Thursday, November 19, 2015

Channel stuffing by Valeant in Europe confirmed

This was (correctly) denied by Valeant who noted that they could not use specialty pharmacies to stuff the channel as the sale by a specialty pharmacy was only recognised by Valeant when the end customer was identified (and the drugs effectively sold to the end consumer).

It turns out that specialty pharmacy (and its attendant issues of ripping off insurance companies) is common at Valeant. It extends well beyond Philidor (as I will demonstrate in a future post).

In other words it is unlikely the channel is stuffed at all in America. But insurance copayment issues are far more widespread than Valeant asserts.

Yet receivable levels at Valeant are fairly high which leaves open the possibility that the channel was stuffed in places other than America.

This is now confirmed.

The Slovenian business press have done a fabulous job tracking down the stuffed warehouses in Slovenia. It is the front story on the main Slovenian business website (link) and they have kindly reproduced the story in English (link).

With a few forthcoming speciality finance scandals and confirmed channel stuffing this is getting uglier by the minute.

John

PS. Letter to Valeant longs (ie tragics)...

Dear former winners,

Valeant owns the big branded analgesic business in Russia (one example). Branded versus unbranded paracetamol/acetaminophen etc.

This sort of stuff is economically sensitive. No-name but identical products sell on the same shelves at 10% of the cost of the branded stuff.

Did you ever wonder why the sales of this did not fall in Russia and Eastern Europe given the economic issues there?

That is right - they stuffed the channel.

http://www.finance.si/8838444/Slovenia-involved-in-Valeant-scandal

Keep your spirits up.

It is only (your clients') money.

John

SunEdison's new shareholders

There will be plenty of day-traders.

But even then there is likely to be one or two very large new shareholders. I have no idea who they are.

Whatever: I can't imagine them leaving Ahmad Chatila (the CEO) in place.

He has refused to resign, doesn't speak to reputable credit analysts and is responsible for the VSLR purchase.

The only remaining question: how bloody is the fight over his removal?

Mr Chatila should resign quickly and leave it to the new shareholders (if they wish to identify themselves) to pick his successor.

Ultimately he won't have any choice - but going without a fight will minimise the damage.

John

Whether the new shareholders are new bag holders is yet to be seen. I don't think they will be but the market disagrees with me.

Tuesday, November 17, 2015

Sun Edison disclosure practice

It is complete with the usual suggestion that there is debt at Sun Edison that is both (a) recourse to the parent company and (b) does not have sufficient and allocated cash left to settle it.

That is the central question with Sun Edison. Bears suggest that Sun Edison has parent company debt that they do not have the wherewithal to pay. The company has steadfastly denied this. They state all debt is either (a) non-recourse or (b) has well determined cash flows that will be used to pay it. Alas certain debts have shifted from the non-recourse to the recourse column.*

I confess I am concerned with the Credit Sights note. I own Sun Edison stock which I purchased in distress (about $9). This was after it lost two thirds of its value.

Proving my ability to pick stocks that halve it halved again.

The line in the Credit Sights report that concerns me most however is not assertions about recourse versus non-recourse. That is the bet I have taken.

My concern is this:

SUNE stopped returning our emails and phone calls over a month ago so we are unable to confirm this new recourse status with the company as the missing one letter footnote could just be a typo.Sun Edison is a financial institution. It requires the trust of financial markets to do business.

Credit Sights is a highly reputable (if somewhat bearish) debt research shop.

Not returning their calls is simply unacceptable. The management of Sun Edison (as this blog has stated) have to start sounding like and behaving like the management of a mortgage REIT.

They are not doing so. Financial institutions do not ignore the people who analyse their debt.

So Mr Ahmad Chatila (CEO Sun Edison), how about you return Credit Sights' phone call?

Or, failing that, will the board of Sun Edison please fire the CEO now.

John Hempton

Disclosure: Long Sun Edison (unfortunately)

* One reclassified debt: a margin loan on Terraform stock was once classified as non-recourse and is now classified as recourse.

Wednesday, November 11, 2015

Video Raises Doubts over Flotek's Most Recent Statements

They argued that FracMax and their "complex nano-fluid" [CnF] worked nonetheless.

You can find the SEC filing here.

They however denied one suggestion in my original post. Flotek had long said that FracMax - an oil-field-database iPad app was a key to their sales success. However the iPad app crashed two iPads and clearly did not perform its stated function.

Here is what Flotek said in the SEC filing.

A final assertion made in the report claims that attempts to download FracMax® for personal use resulted in iPad malfunctions and no success in obtaining an operating version of the software application. The author concludes that the program does not operate properly.

As the Company has consistently noted since inception, FracMax® is a proprietary software application for the exclusive internal use of Flotek employees. While the Company is preparing to release a new version of the software available for use by operators, FracMax® is not currently available outside of Flotek employees. A key code as well as other security requirements are necessary to obtain a working copy of the FracMax® application. This has been a consistent policy since FracMax® was introduced in 2014.In other words they stated that there is no version of FracMax available to people who are not FloTek employees.

Here is a video that Flotek presented on their investment day in September.

This video ends with a long claim for the benefit of FracMax. To quote:

Now US and National Oil Companies can license a versions of the application customised to them on a FracMax centric Apple iPad which offers the ability to import specific reservoir and production software outputs for individual wells. Its associated FracMax Halo Technology enables selection of unique data fields for the particular user.

With the Flotek FracMax app hundreds of hours worth of detailed and potentially expensive return on investment analysis is available with the touch of a screen.

Its more impactful and convenient than ever to experience the real world benefit of CnF, an innovation that is revolutionising an industry by truly making a difference.

You can touch it, you can see it, and now you can believe it. Your data has become intelligent in a way never imagined.

The future is here.

This version of FracMax is clearly available to non-Flotek employees.

I hope that Flotek can show us at least one modified version of FracMax useable by third parties. Or they can somehow explain away that video.

Or otherwise it is simple.

There is a major misrepresentation with likely severe legal ramifications.

And it will get ugly.

John

Tuesday, November 10, 2015

Flotek: a plea for accuracy

===========

Warning: this is a really gonzo story. We tried to check the data and use the main marketing tool for a billion dollar company.

None of it worked out. The data looks like it was made up or at least systematically rigged. The marketing tool (an iPad app) simply crashes and is non-functional.

We can't tell whether the whole company is this suspect - but this is as non-sensical as anything we have seen on Wall Street. The closest comparable on this blog was Universal Travel Group, a stock which is now delisted and where the principals settled civil fraud charges.

If you own the stock you must work this to the end. Try to reproduce our results. If this is the whole story this stock will trade with a low single digit handle or lower.

John W. Chisholm is a fan of accuracy. Demands it, even. As the CEO of Flotek Industries, Inc., (NYSE:FTK) he requires factual, mathematical accuracy.

Here’s John Chisholm describing it to Jim Cramer in February 2015:

Let's go through one of his presentations and check the data.

Chisholm compares four wells in Texas: one that used CnF in its completion (“Molnoskey 1H”) and three nearby wells that did not (“Targac 1H,” “Gillespie 1H,” and “Berger 1H”).

Slide #

|

API #

|

TX Lease#

|

Well Name

|

Operator

|

58, 59

|

42-285-33654

|

10702

|

Targac 1H

|

Sabine Oil & Gas LLC

|

60, 61

|

42-285-33673

|

10811

|

Gillespie 1H

|

Sabine Oil & Gas LLC

|

62, 63

|

42-285-33756

|

10920

|

Molnoskey 1H (CnF)

|

Sabine Oil & Gas LLC

|

64, 65

|

42-285-33802

|

10972

|

Berger Unit 1H

|

Devon Energy Corp

|

So that particular well there, here's what we want you to focus on. 11 million gallons were pumped in that frack job. Here's the initial production: eight thousand eight hundred barrels in the first month, no CnF in that well. 'Kay? 11 million gallons, 8800 barrels.

Let’s compare the numbers.

Eagle-eyed readers—who no doubt share our commitment to correctness—will note several problems here.

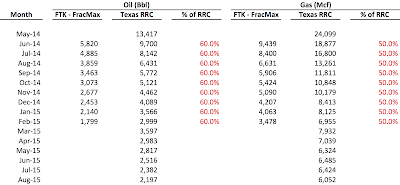

- The production data shown on Chisholm’s slide does not match what was reported to the RRC.

- The data appears to have been adjusted, as the numbers shown on the FracMax slide total only 60% of the oil production reported to the RRC and 50% of the gas.

- The first month’s oil production was not 8900 barrels in December 2013, but 17,761 in November 2013.

Chisholm it seems understated production data for the well that contained none of Flotek's special "complex nano-fluid".

Alas we found that this is a pattern rather than isolated error.

After retrieving the production data using ID # 10811, we find that Gillespie has the same undisclosed adjustment as Targac. Using the same table as we did for Targac, we compare the FracMax numbers from Flotek’s slide and the original RRC data.

Once again, the numbers don’t match. Chisholm correctly notes that both water use and production at Gillespie 1H were lower than at Targac 1H.

But what he didn’t say was that his numbers did not match the official data from the Texas Railroad Commission: production was both a month earlier (May, not June) and substantially higher than he claimed.

Not only were Flotek and Chisholm’s repeated insistences that the data is “as reported by the operator” incorrect, but the adjustments we have seen ARE consistently favorable to the Company’s CnF well and detrimental to the non-CnF wells.

Mistakes happen, though they undermine the many declarations of FracMax’s statistical robustness.

Given this pattern of adjustments we can’t help but wonder if these divergences are, in fact, mere mistakes. It is just too suspicious to consistently understate the results from wells that did not use their product.

Comparing the adjusted and unadjusted data for Molnoskey (CnF) and Targac (no CnF) reveals a starker problem: for at least some months, when the oil production is reported without Flotek’s alterations, the CnF-containing well performed worse, not better.

The table below compares monthly oil production in barrels, starting with the first month, of Targac and Molnoskey, the two wells Chisholm compared above. Under the heading for each well, there are three columns: Flotek’s numbers from its FracMax slide, the Texas RRC numbers, and Flotek’s numbers divided by the Texas #s shown as a percentage. (This data is the same as shown in each well’s respective comparison tables above.)

Under the heading “Diff in Production (Mol. – Targ.),” we subtract the two sets of reported numbers. First, we show Flotek’s numbers for Molnoskey – Targac, for the same month of production. These show an increase, as Chisholm stated. But when we use the original Texas RRC numbers, in the rightmost column below, we find that, for at least some months, Targac (no CnF) outperformed Molnoskey (CnF).

Sure many factors affect production (eg geology, how much water and sand and maybe acid are pumped into wells and maybe even the surfactants use).

Our aim is not to prove that CnF makes no difference. To do that we would need a large sample set. Rather we point out that on John Chisholm's data (after taking out the errors) it is impossible to conclude that Flotek's complex nano-fluids do anything.

We believe in "accuracy" but there ain't none here.

So let’s look at the final well.

As above, we look up the production data for Berger from the RRC using ID# 10972. Once again, Flotek’s reported production data from FracMax does not match the RRC’s, as the by-now-familiar table below shows:

Where before Flotek omitted the first month of production (usually the largest), in this case they have omitted the first two months of September and October 2014, as well as the most recently reported month, June 2015. And we find again the same undisclosed alteration of the RRC’s data, as FracMax displays only 60% of the RRC’s number for oil and 50% for gas.

The size of the claimed Flotek data base

“[W]hat you'll see today is on a FracMax instance that has 98 thousand wells. Not 98. Not 980. Not 9000. Ninety-eight thousand wells in the United States that we have all categorized based on what went in and what the production is. And 10% of it has CnF in it. And any statistician will tell you that's enough of a database that you can make algorithmic, statistic inferences as to what the economic impact is on a dataset that big.” [emphasis in original]

So we downloaded an app claiming to be FracMax.

We just can’t make it work and we tried with a brand new ipad just to test compatability.

We find the same Flotek application pictured in the consumer app store above:

Clicking on the link leads us to the same page as before, except with “Volume Purchase Program” as the header:

(Note the section on “Managed Distribution” on the webpage above. It indicates that free apps are only available in bulk when using a “Mobile Data Management” solution, which implies control over the end user’s iPad. This form of distribution would be more common within a single enterprise whose mobile devices are managed centrally.)

We would love if other readers could try to load the app. At last testing it crashed both our ipads.

And we like a good stock puzzle - especially one where the management seem to make it up.

John

Adlai Stevenson suggests that “Accuracy is to a newspaper what virtue is to a lady, but a newspaper can always print a retraction.”

Can we expect a retraction or is Flotek truly without virtue?

==========

Post script:

The company put out a press release that admitted to most the key issues in this blog post. The press release is repeated here.

Flotek has carefully reviewed a recent report regarding the validity of the data from the Company's FracMax® database by analyzing data from a small subset of wells in FracMax®. The analysis suggests the production data presented by Flotek – for three of the wells analyzed – were misinterpreted by Flotek and understated the production of those wells.

"We take any contention of errors in our data, processes and analysis very seriously," said John Chisholm, Chairman, President and Chief Executive Officer of Flotek. "We appreciate the thorough analysis provided in the report and are using this critique as well as others to improve our FracMax® application to ensure both the validity and reliability of the underlying data as well as the accuracy of the analytical processes."

As a result of our initial review of the report we have concluded that the FracMax® database – partly a result of third party data used by Flotek – identified the three wells in question to be contained in units with multiple wells (the state of Texas organizes production reporting by units, or leases, that report total production in the aggregate). The FracMax® application uses algorithms to assign production to individual wells within multiple well units. In this case, the report contends that the wells in question were on single-well units and, as a result, 100% of the production from those units should be assigned to the identified wells. After review of the report, data from the Texas Railroad Commission as well as other third-party data providers, it appears that the wells in question are single-well units.

While the adjustment does impact the magnitude of the outperformance of the well completed using CnF® when compared to the non-CnF® treated wells, it does not, the Company believes, change the conclusion that the CnF® well outperformed the non-CnF® wells, especially when normalized for the length of the lateral completion zone.

"While we are concerned by the unintentional data and processing error that led to this unitization miscalculation and are taking aggressive steps to ensure this process is immediately corrected, our analysis of the wells in question concludes the use of CnF® improved productivity when compared to the neighboring wells that did not use CnF® in the completion process," said Chisholm. "Moreover, Sabine Oil & Gas – the operator of three of the wells in question – continues to use CnF® on its completions, an indication that Sabine's internal data show compelling benefits from the use of Flotek's Complex nano-Fluids® suite of completion chemistries."

The Company has conducted an initial review of the FracMax® database and has determined that this data and process error does not impact the vast majority of wells in the database which appear to be unitized appropriately by the software application. "In fact, there were several other wells in the investor presentation that were unitized and reported correctly, showing the benefits of CnF® that were not discussed or referred to in the report," added Chisholm.

"While FracMax® is an important tool in the development of new markets for CnF®, the most important determinant of the success of CnF® is the actual performance of the Company's completion chemistry in the wells of new and existing clients," said Chisholm. "The growth in validations that result in new commercial customers is the ultimate proof of the efficacy of our completion chemistries. Our clients and their experiences – as seen through their own proprietary production data – are by far the best evidence of the performance-enhancing nature of CnF®."

The number of production companies using CnF® in the completion process continues to grow with a consistent flow of validation projects for operators of all sizes.

A previous press release took issue with my assertion that the FracMax iPad app did not work. To quote:

"In addition, as we have noted consistently over the past year, FracMax® is currently used exclusively by the Flotek team to analyze well and performance data for our clients," added Chisholm. "The application is not available outside of Flotek and, as a result, cannot be downloaded without appropriate credentials."I have yet to see any working FracMax app. Moreover I have not seen anyone (such as a client) using said app. The company now says that the app is entirely an internal tool. However this is not how it was represented in the past. Here is a link to the app's website on Archive.org.

And here is a picture.

This is the "innovative mobile app where the industry revolutionising impact of Flotek's CnF technology is on full display" and we should "prepare to experience what it can do for yourself".

This is very different from the current assertion that FrackMax is an internal sales tool only.

Here is a simple challenge to Flotek management: find a friendly Wall Street Journal reporter who will report - even in a brief column - that they have experienced it for themselves.

I do not think it can be done. Without further proof I remain convinced that the management are simply making it all up.

John

General disclaimer

The content contained in this blog represents the opinions of Mr. Hempton. You should assume Mr. Hempton and his affiliates have positions in the securities discussed in this blog, and such beneficial ownership can create a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance and are subject to certain risks, uncertainties and other factors. Certain information in this blog concerning economic trends and performance is based on or derived from information provided by third-party sources. Mr. Hempton does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and Mr. Hempton is not obligated to, and may not, update it. The commentary in this blog in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this blog is not directed for investment purposes at US Persons.