Monday, February 24, 2014

The really strange Comcast-Netflix deal

John

===

Verizon took the FCC to court on net neutrality and won.

The big potential loser was Netflix. Under the old rules [the ones that the court overruled] tier one internet providers like Comcast or Verizon had to deliver Netflix packets the same way as they delivered any other packets (on landlines anyway) - and that meant that they could not selectively slow Netflix packets. If they were not allowed to selectively slow Netflix packets then they couldn't charge Netflix for the privilege of having their information delivered.

The argument for slowing them is that Netflix uses so much - and - so say Verizon and others - they should "pay their share". [Of course the counter argument is that when I buy my capacity I am paying for data to be delivered to me - and I have paid for all data, not all data except Netflix...]

Winning the court case had to be a positive for Verizon (that is why they took it to court). And it had to be a negative for Netflix (the most likely party to be charged). You wouldn't notice that in the stocks though - Netflix is up hard, Verizon not so much.

Comcast had more reason to dislike Netflix than Verizon though. After all Netflix competes with Comcast's core service (video delivery) and Reed Hastings of Netflix used to complain endlessly about Comcast's breach of net neutrality rules.

However Comcast - as part of its deal in purchasing NBC - agreed to follow net neutrality rules until at least January 2018 even if the FCC lost the net neutrality issue in court. After the FCC lost in court there was only one company that could not legally selectively slow Netflix content - there was thus only one party which Netflix did not have to deal with.

That party was Comcast.

And so it is really strange that the first deal Netflix did was with Comcast.

Netflix has just given Comcast a few million dollars - and seemingly for no reason.

Now Reed Hastings is a clever man - and he is not in the business of giving away millions of dollars.

So I presume he did it for a reason.

And I think it is this. The reason is to set a price. A low price. The lower the better - because after this they have the serious negotiation with Verizon. [And Verizon took the government to court and won - which leads you to think that Verizon is likely to be aggressive.]

Comcast knew they were not entitled to a brass razoo - and Netflix was giving them a few million dollars. From Comcast's perspective that was easy [take the gift]. The amount looks low. Comcast manages to look reasonable (and I don't normally put the words reasonable and Comcast in the same sentence).

And Netflix sets a low price.

It's a negotiating ploy.

But I don't believe it will work.

Lowell McAdam is unlikely to fall for it. He is not going to settle for single-digit millions. The tables have turned and the carriers are getting market power over Silicon Valley - and this is probably the quickest and easiest place to exert some power.

I think Reed Hasting wasted his few million.

Seeking different opinions as I have been wrong often.

John

No position in Comcast, Netflix. Long Verizon.

POSTSCRIPT: The first comment linked this article. VERY USEFUL AND PROVES I KNOW LESS THAN I THINK I DO ABOUT THESE ISSUES.

Friday, February 21, 2014

I am out of tune with these times

But I am not comfortable with that position either. Clever people are doing things I don't understand and I am just feeling old and tired.

PS. No position on $FB. Still long $GOOG.

Monday, February 10, 2014

Blue Nile and Marc Andreesen's theory of public company shareholders, oh and a valuation of Amazon

The growth investors will hold a stock as long as the rate of revenue growth does not slow. When it slows they dump - and the shares of really fine companies can fall sharply because the growth rate falls from (say) high single digit to mid single digit. What are objectively great results can see 25 percent price falls simply because the results do not measure up to the expectations of the shareholder base.

The growth investors don't much care about earnings (they come later). But they do care how big the eventual market becomes.

A recent example of a fall (which may or may not be justified) is Amazon who were seen missing lofty expectations for Christmas sales. [The sales numbers were fantastic, just the expectations were more fantastic.]

A fallen growth stock doesn't become fashionable again until it has a lower-than-market price-earnings ratio where it attracts "value investors". Value investors have a different agenda. They want the business run for cash and maybe for buybacks. Shareholders will pressure management to meet their expectations. [Example: Apple.] If earnings fall or buy-backs slow these shareholders are disappointed.

Below the value investors - and mentioned in later tweets - are the Ben Graham style bottom feeders who get really interested when the stock is trading at half cash. Whereas traditional value investors want the business run for cash the true bottom feeders want the business closed for cash. Zynga at bottom was borderline of interest these investors.

Outside this are the arbitrageurs that just want to rent the stock for a short term deal. No deal and they are disappointed.

This is a generalization. But being a non-conformist at heart I want to look at the places between - stocks dumped by growth investors for example before they become interesting to value investors - or stocks that are approaching Ben Graham levels but still have viable businesses.

Between the cracks are interesting places to look. Zynga was interesting at the edge of being a Ben Graham stock. Google's had a slowdown that lasted one quarter. Buying a growth stock when the slowdown is temporary and lasts one quarter provides great opportunities. See January 2012 where Google dropped a double-digit percentage in a sharply rising market.*

So I am going to look at a twixt-and-between stock: Blue Nile. This is a failed growth stock that doesn't yet have a low PE and has an enormous short interest. The company recently missed and guided revenue and earnings down - which is problematic for a stock with a 50 PE ratio.

The knock on the stock: it has been missing expectations for years.

==

The Jeweller with one of the all-time-great business models

Blue Nile has possibly the most seductive business model I have ever seen. It is an online build-your-own seller of engagement rings.

The modal purchaser of an engagement ring is a man in their 20s or the 30s who doesn't give two hoots about jewellery. The purchase is large (a month's salary?) and is full of terms that he doesn't know (VS2 clarity anyone). He is buying it for someone who he hopes will accept his proposal.

The ideal customer provides no return business. Ever.

The total absence of return business means that the downside for ripping customers off is low. [They are not coming back so if you gouge them it won't matter.] The high-ticket price and the general ignorance of the customer guarantees a rip-off. If the customer is at all sophisticated about human nature they know it.

The shop-keepers know this too. They have glamorous premises (which just adds to the feeling of being ripped off). They use lighting tricks to make the diamonds sparkle. And the sales guys are - in my one-off experience** - a less explicitly testosterone laden version of car salesmen. Slick. Dishonourable. But smooth, so smooth.

Into this comes Blue Nile who offer diamond engagement rings on a build-your-own basis with transparent pricing. You go to their site and choose one stone, three stone, this clasp, that clasp, this quality and size of diamond etc. They tell you if you are choosing a quality of diamond so high you can't tell the imperfections except with a microscope. As you move the slider up choosing a bigger diamond or a higher quality diamond the price changes and you can see the price change so you know how much you are paying for size/quality and settings.

The margin is thin - so there is no way you can feel "ripped off" and it comes in a blue-box which to my (admittedly unsophisticated eye) is just a darker, richer shade of blue vis the expensive boxes sold by Tiffany's.

If you have not played with the jewellery site do so. This is internet shopping at its finest.

It is also a truly great business model. Transparent pricing makes a guy keen to shop there. But the real joy is the negative working capital.

A traditional jeweller sits huge amounts of inventory around waiting for a victim (ahem: customer) to come through the door. They need to sell at a price high enough to get a return on all that inventory. Zale Corporation has $900 million in inventory. That inventory is the majority of their assets and represents about a year of cost of goods sold. The first 10% of margin is just getting a return of 10% on the inventory holding. Tiffany is even worse with $2.4 billion in inventory and annual cost of goods sold of $1.7 billion. They have 17 months inventory sitting around glistening under expensive lights and more expensive security. Margins need to be enormous just to give a return on inventory holdings.

By contrast Blue Nile recognizes diamonds are commodities and doesn't bother with all that inventory. They just buy-to-order. If you want a round-cut three-quarter carrot diamond with an ideal-grade cut and VS2 clarity it will cost you about two and a half grand and one is pretty well like another. So Blue Nile take your money, build the ring to order and ship it to you. Turn-around is not fast but is adequate and Blue Nile operate with negative working capital. At the last (and disappointing) numbers Blue Nile has $34 million of inventory (mostly non-engage ring product) and $134 million in accounts payable. The offset is a cash balance well over $100 million.

And Blue Nile can sell much cheaper than a traditional jeweller. A traditional jeweller with this turnover would carry maybe $350 million more inventory and would require a return on that. They would also need security and insurance for that inventory and would pass that onto customers. On top of that there are no premises and slick dishonourable sales people to pay. All this would add up to more than 20 percent cost advantage.

The advantage that Blue Nile has over its competitors is much bigger than the advantage that (say) Amazon has over Best Buy.

If you had that advantage the rational thing to do is to price really keenly, be as honest and transparent as possible and grow and grow and grow some more.

In other words to do what Amazon does.

One day - sometime in the dim-distant future - growth will slow because you have captured the market and then you price with say a 8% margin and mint money.

The maths will look like this. We don't know what the "end-sustainable sales" are but for every dollar of sales there is 8c of margin. Post tax there will be about 5.6 cents of earnings. Put that on 13 times and the stock will settle out at 72 percent of sales.

If end sales are a billion the market cap will be $720 million. If they are 5 billion the market cap will be $3.6 billion.

This maths gives you the quick way of valuing Amazon. Amazon sales are currently $75 billion. If they quadruple between now and maturation the end sales will be $300 billion. The end market cap will be $210 billion. The current market cap is $165 billion. If Amazon can quadruple sales the stock will be a winner. I think it probably will. But to do really well on the stock sales probably need to rise 600 percent. [We have no position in the stock.]

Alas Blue Nile is not Amazon. Despite what looks like a massive advantage and a near perfect business model Blue Nile just has not grown that fast.

In 2008 Amazon sales were $20 billion. They are now $75 billion. Sales have better-than tripled.

By contrast Nile has disappointed. Sales are only up about 50 percent. And in that time margins have slid so earnings are flat. Earnings are flat at Amazon too but nobody gives a toss. All they care about is the sales growth.

But they do give a toss at Blue Nile. Blue Nile guided for earnings/margins and missed. And their sales growth has slid to low-teens. It raises the question: if they really have a better business model why isn't it growing at the torrid pace that Amazon is growing.

One problem is that marriage just isn't that fashionable. Marriage rates are in historic decline... also people are stinging on engagement rings... but that doesn't quite explain it. Blue Nile remains way too small a part of the market.

The obvious suggestion is that engagement rings are such an emotional purchase that the bride-to-be really wants to see it and hence shops traditionally. And despite the movies men don't often get down on a bended knee and offer a surprise proposal ring-in-box proffered up ready for rejection. [I would have been way too insecure...]

And so the end market for Blue Nile is just not that big.

==

But there are offsets. Blue Nile does have a reputation for not ripping you off. I can imagine plenty of Chinese want loose diamonds as a form of portable wealth. The end-market here could be enormous. If Blue Nile can capture any of that the sales will be huge albeit at low margins.

And there are some technologies out there which will make Blue Nile a very much better business. The Oculus Rift is one of the hottest venture capital concepts. Cheap highly realistic 3-D virtual reality headsets are coming. 3-D scanners will also be under $100***. When you inspect real-estate online you will be able to walk in your headset through the house in realistic, high-resolution 3-D. When you buy jewellery online you will be able to see how it looks on your (or your bride's) hand. And you will be able to tweak it so you know when that stone really is so large it is grotesque. In other words online shopping will be a much better experience.

==

The value proposition in Blue Nile stock

Trailing sales are $450 million. The market cap is $442 million. Sales are growing still but the rate is disappointing. The PE ratio is over 40 but that is because the business is not earning much margin.

It is not a value stock yet. The PE is way too high.

Rather the stock is held by disappointed growth investors. After all this was the perfect business and it didn't perform.

Also it is closer to 1.0 times sales than my magical-end point of 0.7 times sales. It will get to 0.7 times sales one day - either by the price declining further or the sales increasing. Given the low-teens growth rate getting there via growth seems likely to me albeit at a slow-grind for shareholders.

In other words Blue Nile is twixt-and-between. Its not a great growth stock and is hardly a value stock.

It wouldn't be much interest to me except that it has a short interest of 20 percent of the float, is more than 115 percent owned by institutions and is - on the metrics above only about 20 percent overpriced. After all it will wind up as a value stock one day at 0.7 times sales.

We are in a market where lots and lots of stuff is more than 20 percent overpriced. So I don't get it. Can someone please explain the short interest? Do the shorts really believe this deserves to trade at half sales?

==

Why we own it?

When stocks have a very high short interest and the shorts are wrong the stocks are unbelievably large winners. Think Tesla, Netflix and - dare I say it Herbalife.

So far on Blue Nile the shorts have not been wrong. This is a company which is disappointing on growth and disappointing on margins. But as I noted there are things that can go right.

Top of my list is the Chinese developing a fascination with loose diamonds. The amounts of money here are enormous - and as a general rule I don't want to be short Chinese corruption. Chinese corruption is a very big market.

Maybe more certain: the Silicon Valley guys are completely obsessed about the Oculus Rift and immersive and cheap 3-D experiences. They are early (which is their job). Still I don't want to be short a real 3-D stock. Cheap 3-D technology will change the online shopping experience dramatically. I can see Blue Nile sales eventually quadrupling - in which case the stock is very cheap indeed. But that eventual sales growth relies on technologies that will not be widespread this year and are not part of Blue Nile's publicly stated plans.

John

*I remember well. We were long. January 2012 was our worst ever month.

** I am married to my first wife. Shopping for an engagement ring really was and will remain a one-off experience.

***Lidars with the processing power in your phone and the cloud.

Friday, February 7, 2014

Jerry Seinfeld on Jos. A. Bank and Men's Warehouse

I asked my readers to do some due-diligence for me, taking photos of JOSB stores over the Black Friday sales. I got back a small, biased sample. Most my readers (with a value-manager exception noted below) are not the sort of people who shop there. A typical response I got was this:

This [with attached photos] is the Jos Bank store at the Galleria Mall in Ft Lauderdale, FL. I started taking pictures and they asked why I was doing it. Tried to take the front from both sides and from the escalator so you get an idea, took pics of shelves and prices, hope it helps. This was Black Friday 7:30 pm, I was the only person in the store.Several other people said that they were the "only person in the store". And yet JOSB reported in their conference call that their sales over the Black Friday period were great. Here is a direct quote from their last conference call:

We're particularly happy with our strong sales in week 4 of November which includes Thanksgiving and Black Friday, and also the first week of December so far which includes Cyber Monday. Customers really responded to our combination of fresh and timely product offerings, strong door-buster pricing and compelling values throughout the store. And we achieved these strong sales without deterioration in the efficiency of our advertising spending and without a deterioration of our gross profit margin rate.Even by the standards of retail advertising there is double-talk here. The company does have "door-buster pricing" but it also has nine months of inventory, something they justify on the basis that a wide offering is a competitive advantage and that men's fashion changes slowly. "Fresh and timely product offerings" is not something I associate with JOSB. Nor is "fresh and timely" consistent with JOSB's accounts. And the sales aren't "door busters" if the seeming absence of customers is anything to go by.

Whatever: JOSB seems to work. For years they have had great sales from lightly trafficked stores. Indeed Vitaly Katsenelson (someone I make a point of reading) has commented on it in the past. This is from 2008 (at the height of the crisis). Vitaly made a pile of money on the stock:

When I think of the Jos. A. Bank (JOSB), I think of Yogi Berra’s saying “Nobody goes there because it is too crowded.”

Only in the case of JOSB, it sounds like this: “EVERYBODY goes there because it is NOT crowded.” As most men who shop there will attest, you are lucky to see and handful of customers shop [...] at any given time. Nevertheless, it seems that JOSB operates in a very different economy and there is an incredible disconnect between its performance this year and the rest of the economy as well as other retailers.

JOSB reported 3rd quarter numbers couple of days ago and they were stellar even by a healthy economy’s standards.

They were truly incredible considering that negative double-digit same-store sales for retailers have become the norm. JOSB reported same store sales of 7% for the quarter (the company doesn’t report monthly numbers anymore). Total sales were up 13.7%. Operating profits before taxes were up 20.3%. Cash was up year-over-year, and inventory growth lagged sales. Every single metric was simply beautiful.And Vitaly does shop at JOSB - and proudly shows me his cheap suits. He clearly spends a pile of money without achieving sartorial elegance. [Still he made good money on the stock and I would take that over a decent fashion sense any day...]

One of JOSB's tricks might be that they keep the average ticket per customer very high by getting them to buy several suits and multiple ties and shirts simultaneously with their "buy-one-get-three-free" marketing. A high average ticket means you can have lots of sales but not many customers.

[Contra: selling three suits at once would tend to fill most men's wardrobes. In most houses the wife has three to five times the hanging space of the husband. Six suits would fill mine permanently. Its hard to get return customers when their wardrobe is already packed with clothes.]

The situation at JOSB is so anomalous that people with a better sense of humour than me just decide to laugh at it. I can't do any better than this:

John

Monday, February 3, 2014

Get your opiates for free: Capitalism meets the zombie apocalypse

This ambitious marketing strategy allows more than enough time and supply to create addicts.

The company is Galena Biopharma and their product, under the marketing name of Abstral is sublingual Fentanyl.

Fentanyl according to Wikipedia is a potent, synthetic opioid analgesic with a rapid onset and short duration of action. In other words you get really high, really fast and it doesn't last long. Also according to Wikipedia it is "one of a small number of drugs that may be especially harmful, and in some cases fatal, with just one dose".

Fentanyl has a legitimate use - for intense "breakthrough" pain spasms for someone already being treated around the clock with a heavy opiod like morphine. The legitimate user is probably a terminal cancer patient with bursts of pain so intense that morphine just doesn't cut it. In that case the seriously addicting properties of the drug are not particularly relevant and the benefit of use is indisputable.

Outside that it is hard to think of a good use for this drug.

The drug has killed plenty of people including a few notable rock-n-rollers. Read Wikipedia for the gory details.

Galena's hot new product is a sublingual version of an old drug. The marketing (on their website) argues this drug is really fast. To quote: "Patients preferred Abstral for speed".

However to give it that extra marketing pizazz they are giving it away. Here is the pitch - which I believe as a matter of policy should be criminalized.* [I note that tobacco companies are not allowed to give free samples of cigarettes - and it is curious that same does not apply here.]

The advert has an irony of its own. It shows a new-age style woman completely blissed out (with a smiling kid) and the slogan "time better spent".

We have US corporations doing hippy-alternative-lifestyle drug marketing for drugs that are especially effective in turning you into a zombie. Capitalism meets the zombie apocalypse.

It is as if Tim Leary was reincarnated as a cynical capitalist going for the mega-dollars.

John

I don't think I can overstate just how evil I think* this is. Fentanyl is very fast acting and is sometimes used in cutting heroin to make it more saleable. Drug dealers test the quality of heroin by "tasting" it. If it acts quickly then it is presumably good. [See Lou Reed singing about "sweet taste".]

Because Fentanyl is fast-acting it is sometimes cut in to make the taste more immediately effective. However because of Fentanyl's properties it can turn the batch of heroin deadly. There is a Fentanyl laced batch in the US at the moment - the latest victim was probably Philip Seymour Hoffman. See this story about a "killer" batch of heroin with about 100 victims.

It is a strange world where Herbalife is considered an unethical stock. I have met several people who (for good reason) claim their life was saved by Herbalife. Herbalife may be an insidious cult like AA. But like AA it makes people healthier.

This is a company which will end people's lives. Oh, and give away the product for free.

===

For the record, this is the company's black-label warning on Abstral:

Do not use ABSTRAL unless you are regularly using another opioid pain medicine around-the-clock for your cancer pain and your body is used to these medicines (this means that you are opioid tolerant).

- a child takes ABSTRAL. ABSTRAL can cause an overdose and death in any child who takes it

- an adult who has not been prescribed ABSTRAL takes it

- an adult who is not already taking opioids around-the-clock takes ABSTRAL

If possible, try to remove ABSTRAL from the mouth.

---

*Whether giving away highly addictive drugs should be criminalized was a subject of debate amongst people I ran this blog post past. The range of opinion was from libertarian to nanny-state. My strong view that this behaviour should be criminal is a political view that others I respect differ from. For some the attitude was that it is very nice of the company to give away the drug to people in terminal pain, and if it creates some addicts - well that is their fault isn't t.

Saturday, February 1, 2014

A metadata summary: the Herbalife letters

The meta-data for the three letters is different, and sometimes there are subtle differences in the signature block and the resolution at which they are printed. The dates on the letters also change.

For completeness here is the metadata for each letter.

SEC Letter

Markey's site: 1/22/2014, made on a Hewlett Packard MFP

Ackman's site: 1/21/2014, made on a Hewlett Packard MFP

Post's site: 1/23/2014, made on an OmniPage CSDK 18, with the "copier@persq.com" author

FTC Letter

Markey's site: 1/22/2014, made on a Hewlett Packard MFP

Ackman's site: 1/21/2014, made on a Hewlett Packard MFP

Post's site: 1/23/2014, made on an OmniPage CSDK 18, with the "copier@persq.com" author

Herbalife Letter

Markey's site: 1/22/2014, made on a Hewlett Packard MFP

Ackman's site: 1/23/2014, made on an OmniPage CSDK 18

Post's site: 1/23/2014, made on an OmniPage CSDK 18*

* The Ackman and Post files are identical here. No other letters are identical.

I will leave the conclusions to readers.

John

PS. Michelle Celarier now refers to me on Twitter as an abuser. She suggested that I was "full of sh-t" for indicating that the dates were notable.

PPS. There was an enormous put option purchased on Herbalife before the letter was released to the public. This was reported widely but Dealbook at the New York Times is as good a link as any. These options were purchased about a week before any of the dates here. Many people have suggested insider trading based on that Dealbook article. I have my doubts. The British Prime Minister Harold Wilson famously observed that "a week is a long time in politics". I would be very surprised indeed if there were public versions of the letter circulating a week early.

Thursday, January 30, 2014

Michelle Celarier is sitting on a major story

I demonstrated that there were multiple versions of the letters that Senator Markey wrote concerning Herbalife.

The version on Bill Ackman's website has an earlier date than the one on Senator Markey's website. Moreover the one on Bill Ackman's website had been produced with a scanner.

The New York Post website carries the Ackman-website versions. Michelle Celarier claims that she got those versions from Senator Markey's website.

At first glance this looks problematic. The metadata on the New York Post versions includes the following: "Author: copier@persq.com".

It is thus plain that the letters were produced by Pershing Square.

However, even after my post Michelle Celarier believes she got the letters from Senator Markey's website:

I see no reason to disbelieve her.

However if she can prove this she is sitting on a pretty good story. Bill Ackman, billionaire hedge fund manager, gets to produce letters for Ed Markey's signature and gets them put on Ed Markey's website without alteration.

I look forward to reading that story in the New York Post.

John

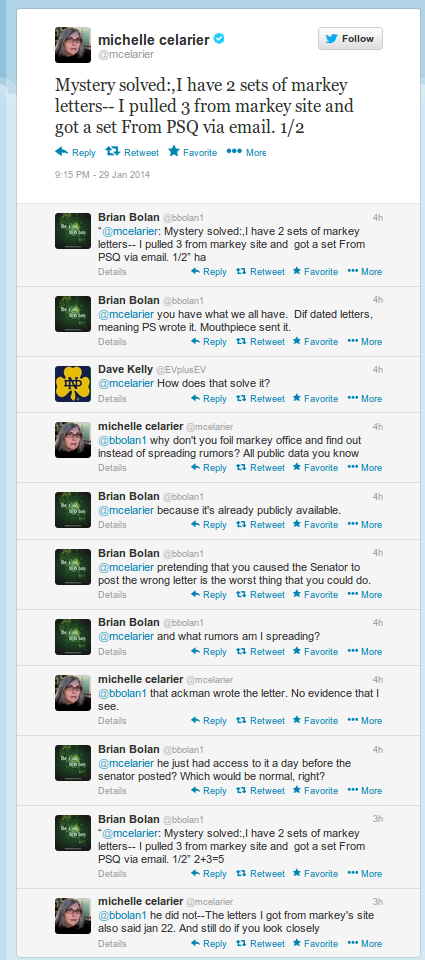

Michelle Celarier has issued an update on her Twitter stream. She now acknowledges that she received the letter from Pershing Square.

As the letters were clearly market sensitive there is one detail that is still missing - the date at which the letters were received by The Post. The letters on the New York Post website are dated the day before Senator Markey released his letter.

Here is Michelle Celarier's update. I thank her for being so open with us.

J

Michelle Celarier is mistaken about her sources

The Bill Ackman version was dated January 22, 2014.

The Edward Markey version was dated January 23, 2014.

This letter was highly market sensitive, and trading on it in advance would be insider trading under either the Stock Act or the Supreme Court decision in the R. Forster Winans case.

I have no evidence however that anybody traded. I only note the sensitivity of the letter.

I also tartly noted that Michelle Celarier's New York Post article on Senator Edward Markey's letter had the letter dated January 22, 2014 - the same date as the letter on Bill Ackman's website.

--

This caused a minor stir in the Twittersphere. Witness this exchange between Josh Brown and Michelle Celarier.

Previously Michelle Celarier insisted that she pulled the letters of Markey's website and that maybe Markey had updated them at some later stage:

As Michelle Celarier has called me "full of sh-t as usual" I feel the need to defend myself.

I note, other than the date, there is one substantive difference between the letters on Ackman's website and the one on Markey's website.

Here is the signature block on the Ackman-website letter:

Note that the signature is in grey.

And here is the signature block on the Markey-website letter.

Note that the signature block is in blue.

I have checked many letters on Senator Markey's website.

As far as I can tell he always signs in blue.

The conclusion I have is that the letter on the Ackman website is a scanned letter.

This conclusion is confirmed by looking at other details. The Ackman-website letter for instance renders Edward Markey's letterhead unreadable:

(The picture really is that faint.)

By contrast the Markey letter has a readable letterhead:

The document properties are also different. The Markey version was produced on a Hewlett Packard MFP.

The Ackman-website version was produced on an eCopy ShareScan.

The letter put up by the New York Post was not the original letter. It was a scanned letter. It was also produced on an eCopy ShareScan and it has the same legibility issues as the Ackman-website letter.

Michelle Celarier is likely mistaken about where she got the letter from.

John

An update is warranted: Google Cache clearly shows a letter dated January 22 was at one stage on Senator Markey's website.

However this does not obviate the fact that Michelle Celarier's copy of the letter was a scanned copy with Pershing Square consistent metadata. However it does remove some suspicion as to timing of receipt of the copy.

J

Senators for billionaires: Edward Markey edition

A year later and Bill Ackman has managed to get a Senator to help him. Edward Markey (Democrat, Massachusetts) famously raised "the Herbalife issue". It whacked the stock.

I confess I might have been wrong.

Actually with respect to Markey I am wrong.

There are TWO versions of the Herbalife letter. One is from Bill Ackman's website.

Here is a picture:

You will note that it is dated January 22, 2014.

And one from Edward Markey's website:

It is dated January 23, 2014.

I would normally comment no further, but I can't help myself. You see the version the New York Post carried under the Michelle Celarier's byline is the Ackman version.

I gather the Kennedy Family consider themselves the rightful heir to Markey's seat. [It is the Kennedy's traditional seat.]

It can't hurt their cause that Markey is demonstrated to be the tool of billionaire Wall Street types.

J

PS. Hat tip http://twitter.com/TheSkeptic21

Tuesday, January 28, 2014

Unfriending

Besides I don't really have 300 friends and nor do most of you. And I don't really know the 3000 people in my Google contacts.

Facebook revenue is still rising fairly fast. Relevance is another matter.

No position in the stock. Was long a while ago - but stuffed the timing up for small profits.

General disclaimer

The content contained in this blog represents the opinions of Mr. Hempton. You should assume Mr. Hempton and his affiliates have positions in the securities discussed in this blog, and such beneficial ownership can create a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance and are subject to certain risks, uncertainties and other factors. Certain information in this blog concerning economic trends and performance is based on or derived from information provided by third-party sources. Mr. Hempton does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and Mr. Hempton is not obligated to, and may not, update it. The commentary in this blog in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this blog is not directed for investment purposes at US Persons.