog – who noticed links with a story I wrote up in March 2009.

For reasons I will explain below this fund collapse is qualitatively different and more serious than any previous fund collapse in Australia and that the Australian press have not yet detailed why this one is important.

The letter argued that it was possible that the Alpha Strategic fund was a fraud. I did not have the ultimate proof of that so I did not make my letter public and will not do so yet. However there is a way of proving that a fund is not a Ponzi – and that is to “show us the money”. If the assets are really there then it should be possible to convince regulators of that fact by showing them the assets. If Bernie Madoff had been asked to prove the existence of all the money he supposedly managed then he would have been caught because he could not comply. An honest fund should be able to comply fairly quickly – sometimes within 20 minutes – but almost certainly within a week.

The Australian regulator asked Astarra to show them the money – and to date that has not happened. That does not mean that the money is not there. It is however suggestive, especially as approximately three months have elapsed whilst regulators and fund administrators have tried to “value” the fund assets. Indeed the difficulty of valuing assets was sufficient for the regulator to cancel licenses and to place the funds in the hands of administrators.

At a meeting last week the (regulator appointed) administrator Neil Singleton said that with respect to one fund the only proof of assets they have is a letter from a Virgin Islands company stating that the fund (presumably the Strategic Fund) held 118 million in interests in other hedge funds. This letter did not detail any interests held and gave no mechanism for confirming that statement. However the administrator has not stated that the assets are not there – so – like the regulator and the administrator I too will leave that question open. The press simply says the details as to the $118 million are “sketchy”.

Background to the Australian privatised social security system and where various Astarra entities fit in to that system

Australia has a privatised social security system. Much of the money is with large honest players run in a nearly index manner and which have cut fees to relatively low amounts. Those funds are run by Australia’s otherwise dying trade unions. Privatised social security (which Australians call “superannuation”) has been the saviour of the union movement in Australia – and – through their control of funds the unions now are within a breath of control (though generally do not vote their control) of a large proportion of Australia’s industry.

The money that is not with the union funds is in a rag-tag of funds run by large banks (for example Colonial’s wraps owned by Commonwealth Bank) or with independents and/or self-managed funds. The money in those funds (wraps) is let to a large number of sub-funds – sometimes large, sometimes boutique funds managers who live off the large and mandated fund flows from our “superannuation system”.

The boutique funds range from very good to awful and shonky. Indeed I think the best no load mutual available anywhere in the world is in Australia (I used to work for the manager). But there have been some flea-bitten dogs sold to Australians. One thing is for sure – you cannot do privatised social security without very good fraud protection because that amount of money from unsophisticated investors is a truly massive honey-pot for scammers and flim-flam artists. As an aside, possibly the worst thing about George W’s privatised social security proposals was that they would be supervised by Cox’s toothless and supine Securities and Exchange Commission.

Trio Capital (the “mother-ship” of the Astarra entities) is a “wrap provider” – meaning a financial planner might use Trio to invest all their client’s retirement money. The Astarra Strategic Fund is an individual fund under that wrap. My letter was about the Strategic Fund – and the collapse of the Strategic Fund would not be qualitatively different from the collapse of any of about six funds that collapsed during the financial crisis. The financial planner might have put her clients in six (or more) funds – and the loss of one of them is a blow – but in no way imperils the system.

But (somewhat surprisingly) the entire Trio edifice has been placed with administrators – which means that the end-beneficiary has had their entire retirement savings blocked. In some funds there is not even enough cash to pay pensions to retired people for the month of January. Some pensioners are not having their current payments blocked but there are doubts about future payments. [Details as to who will receive pensions for the month of January can be found on Trio’s website.] This is qualitatively different from earlier fund failures because it is a failure of every fund that a person might have invested – a failure of the core asset protection mechanism in the Australian system. [I cannot work out why the otherwise sensationalist Murdoch press has not written a single story on this yet. All they need to do is find a cluster of pensioners who will not receive their pension this month and who will have no idea as to why.]

How I came to write my letter to regulators

Six months ago a reader pointed me to a fund of hedge funds (called Absolute Alpha) based in Australia.

I looked – and within forty minutes I became very concerned – but could not prove harm to the fund’s investors. I tipped off the Sydney Morning Herald.

The journalists at the Herald worked hard at the story but alas they too could not prove harm. Indeed a major bank misled them as to whether the assets were in (their) safe custody. The bank confirmed the assets were in custody – a statement they have now withdrawn. Obviously with a reputable third party vouching for the assets any hypothesis of harm was going to be hard to sustain. The Herald published nothing.

I however remained suspicious – but could not easily do anything. For there to be something desperately wrong either the bank had to be a party or grossly negligent as to their custody of the assets.

Absolute Alpha was a boutique fund manager loosely associated with – and partly owned – by a superannuation wrap provider called Astarra. Astarra is now called Trio. The wrap provider did all the superannuation compliance and in turn (claimed to) invest funds with other fund managers – mostly reputable managers. The relationship between Trio and some of the funds in which they were supposed to invest is complex.

The amount of money in Absolute Alpha was probably under 100 million. There were plenty of things that did not look right – but I did not think there was much I could do about it.

So I let it go – though I did not forget about it.

Later I tried to log into Absolute Alpha’s website and it was dead.* This (falsely) indicated my worst fear.

Again I alerted the Herald.

Alas it was not so simple. Absolute Alpha it seems had taken over the funds management of all the money in the Astarra wrap. They had renamed themselves Astarra. Astarra later renamed itself Trio. Astarra’s website boasted of a billion dollars in funds under management.

This was potentially very bad news. Australia is about a twentieth the size economically of the United States – so $1 billion in funds under management was the equivalent economically of $20 billion in the US. If my bad-case was true we had a Madoff (at least proportionately) in the making. [Now the funds have been taken into administration the official numbers are about 40 percent of the numbers boasted on the website. The danger was not quite as big as I thought it was.]

Anyway I wrote a letter to the Australian Securities regulator (ASIC) laying out all my concerns and (implicitly) the method for testing my concerns were false. [I sincerely hoped I was wrong – and hoped the regulator would prove me incorrect by identifying and valuing the assets. I still sincerely hope all the money turns up in the British Virgin Islands.]

I have heard lots of criticism of the Australian Securities regulator. However on this important matter their actions were exemplary. They did what the SEC could not do and act on a “Markopolos letter” within weeks. They did what the SEC should have done when they investigated Madoff – and attempted to confirm the existence and value of the assets.

Three weeks later ASIC put a stop on all Astarra funds – prohibiting new money going in or any moneys going out. They acted to protect investors. This showed responsiveness that Mary Schapiro and American regulators can only aspire too. The Sydney Morning Herald finally published a cryptic story on the front page. The Sydney Morning Herald article did not suggest – and I did not reasonably think – that the problems extended further in the Trio edifice.

A few months have passed and eventually all major Trio entities were placed in administration by the superannuation regulator. They will probably be liquidated. The funds have been passed to (reputable) private sector “forensic accountants” – the choice of accountants being made by the securities and superannuation regulators. They are the sort of liquidators you use when (as stated by the regulator in their press release) you are not “able to satisfy concerns regarding the valuation of superannuation assets”.

The whole mess will be explored by the accountants - and if the assets are not there then the matter will played in court – at which point I will publish my “Markopolos letter” analysing what I got right and wrong.

But for the moment I will leave you with what attracted me to Absolute Alpha in the first case. It was the CV’s of the principal players. Here they are:

Shawn Richard - Chief Executive Officer

Shawn is the founder of Absolute Alpha and a key member of the investment team. Prior to founding Absolute Alpha, Shawn has held and continues to hold, various senior positions, including directorships of companies both in Australia and overseas.

Shawn has been involved in financial markets since 1996 and had been specialising in alternative investments for more than 8 years, both offshore and in Australia. Over this time, Shawn has established relationships with some of the most exclusive hedge fund managers around the globe.

Shawn’s offshore experience in alternative investments includes among others, structuring and analysis of derivative instruments with some of the largest private hedge funds in the United States. Shawn was also part of a small team of professionals providing risk management services to Asian institutions and regional banks in relations to their exposure in equities.

Shawn holds a bachelors degree in Finance from the University of Moncton.

Eugene Liu -Chief Investment Strategist

Eugene is the Chief Investment Strategist of Absolute Alpha. As Chief Investment Strategist, Eugene is involved in the development and evaluation of asset strategic plans, development and modelling of analytic tools, reviewing and analysing investment data to formulate investment strategies, and the investment risk management process. Prior to joining Absolute Alpha, Eugene worked with the Asset Management team of Pacific Continental Securities and World Financial Capital Markets in the US and Asia. In these roles, Eugene performed extensive financial modelling and valuation analyses of various hedge fund strategies. Eugene also led a team of arbitrage specialists who provided structured product deal flow to many of the largest hedge funds in the industry.

Eugene holds a degree in economics from Trenton State College in New Jersey.

Charles Provini (US) - Asset Consultant

Charles has been involved in hedge funds for more than 20 years and is a senior asset consultant and member of Absolute Alpha’s investment committee. Currently, he is the President of Paradigm Global Advisors, a well established hedge fund manager based in NY and he is also the Chairman of C.R. Provini & Co., Inc., a financial services firm, founded in 1991. Prior to this, Charles held various senior positions, including, President of Ladenburg Thalmann Asset Management, Director at Ladenburg Thalmann, Inc., one of the oldest members of the New York Stock Exchange, President of Laidlaw Asset Management, Chairman and Chief Investment Officer of Howe & Rusling, Laidlaw’s Management Advisory Group, President of Rodman and Renshaw’s Advisory Services, and President of LaSalle Street Corporation, a wholly-owned subsidiary of Donaldson, Lufkin & Jenrette.

Charles has been a leadership instructor at the U.S. Naval Academy, Chairman of the U.S. Naval Academy’s Honour Board and is a former Marine Corp. officer. He is frequent speaker at financial seminars and has appeared on “The Today Show” and “Good Morning America” discussing financial markets.

Charles is a graduate of the U.S. Naval Academy and has an MBA from the University of Oklahoma.

Now the first CV – Shawn Richard – is notable only for what it does not say. It does not mention a single firm that Shawn ever worked for – and hence reduces the possibility of doing due-diligence.

Eugene Liu’s CV is not so careful mentioning two firms, Pacific Continental Securities and World Financial Capital Markets. Pacific Continental is easy to find – it was a bucket shop of enormous proportions in the UK. Essentially the firm found hapless victims and steadily moved their life savings into soon-to-be worthless scam stocks for huge commissions. This was explored widely in the UK press including beautiful articles about a salesman’s time as scam artists. World Financial Capital Markets is a little harder to trace as a firm. Several firms have had that name – but one firm by that name met an unfortunate end involving fraud and the principals reappeared at Pacific Continental.

It turns out that Shawn Richard was a manager with Pacific Continental in Taiwan.

The third CV is of Charles Provini who used to be the CEO of Paradigm Global and who was (falsely) claimed to remain in that position. When I copied these CVs off the Absolute Alpha website Provini had not worked for Paradigm for about two years. Some of the rest of Mr Provini’s CV is raised my eyebrows too – for instance he worked as the President of Laidlaw Asset Management. A firm of that name was cited by the UK securities regulator (the FSA) for cold-calling and selling scam funds to UK investors.

The link to Paradigm Global was what raised my eyebrows. Paradigm is an asset manager (for funds of hedge funds) owned by Hunter Biden and James Biden. These are the Vice President’s son and brother respectively. I have written about Paradigm extensively before as it has an unfortunate habit of being associated with scams. Absolute Alpha was not difficult to do due diligence on. It took me only 40 minutes to work out that they were needing very close scrutiny. It does not speak well to the due-diligence of a fund of hedge funds (which is what Paradigm claims to be) that they keep being associated with cases like this.

The Biden connection was what prompted me to look at Absolute Alpha and hence what led me to write my “Markopolos letter” to ASIC and hence what rapidly led to the closure of Astarra and Trio. It is worth asking how deep that connection is.

Are Absolute Alpha/Astarra really associated with the Biden’s firm?

At first glance the links between Astarra and the Bidens’ firm are weak. Provini could have been marketing “vapourware” with no real association.

All that is certain is that Provini was cited on the Absolute Alpha website as an asset consultant and President of Paradigm for at least two years after he was sacked from Paradigm. Provini is now running inconsequential penny stock companies.

But the links run deeper than that. Absolute Alpha also used to cite other staff members who worked at Paradigm – indeed the original “managing partner” was also a staff member at Paradigm.

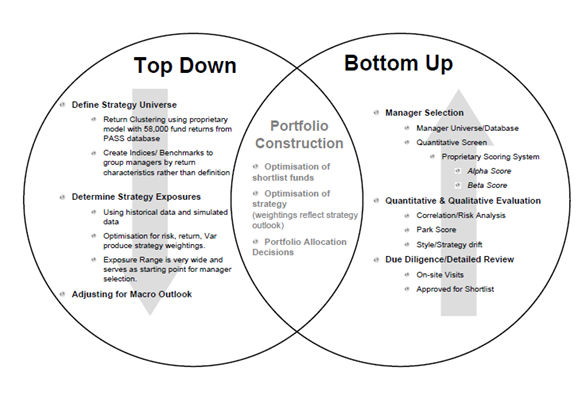

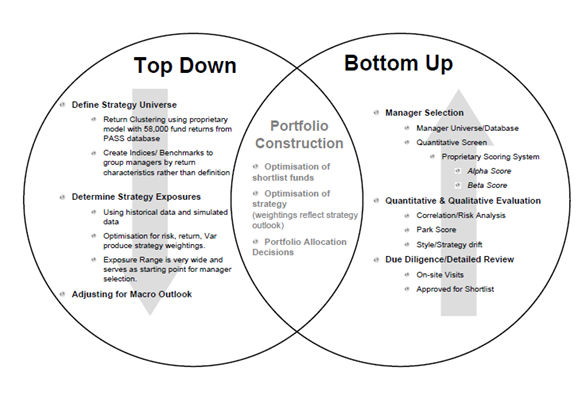

Absolute Alpha used to publish a process diagram as to how they identified funds to invest in. I have reproduced that diagram below:

It mentions two things which link Absolute Alpha (now called Astarra) to Paradigm global. These are the use of the Park Score (named after James Park – the founder of Paradigm) and the PASS database – the core database of hedge funds from which Paradigm claims to make its investment decisions.

Still, this could all have been ripped off Paradigm without Paradigm knowing.

Alas Paradigm does not get off so lightly. The boys from Absolute Alpha went to New York and co-marketed with people from Paradigm. Indeed I know someone who thought that Absolute Alpha were OK because staff at Paradigm had vouched for them. Whether Paradigm knew that Shawn and Eugene in Australia were using “Paradigm inspired” marketing material however is unknown.

Paradigm – the Biden’s firm – had unwittingly got involved in another funds management firm which has been closed by regulators or been exposed as Ponzis. That is four I know of now – and I have yet another one that I suspect of being unsound.

A plea to Michelle Malkin

So much of what is published by the conservative blogosphere is non-fact based muckraking. And yet – sitting here has been my observation that the fund of hedge funds associated with the Vice President’s family has an unnerving habit of association with scams and other funds closed by regulators. Surely a competent muckraking conservative blogger can actually do some digging rather than pontificating from the sidelines.

It makes me think of conspiracy theories. Maybe conservatives in the US do not want to do this sort of financial digging because most the fraudsters and scamsters are part of the Republican movement and do not like regulators because – well – they might catch them.

But there must be honest Republicans out there. It is time for Michelle Malkin to do some honest work. So I will plead with her – can you please do some digging into Paradigm or find some other muck-raking conservative to do it for me.

I for one want to get back to making money honestly.

John

*Incidentally – I was attempting to log into the Absolute Alpha website because I was discussing the whole matter with a reader from Talking Points Memo. You know you you are. Thank you.