Background: Roddy Boyd wrote a fine article about Philidor - a speciality pharmacy tied to Valeant. You can find the article here. Some of the conference call addresses that article. However I want to start in the Q&A.

Alex Arfaei - BMO Capital Markets - Analyst

Sure. Just trying to figure out -- you said [Salix Revenue] was going to be about $300 million, you're recognizing $460 million. So, I'm just trying to figure out what changed since you provided that guidance.

J. Michael Pearson - Valeant Pharmaceuticals International, Inc. - Chairman and CEO

I think a couple things. One is we don't know exactly -- we know what the inventory is with the big three, we don't know how much inventory there is in some of the other distributors because there were no agreements in place to tell us that. What we're not doing is providing any discounts or any incentives for people to buy Salix products.

Also, the inventory was not sort of -- it wasn't that everyone had like five months of extra inventory of everything. It really varied by product. So, there might have been a year's worth of one product and four months of another product. That's why it's taking time. It's taking time to reduce those inventories.

But I think the sales, the fact that sales have increased -- again, there's no sales incentive, I think it's all growth. The products continue to grow above what we had forecasted in our deal model. And, as Rob mentioned, we're going to continue to try to be conservative. We don't want to get ahead of ourselves.

Then integration costs, the integration costs we've exceeded --."

“When I use a word,’ Humpty Dumpty said in rather a scornful tone, ‘it means just what I choose it to mean — neither more nor less.’'The question is,’ said Alice, ‘whether you can make words mean so many different things.’

You would think however at this time that the CEO of Valeant would be precise - lawyered up - regarding what they said about their incentive programs. After all just last week they received subpoenas on those programs. To quote their press release:

Valeant recently received a subpoena from the U.S. Attorney's Office for the District of Massachusetts and a subpoena from the U.S. Attorney's Office for the Southern District of New York. Most of the materials requested by the subpoenas relate to documents with respect to our patient assistance programs, and also include requests relating to financial support provided by the company for patients, distribution of the company's products, information provided to the Centers for Medicare and Medicaid Services, and pricing decisions.

And indeed the patient assistance programs, and Valeant's relationship with a speciality pharmacy called Philidor Rx services is central to this - and was addressed for the first time in the conference call.

What is Philidor Rx Services?

Philidor Rx Services is a mail order specialty pharmaceutical company distributing almost entirely Valeant products and whose use is pushed by Valeant sales reps. It does not report its prescription data and hence analysing Valeant based on standard prescription data services gives erroneous results. [This led to some disagreement when Valeant tried to buy Allergan where Allergan were giving sales numbers and Valeant was denying them.]

Here is some sales and marketing material left by Valeant sales reps - including referrals to Philidor.

Note that the phone number for the Valeant access passport and for Philidor are identical.

Philidor is very large - and has grown very rapidly. [State] Senator Stewart Greenleaf recently filmed an interview with Andy Davenport of Philidor and put it on his facebook page. That video is below:

The interview at no point indicates that Philidor is tied to Valeant. Andy Davenport state they partner with "manufacturers to help bring their branded medications to market as cheaply as possible". He says "manufacturers" plural but in reality they are captive by a single branded good manufacturer. He also says they chose the best manufacturers for the products on the market.

It stated that they have 635 employees nationally - and they think they will get something near to 1000 employees in 2015. They thought they would be 12-15000 prescriptions per day by the end of 2015.

The word Valeant never appears in this video. Similarly the word Philidor never appears in anywhere in the SEC filings for Valeant even though it is probably a double-digit percentage of Valeant's sales. That is right - there is simply no mention of it in SEC files.

Moreover Philidor has gone to some extent to hide its ownership. Here is the "whois" data on website ownership with the key details given:

Domain Name: PHILIDORRXSERVICES.COMOwnership it seems is deliberately hidden.

Registry Domain ID: 1774229314_DOMAIN_COM-VRSN

Registrar WHOIS Server: whois.networksolutions.com

Registrar URL: http://networksolutions.com

Updated Date: 2015-07-21T19:49:11Z

Creation Date: 2013-01-17T19:57:48Z

Registrar Registration Expiration Date: 2016-01-17T05:00:00Z

Registrar: NETWORK SOLUTIONS, LLC.

Registrar IANA ID: 2

Registrar Abuse Contact Email: abuse@web.com

Registrar Abuse Contact Phone: +1.8003337680

Reseller:

Domain Status: clientTransferProhibited http://www.icann.org/epp#clientTransferProhibited

Registry Registrant ID:

Registrant Name: PERFECT PRIVACY, LLC

Registrant Organization:

Registrant Street: 12808 Gran Bay Parkway West

Registrant City: Jacksonville

Registrant State/Province: FL

Registrant Postal Code: 32258

Registrant Country: US

Registrant Phone: +1.5707088780

Registrant Phone Ext:

Registrant Fax:

Registrant Fax Ext:

Registrant Email: b45245uq2sj@networksolutionsprivateregistration.com

Indeed Philidor appears to commit criminal offences to hide who their owners are.

The California Board of Pharmacy denied them a license to operate in California and in a court filing stated:

On July 24, 2013, in Respondent's application for licensure, Respondent made a false statement of fact with the intent to benefit Respondent, in that Matthew Davenport certified under penalty of perjury in section "E" of the "Parent Corporation or Limited Liability Company Ownership Information" application form that there were no entities with 10% or more ownership interest in Respondent. In fact, at that time, there was one (1) individual and one (1) corporate entity with more than 10% ownership interest in Respondent.

There are many other allegations of perjury by Philidor or its offices. Most of this [government alleged] perjury was designed to obscure who the owners of Phildor were.

What is Philidor's business model?

Philidor's business model is - as far as I can see - to facilitate the sales of Valeant products. They do this by being flexible about copays and aggressive about filling refills. When I first hinted at Philidor I got several responses from readers that knew precisely what I was talking about - primarily because they had been Philidor customers. This is a typical response:

John, I enjoy your blog very much. I happened to see your cryptic message and I think I know what it is.

I'm no expert on Valeant, but I just so happened to have been prescribed one of their pharmaceuticals about 6 months ago. It was a foot cream to treat athletes foot called Luzu. What was strange was that the podiatrist suggested that the prescription be set up with a "by mail" pharmacy, telling me that they would cover the co-pay for the first prescription.

I went ahead and had the podiatrist sign me up with Philidor and the prescription was delivered. A few weeks later, I got a call from Philidor. They offered to cover the co-pay for all of the remaining refills, which was maybe 3 more refills. What is important is that this really isn't the type of prescription that would normally require constant refilling. I probably wouldn't have never ordered these refills if someone else hadn't offered to cover my cash costs.

I found this to be a pretty aggressive marketing tactic, which certainly could be used to attempt to stuff sales and bilk insurance companies. I do understand that Philidor was either created by or strongly associated with Valeant.

Well, not sure that is exactly what you were getting at with the cryptic message but that's what I got out of it.....

Cheers

I asked (and you will see why I asked later) who the insurance provider was and got this response:

The provider was Anthem, www.anthem.com

I'm not versed in the Healthcare world but I just found it so strange and aggressive that it made me question the efficacy of the practice. What was perhaps the most strange was that the doctor seemed to have been incentivized to steer me towards Philidor, and was at least somewhat aware of the relationship between Valeant and Philidor. It made me wonder what perks the doctor may have been receiving to plug Philidor and Valeant drugs.

With all that said, I now have a least a few years supply of athletes foot cream, haha.It is also easy enough to find complaints online (by former staff) about Philidor auto-refilling prescriptions without appropriate customer approvals. [To do this you obviously need to waive copays.]

There are multiple reports online about Philidor robo-calling people and sending them prescriptions. Some reports state that the prescription arrives without approval.

Philidor it seems was established with a great deal of assistance from Valeant sales people. Here is the citation on an award Valeant gave to one of its drug reps. [The rep in question is a former major league baseball player - and a copy of all the awards can be found here.]

Efforts to find out who really owns Philidor

We made extensive efforts to work out who owns and who facilitated Philidor. As we noted the website gave no clue. As of 24 June 2014 (according to the Great State of California) there was one individual owner and one corporate owner with more than a 10 percent stake.

So we dug and dug.

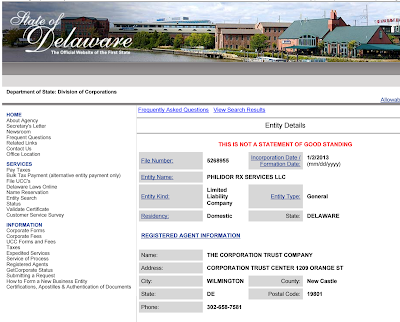

Philidor Rx Services LLC is a Delaware LLC that was formed in early January 2013.

The head office is in Pennsylvania, and it formed an LLC in Pennsylvania a few weeks later.

As Philidor operates in a number of states, it needs pharmacy licenses and "foreign" incorporation in several of those states. One of them is North Carolina, where Philidor Rx Services registered as a foreign LLC in late 2014.

Helpfully, North Carolina's registration lists some of the people involved in the LLC. (This is a bit nuanced, as North Carolina law indicates that all "members" aka owners of an LLC are automatically considered managers, unless the Articles of Formation state otherwise. So we can't prove using this document that the people listed are definitely legally the owners, but it's a pretty strong bet. Some of this is explained here:

Anyway you can find a list of the "members" of Philidor here which for convenience I have cut-and pasted as a picture.

In early 2015, something changed, for reasons we are don't quite understand. At that time, all on roughly the same day, each "manager" listed in the NC filings above had an identical UCC filing placed on their holdings in Philidor in their respective home states of PA, NJ and NY. We think this corresponds to a mortgage or lien over the shares. There should be a similar lien in Florida but we have not found it yet.

The lien covers all equity interests of any type that the individuals would acquire. Here is one such filing.

You can find the original filing here.

The lien was filed 24 February 2015 and is in favour of KGA Fulfilment Services.

KGA Fulfilment Services was easy to find. They exist in the SEC database only once - as a subsidiary of Valeant in an attachment to the last annual accounts.

So here we have it. A company that (at least in 2015) looks to be financed by Valeant but where management have gone to the extent of [alleged] perjury to hide who the underlying financiers are - and who auto-refill prescriptions waiving copayments.

There are also very big accounting issues with financing your customers [and not disclosing it] and we were very interested in the scale of this financing.

The new disclosure in the 3Q 2015 conference call

We have been poking around Philidor for some time now. Other people have too - as I have been sent things by other people. Roddy Boyd almost certainly tried to get answers from management when he wrote his (above-linked) article.

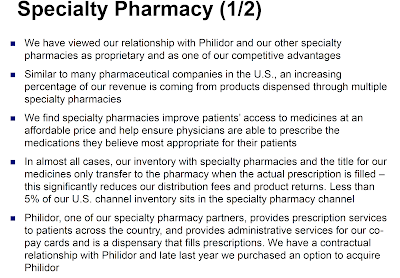

The conference call was the first time in any correspondence that Valeant has disclosed their relationship with Philidor. Here is the core slides from the conference call presentation.

They specifically state that they purchased an option to acquire Philidor in late 2014 and that they now consolidate Philidor as a variable interest entity. Normally that would be disclosed at least by name. Buying what was probably your biggest customer usually requires disclosure.

Whatever, Valeant say the effectively purchased Philidor in 2014 - but then the question is why there was no charge over Philidor holdings until late February 2015. It is hard to enforce an option if you do not have security over the shares.

R&O Pharmacy

R&O is a relatively small local and mail-order pharmacy operating in Ventura County California. I suspected originally and possibly even now that Valeant used R&O because Philidor did not have a license to operate in California.

This first came to my attention when The Skeptic tweeted a picture of a demand letter sent by Valeant demanding almost $70 million in payment from R&O. Here is a link to the demand letter and below is a picture.

This produced one of the most bizarre court filings I have ever seen. R&O simply deny [under penalty of perjury I presume] that they have received any relevant invoices from Valeant. You can find the filing here - and the key text is below:

On September 4, 2015, R&O received a letter from Robert Chai-Onn, Valeant’s Executive Vice President, Chief Legal Officer and General Counsel. In the letter, which was the first correspondence that R&O had ever received directly from Valeant, Mr. Chai-Onn claimed that R&O, a small licensed California pharmacy, owed Valeant over $69,000,000. However, R&O has never received a single invoice from Valeant in any amount and until September 4 had never received a single demand for payment from Valeant. R&O has requested copies of the invoices, but to no avail. Indeed, it seems that Valeant has no evidence whatsoever to back up its claims.

Therefore, R&O believes that one of two things must be true:

1. Valeant and R&O are victims of a massive fraud perpetuated by third parties; or

2. Valeant is conspiring with other persons or entities to perpetuate a massive fraud against R&O and others.

The purpose of this action is for R&O to get to the bottom of this, avoid accrual of avoidable damages, if any, and secure an early adjudication without waiting until Valeant sees fit to file suit.To say this was puzzling is understating it. It seems vanishingly unlikely that R&O (a licensed pharmacist) would rush to court to commit perjury regarding a $69 million amount. But essentially that is what Valeant stated in the conference call. To quote Mike Pearson (Valeant's CEO):

Next question: Why did Valeant's General Counsel send a letter to R&O? R&O is one of the specialty pharmacies in our network, and Valeant has shipped approximately $69 million at wholesale prices to them. This represents approximately $25 million at net prices. Any products R&O dispensed to patients were recognized as our revenues, and are reflected in our receivables. Any products still held by R&O are reflected in our inventory. R&O is currently improperly holding significant amounts it receives from payers. We will refrain from comment on active litigation, and look forward to showing in court that we are owed the money.This is a pretty big difference you might think. R&O says that they have never received communication directly from Valeant and Valeant says that they are one of the speciality pharmaceutical companies in their network and they have been shipping them material for some time.

The problem is that neither of these explanations make much sense to me.

Here is the limited stuff that I can find out about the relationship between Valeant and R&O and (dare I say it) our old friend Philidor.

First there is a name server associated with Philidor's website. You can find all the domain names on the same name server at this link. Here is the list:

Domains hosted on as62559

| Domain | IPv4 Address |

|---|---|

| westwilshirepharma.com | 8.34.189.50 |

| saferxpharma.com | 8.34.189.50 |

| randopharmacy.com | 8.34.189.50 |

| orbitpharmacy.com | 8.34.189.50 |

| dandapharma.com | 8.34.189.50 |

But - and this is really strange - it is a different R&O Pharmacy from the website that received the supposedly spurious demand for roughly $70 million.

These are the two websites for an R&O [or an R and O] pharmacy. Here they are.

http://r-opharmacy.com/

and

http://randopharmacy.com/

Only the latter one of these has the same name server as Philidor. Here - before they disappear - are pictures of the front page of both websites.

The seemingly non-related website:

And the one that shares Philidor's web server:

You will notice if you poke around the website that the phone numbers are also quite different. The Philidor associated website has used the same method to hide its ownership as Philidor. Its domain register as follows (edited):

Domain Name: RANDOPHARMACY.COM

Registrant Name: PERFECT PRIVACY, LLC

However the randopharmacy.com website contains a privacy policy. You can see an original here, or a copy here or a picture below.

Now if you read it says this:

It’s Your Information. This Notice describes your rights concerning your health record.

The law requires health organizations, such as Philidor Rx Services, to:

-maintain the privacy of your health information

-provide you with this Notice of our legal duties

-describe our privacy practices

-notify you if we have an information breach

We know your health information is very personal and we are committed to protecting your privacy.

Look at that highlighted section: randopharmacy.com says the law requires organisations like Philidor to do things.

You see this pharmacy has revealed itself. This R and O pharmacy is Philidor or at least a closely associated related party to Philidor.

And now I have a theory about what happened in this law suit. Valeant has sent product to randopharmacy.com and then sent demands to http://r-opharmacy.com/. The latter has responded by telling Valeant that they are the victim of a major fraud.

R&O Pharmacy [the one that received the demand letter] appears to right. Valeant appears to be either involved in or the victim of a major fraud.

But alas again it is not so simple. I phone the phone number on the randopharmacy.com website and got what sounded like a fax machine. [There was no personal contact and the number didn't work for a telephone pharmacy.]

So I rang the phone number on the r-opharmacy.com website [805 319 7260)] out of California hours. They could not take my phone call right now.

However they offered a button to push (the number 1 on my keypad) if I wanted to fill a dermatology prescription.

Philidor Pharmacy answered the phone.

I asked only one question - which was to assert that I lived in California and to ask whether they would ship to me. The answer floored me:

"Yes Sir the whole US of A".

You see the problem. Philidor was denied a non-resident pharmacy licence in California with the Californian authorities alleging perjury. But they ship to California anyway.

We are still trying to work out who is committing fraud on whom. There is clearly some going on but who the victims and who the perpetrators are is not obvious.

But what we have is Philidor (a Valeant consolidated entity) selling pharmaceuticals unlicensed in California and with a fake website for randopharmacy.com. They do this despite being specifically denied a license in California.

However R&O Pharmacy - the real one - clearly has a strong link with Philidor. You can call R&O's phone number and be transferred to Philidor.

It is entirely possible that R&O thought they had no relationship at all with Valeant until the demand letter came. They clearly knew they had a relationship with Philidor - but Philidor and Valeant carefully shielded their relationship and it only became public in the conference call.

One possibility is that Philidor sold scripts in the name of R&O [which would explain the double-website] and kept the money itself - telling Valeant that the money was sitting at R&O and was owed by R&O. I guess other possibilities are also possible and I have no way to handicap them.

Whatever: Mike Pearson has a very big problem and it extends beyond the more $50 million he will need to write off. It is possible - even likely - that some people associated with a variable interest that Valeant consolidates [and I have limited idea which people] have set up an entirely new randopharmacy.com - and have defrauded either Valeant or possibly some insurance companies of almost $70 million.

Valeant has

(a) booked the revenue and

(b) told everyone that they will win in court.

It is does not have decent operational or financial control over Philidor. And Valeant collecting this money seems unlikely.

Trying to work out which Valeant/Philidor/R&O officers committed the fraud - evidence from domain name history

A fraud has been committed here but I can't tell who by. And I can't tell who is the victim of this fraud.

We wanted to see if we could work out in more detail where the fraud was committed - at least for the purpose of telling the relevant Attorney Generals who to subpoena as part of their inquiries.

We went looking for the domain history of randopharmacy.com and we found some useful material. Specifically here was the registration history for 13 May 2015 edited to the core details:

Whois Record on May 13, 2015This proved that for about one day - 13 May 2015 - the domain was registered to Philidor Rx Services (which we now know is consolidated into Valeant and is effectively Valeant). The probability that Valeant needs to sue itself looks stronger. [You can find the entire domain history here.]

Domain Name: RANDOPHARMACY.COM

Tech Name: RX Services, LLC, Phildor

Tech Email: ffcjfc@gmail

There is also at tech contact email there ffcjfc@gmail. That email it seems belongs to Fabien Forrester-Charles as we discovered from the website of Emily Weaver Photography.

Fabien Forrester-Charles is a name that we had come by in our research and will be known to Valeant

Management. He is a part owner of Philidor and had pledged his shares to KGA Facilitating. The document by which he pledged his shares is copied below.

Mr Forrester-Charles appears on several domain name registrations. He may not be the person who established the phoney randopharmacy.com but it is likely that he knows who that person is. [The US Attorneys who have subponead Valeant would do well to ask Mr Forrester-Charles for information.]

Valeant's linked specialty pharmacies - the key to their growth - have been compromised

The tied specialty pharmacies and their rather aggressive copay sales tactics - which are the key to Valeant maintaining sales for some often marginal products whilst raising their prices look compromised.

There is a possibility that the biggest one - Philidor - contains fraudsters who set up fake associated pharmacies and then don't pay their bills. I can't tell whether this is junior staff or senior staff - and I can't tell whether the parties being defrauded are just Valeant or a combination of private insurance companies, Valeant and or Medicare/Medicaid.

The biggest specialty pharmacy (Philidor) is clearly delivering product to California despite being specifically (and pointedly) denied a license to operate in California and giving false statements under penalty of perjury by the Government of the Great State of California.

When you have subpoenas outstanding from two US Attorneys offices into the practices of these pharmacies this is going to matter.

Moreover I demonstrated at the beginning of this post that Mike Pearson does not actually know how the incentive programs work on the ground. He repeatedly (and falsely) stated that Valeant does not use those programs on Salix products.

The reason he largely does not know is the incentive programs are outsourced to specialty pharmacies (and as we will see below) also to some charities. And the key specialty pharmaceutical company appears to have a fraud problem (although we do not know the full nature or extent of that problem).

Copays and copay fraud

The two US Attorneys who have sent subpoenas to Valeant asked specifically as follows:

[D]ocuments with respect to our patient assistance programs, and also include requests relating to financial support provided by the company for patients, distribution of the company's products, information provided to the Centers for Medicare and Medicaid Services, and pricing decisions.[This was quoted above...]

It is worth understanding what the criminal offences they might be investigating are. They relate mostly to copays.

Copayments for drugs exist for good reasons. Firstly and obviously they recoup some of the costs of the drugs from patients. But far more importantly they verify that (a) there is a patient and that they are a real patient, (b) that they actually want the drug at least enough to make a small copayment.

Australia used to have an entirely free pharmaceutical system for people eligible for the pension. A $2 copayment was introduced. This trivial copayment had a surprisingly large effect on the demand for a drug.

Whether it is legal to waive copayments depends on the relationship between the insurance company and the pharmacy. [In many instances waiving of copayment has been deemed to be fraud.] However critically it is a criminal offence to systematically waive copayments when the insurer is Medicare or other Government programs. This is not something to take lightly - the Government does not like to be defrauded.

If the Valeant tied specialty pharmaceutical companies systematically waive copays for Medicare patients then there is considerable doubt whether Valeant can survive. A criminal charge against an entity with $30 billion in debt is likely to be fatal.

Moreover we have found direct evidence that Philidor sells pharmaceutical products in the Great State of California despite being pointedly denied a licence to do so. [Integrity is a question here.]

We looked hard and alas we found no direct evidence that Philidor waives copayments on Medicare insured pharmaceutical products. Indeed if you have a look at any Valeant coupon advertising it specifically states that these coupons are not available for medicare or medicaid patients. Here for example is a picture of the Jublia coupon page. Jublia is an ointment with an 18 percent chance of reducing toe-nail fungus and a cost of over $8,000 per course of treatment:

The relevant text is this: "This offer is not valid for prescriptions reimbursed in whole or in part by Medicaid, Medicare, federal, or state programs (including any state prescription drug programs)."

We have found similar text on every Valeant coupon page.

Drug companies however are a creative lot. They have found a way of ensuring that many Medicare patients are not out-of-pocket on pharmacy purchases. They fund "copay charities". The charities (and you hope they are genuine charities) tend to be funded by many pharmaceutical companies and will make copayments on branded drugs subject to means tests. They are - for obvious reasons - not allowed to be specific to one company's drugs.

Mr Pearson in the conference call was keen to indicate that Valeant was compliant with the law regarding copays. After all this is what the US Attorneys are looking at. To quote:

Valeant's patient assistant programs are administered by a reputable third party, and we fund outside foundations that have multiple donors. Eligibility is determined by the independent foundations. It is also important to note that eligibility for our in-house commercial access programs is limited to patients not covered by government programs. Looking at history, our commitment to patient assistant programs has grown at an annual compound rate of 128% from $53 million in 2012 to approximately $1 billion we expect to spend in 2016.

He specifically says that the "in-house commercial access programs is limited to patients not covered by government programs" and that they use outside foundations with "multiple donors". These programs will of course be the subject of some inquiries by the US Attorneys.

There is a minor contradiction in the statements by Mr Pearson on the call. Earlier in the call he stated that Philidor provides "administrative services for our copay cards" and we now know that Philidor is consolidated and not a "third party".

--

The question of course is whether these lofty standards are upheld in practice. That will be the subject of the US Attorney's inquiries. And there is a problem - we have identified serious issues at Philidor and Philidor provides administrative services for Valeant's copay cards. We have no idea how this will work out - but we suspect there may be some difficulties.

The size of Valeant's "patient assistance" programs and what it says about Valeant's business model

In the above quote Valeant states that their patient assistance programs are growing at 128 percent per annum. They will spend approximately $1 billion in 2016. This will be a high single-digit percentage of revenue and it looks like almost all of their products will have patient assistance for most of their sales.

This is extraordinary. Valeant has long said that they have avoided products which are dependent on reimbursement. If you google the phrase "significant cash pay component" you find literally dozens of Valeant presentations that harp on that as being an advantage of the business model.

That seems to have been a smokescreen. Valeant plans to spend a billion dollars in 2016 so that patients do not have to cash pay for most of their products.

The rest of the call

I could wander through Valeant's numbers in some detail. They are always moderately funky. This time for instance they touted their GAAP profit however did not point out that they had pre-tax losses and their profit was entirely from a sharply negative tax rate. As usual they did not provide a balance sheet anyway - so that is unusually hard to to on the day results are released. However after the

(a) demonstration that the CEO is not on top of the copay program [for instance he falsely denied that the company offers patient assistance on Salix products],

(b) the demonstration that their core distributor (Philidor) has (according to the Great State of California) perjured themselves

(c) the demonstration that they went to extraordinary levels to hide their funding and later effective ownership of Philidor

(d) the likelihood that people at Philidor have been involved in defrauding Valeant by impersonating R&O pharmacy

(e) the demonstration that Philidor sells drugs in California despite being pointedly denied a license to do so

(f) the likelihood that that fraud extends to the programs that are the subject of investigation by two US attorneys and

(f) the demonstration that the company has been misleading about its business model ("significant cash pay") for years

anything I will say about the numbers will be churlish.

I am short this stock. The US Attorneys are actively involved and somehow I think that is bearish.

John