Thursday, January 30, 2014

Michelle Celarier is sitting on a major story

I demonstrated that there were multiple versions of the letters that Senator Markey wrote concerning Herbalife.

The version on Bill Ackman's website has an earlier date than the one on Senator Markey's website. Moreover the one on Bill Ackman's website had been produced with a scanner.

The New York Post website carries the Ackman-website versions. Michelle Celarier claims that she got those versions from Senator Markey's website.

At first glance this looks problematic. The metadata on the New York Post versions includes the following: "Author: copier@persq.com".

It is thus plain that the letters were produced by Pershing Square.

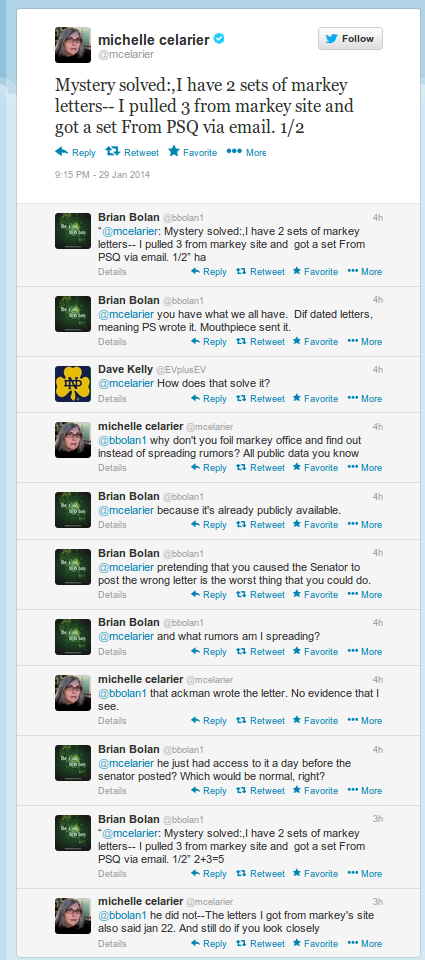

However, even after my post Michelle Celarier believes she got the letters from Senator Markey's website:

I see no reason to disbelieve her.

However if she can prove this she is sitting on a pretty good story. Bill Ackman, billionaire hedge fund manager, gets to produce letters for Ed Markey's signature and gets them put on Ed Markey's website without alteration.

I look forward to reading that story in the New York Post.

John

Michelle Celarier has issued an update on her Twitter stream. She now acknowledges that she received the letter from Pershing Square.

As the letters were clearly market sensitive there is one detail that is still missing - the date at which the letters were received by The Post. The letters on the New York Post website are dated the day before Senator Markey released his letter.

Here is Michelle Celarier's update. I thank her for being so open with us.

J

Michelle Celarier is mistaken about her sources

The Bill Ackman version was dated January 22, 2014.

The Edward Markey version was dated January 23, 2014.

This letter was highly market sensitive, and trading on it in advance would be insider trading under either the Stock Act or the Supreme Court decision in the R. Forster Winans case.

I have no evidence however that anybody traded. I only note the sensitivity of the letter.

I also tartly noted that Michelle Celarier's New York Post article on Senator Edward Markey's letter had the letter dated January 22, 2014 - the same date as the letter on Bill Ackman's website.

--

This caused a minor stir in the Twittersphere. Witness this exchange between Josh Brown and Michelle Celarier.

Previously Michelle Celarier insisted that she pulled the letters of Markey's website and that maybe Markey had updated them at some later stage:

As Michelle Celarier has called me "full of sh-t as usual" I feel the need to defend myself.

I note, other than the date, there is one substantive difference between the letters on Ackman's website and the one on Markey's website.

Here is the signature block on the Ackman-website letter:

Note that the signature is in grey.

And here is the signature block on the Markey-website letter.

Note that the signature block is in blue.

I have checked many letters on Senator Markey's website.

As far as I can tell he always signs in blue.

The conclusion I have is that the letter on the Ackman website is a scanned letter.

This conclusion is confirmed by looking at other details. The Ackman-website letter for instance renders Edward Markey's letterhead unreadable:

(The picture really is that faint.)

By contrast the Markey letter has a readable letterhead:

The document properties are also different. The Markey version was produced on a Hewlett Packard MFP.

The Ackman-website version was produced on an eCopy ShareScan.

The letter put up by the New York Post was not the original letter. It was a scanned letter. It was also produced on an eCopy ShareScan and it has the same legibility issues as the Ackman-website letter.

Michelle Celarier is likely mistaken about where she got the letter from.

John

An update is warranted: Google Cache clearly shows a letter dated January 22 was at one stage on Senator Markey's website.

However this does not obviate the fact that Michelle Celarier's copy of the letter was a scanned copy with Pershing Square consistent metadata. However it does remove some suspicion as to timing of receipt of the copy.

J

Senators for billionaires: Edward Markey edition

A year later and Bill Ackman has managed to get a Senator to help him. Edward Markey (Democrat, Massachusetts) famously raised "the Herbalife issue". It whacked the stock.

I confess I might have been wrong.

Actually with respect to Markey I am wrong.

There are TWO versions of the Herbalife letter. One is from Bill Ackman's website.

Here is a picture:

You will note that it is dated January 22, 2014.

And one from Edward Markey's website:

It is dated January 23, 2014.

I would normally comment no further, but I can't help myself. You see the version the New York Post carried under the Michelle Celarier's byline is the Ackman version.

I gather the Kennedy Family consider themselves the rightful heir to Markey's seat. [It is the Kennedy's traditional seat.]

It can't hurt their cause that Markey is demonstrated to be the tool of billionaire Wall Street types.

J

PS. Hat tip http://twitter.com/TheSkeptic21

Tuesday, January 28, 2014

Unfriending

Besides I don't really have 300 friends and nor do most of you. And I don't really know the 3000 people in my Google contacts.

Facebook revenue is still rising fairly fast. Relevance is another matter.

No position in the stock. Was long a while ago - but stuffed the timing up for small profits.

Sunday, January 26, 2014

When the hedge doesn't work

So you have in your head (or computer) some model of how the world works and what things should be correlated and what should not and you make your bets accordingly.

If your model is good and your position (stock) picking is good you should outperform some market (maybe a 40% bonds, 60% equity portfolio) at lower risk than the above portfolio.

But alas the hedges are necessarily imperfect hedges. [Perfectly hedged portfolios make cash returns - which at the moment is zero before fees...]

And with imperfect hedges sometimes the hedges don't work.

It doesn't matter how famous you are or how clever you are - you still have to deal with the time when your hedges don't work. It happens to all of us. [Truly - if you find a hedge fund manager who says they have never had "model failure" then find another fund manager.]

Its in this context (and noting his massive returns last year) that I remind my readers of a Bloomberg news interview with Tepper less than two months ago.

In this interview Tepper restates his case for equity markets being cheap enough and cheap compared to (say) bonds. I don't think it is a bad case - I don't think large caps are expensive. But they are more expensive than a few years ago. [See previous Bronte comments on the state of the market here and here.] [For the record I think there is a bubble in biotech and non-telecom stocks that are purchased primarily for their dividends and English language small caps that are not financial institutions.]

The real action in the above interview happens about four and half minutes in where Tepper outlines his short case for bonds. He is not short them because he thinks that there will be inflation (in fact he doesn't think there will be). Rather he is short them as a hedge against the consequence of the Federal Reserve trying to exit QE policies.

Bluntly that hedge did not work this week and particularly on Friday.

Equity markets had their worst day in yonks. The airlines (Tepper's biggest position) were not exactly good either (as they were typically off over 4 percent - double the market).

Bond markets however had a very good day. Long bond indices rose several percent in value.

In other words Tepper was long the bad stuff, short the good stuff and the short was meant to be his hedge.

His hedge did not work. Badly. I suspect he was down more than 4 percent on the day - maybe double the equity market.

As I said every single decent manager will have days when the hedge does not work. There is no implied criticism of Tepper here. [I watched that interview because I admire him...]

And I doubt his clients would be worried either. I have never watched Appaloosa pitch to clients but I suspect the risks are accurately described and I suspect David Tepper would say to his clients that if they cannot handle a low-single-digit down day or two they should not be clients. [I know Bronte would want to dissuade such people from being clients...]

But I also know what David Tepper is feeling. At Bronte we also had the worst day in our history (although it was not as bad as I think David Tepper's day was).

First you feel a little beaten up. But at some stage you need to (seriously) examine the possibility you are wrong. And at that point the emotion turns to self-loathing. It is surprising but many of the best asset managers I know really hate themselves. It's an occupational hazard - and indeed may be a pre-requisite to being really good at this game.

That said, self-loathing is not a very productive emotion. You shouldn't just stand there like a deer blinded by headlights.

The thought pattern (and this thought pattern can be ex-ante programmed into a computer if you want) has to turn to risk management - how do we behave if we continue to be wrong? At what point should we pull-the-plug and accept that we just don't get it.

The purpose of this blog post is to explore what to do with the portfolio when the hedge is not working. That is a discussion we are having at Bronte because this week it has not been working (although not in a very serious way). And I have written this from the perspective of a stock-picking long-short equity manager. [The discussion has the same intellectual components from the perspective of a computer driven trading shop - but I can't speak to the specific detail.]

Bronte's portfolio positioning

Because I don't want to give away all the tricks of the trade I am going to describe Bronte's portfolio in an idealized position. [Day-to-day situations vary.]

We have a long book which is mostly large cap like Verizon (although includes a few disclosed mid-caps like Herbalife) which should have a beta of roughly 1. On a day-to-day basis Herbalife is our highest beta stock.

We have a short book which is full of the widest and wildest range of scum, villainy, stock promotes and general nonsense we can find. The typical short position is a biotech scam stock or something like that. Some of these are very high beta indeed and the short book has a beta of about 2.

We may typically be 130 percent long, 50 percent short - but beta-adjusted we are only a net 30-40 percent long. Day to day movements usually reflect this. On a day when the market is up 1% we are typically only up 0.3-0.4 percent. When the market goes down a percent we typically go down a similar amount. To keep the maths simple I presume an ex-ante portfolio beta of 0.4 for the rest of the discussion.

As we have been right a fair bit of the time in our specific stock picks we have accumulated returns that are way better than equity market returns even though we believe we have been taking less than equity market risks.

This week however our performance has been bad. We have tracked down roughly 150 percent of equity market returns. Friday was - as I said - the worst day in our history - but the loss was only 150 percent of equity market returns...

But whilst Friday was the worst day in our history this month has not been the worst month in our history. We have only had one month where the model looked truly broken - and that was January 2012. We wrote it up at length for our clients. In that month we went down roughly 6 percent when the markets went up roughly 5 percent.

As our day-to-day beta is roughly 0.4 we should have been up roughly 2% in a 5% up market. Our 6 percent loss was about 8% of under performance - by far the worst month we have ever had.

In January 2012 we got both ends of our portfolio wrong. Some of our longs went down in a good market. Our shorts ripped up in our face. The letter we wrote at the time noted the largish losses we were taking on Google. [Google was one of our biggest positions and it fell from $660 to $580 or so that month. As discussed in the letter we purchased a tiny amount more...]

However Google wasn't where the action was. Our shorts ripped up in that month - some costing us more than 30 percent. Ex-ante we estimated their beta wrong.

Lets model how this looks.

Our ex-ante position was

130 long,

50 short,

Total position 180 - ie gross leverage of 1.8 times.

At the end of the month our longs had gone up say 2 percent (substantially less than market).

Our shorts had gone up 18 percent (substantially more than market).

Our position would thus be:

132.6 long

59 short

adding up to 191.6

However we have had losses - on these numbers adding up to 6.4 percent. Our capital has decreased from 100 to 93.6.

Our gross leverage has thus increased to 191.6/93.6 - or roughly 205 percent.

This is kind of shocking - we had 6.4 percent of losses but our gross leverage increased by 25 percentage points.

This is a real hedge isn't working situation. We had no choice but to cut positions - and we cut them fairly aggressively. We would have loved to add more Google into that slide - we really would have loved it. But we couldn't. We were forced to cut positions - and could only add more Google because we chose to cut other positions.

--

Now lets compare this to this week. Our shorts have been going down - but our longs have been going down far more. (Witness Herbalife's big decline and Herbalife is not our only bad stock this week.)

Our aggregate position size has been shrinking more or less in line with our capital. We are not becoming dramatically more leveraged. And because we are not becoming dramatically more leveraged we can sit it out.

David Tepper's leverage probably* won't have changed by more than a couple of percent either. He can sit it out too.

And so we can examine (and will examine) individual positions but the market hasn't pointed a gun at our head and forced us to take off positions. Inaction is thus an acceptable policy.

So I can just go back to self-loathing then. I guess David Tepper can do the same (but I suspect he hides it better than me...)

John

*I am not privy to Tepper's aggregate positioning. All I know is from the above interview - hence the word "probably".

Wednesday, January 22, 2014

So many scams, so little time

Roddy Boyd has been chasing a dodgy fund manager. Today he got his man: Bryan Caisse was arrested in Bogota Colombia. A lot of work went into that.

Wednesday, January 15, 2014

Hat-tip: Francine McKenna on the moral bankruptcy of the audit profession

When you think the big four audit firms can't get any worse be prepared to be disappointed.

John

Saturday, January 11, 2014

The Steve Madden counter example: one from the archive

I blogged about it a while ago (repeated below). There is a correction at the end:

=========

Steve Madden - the designer of the ridiculous high-heeled shoes beloved by teenage tarts - gives me nightmares.

===

The promised correction: I have now been followed on Twitter by Wendy Madden, Steve's wife and the mother of his children. He seems to have got the girl, but it wasn't Katy Perry.

Often I look at my short-book, a collection of scum, vile and villainy. And I wonder if under it all there is one or two decent people, another Steve Madden. I guess there is - but I will have to lose five times the initial stake on one or two shorts to find out.

As an investor you can be wrong in ways you never imagined. As a portfolio manager you have to allow for it.

J

Wednesday, January 8, 2014

Taoist temples and local blindness

From there I scoured the world looking for Chinese stocks to short. And until today I never noticed Mazu Alliance which is above the same shopping complex as Bronte. Mazu Alliance is within a couple of floors of where we will be setting up our new expanded office.

Mazu Alliance's business is religious shrines and ancillary activities including "development of the premier site for the worship of the goddess Mazu in Fujian province, China".

I have never seen religious sites traded in public markets, and if Mazu does exist then she is notably uninterested in or powerless to benefit her Alliance's external shareholders. The company has not found the money to pay their listing fees and the stock is not trading.

That did not stop them making one of the more amazing company announcements I have ever seen:

To strengthen the Company’s operations in the development of its 3,600 private temples and cultural halls, the Company is forming key strategic partnerships with aligned Taoist and Buddhist faiths.

In furthering this strategy, the Company is appointing internationally recognised religious dignitaries as advisers to the Company.

The Company announces that Mr Taochen Chang has been appointed as the Company’s Taoist Chief Adviser commencing on 1 January 2014.

Mr Chang is the ‘Heavenly Master’, a title originating with the Eastern Han Dynasty. The position of ‘Heavenly Master’ is allocated to a religious head of the Taoist movement. Taoism has influenced Southeast Asia for over 2,000 years and has also spread internationally. Mazu is a deity in Taoism.

In each generation, the position and title of ‘Heavenly Master’ was bestowed by the emperor of the time. The position has been passed through 64 generations, and Mr Chang, a 64th generation descendant of the family, is the current Heavenly Master. He has an extensive group of followers, and is recognised in Taiwan, Southeast Asia and internationally.

Still, I wonder about my strange blindness that allows me to navigate through obscure Chinese stocks listed in Canada and ignore the operators who probably queue with me for my morning coffee.

John

Monday, January 6, 2014

Xero and the precious petals of New Zealand funds management

Needless to say I purchased some (albeit way too little) and then investigated.

Xero is a cloud accounting software company - essentially doing what Intuit or Sage do but entirely in the cloud. Cloud software in this case obviates the need for a server, computer support or any problems with scalability.

But when I purchased the stock the valuation was absurd - the stock was trading at roughly 200 times revenue. The company also had large losses.

Our core test was to try Xero for our own business: we like it. More on the excellence of the product later.

Anyway the stock started going up fairly hard.

The next time I heard of Xero was when I met a woman from the New Zealand Sovereign Wealth Fund in Singapore. She was a charming woman born in China who disarmed me with her perfect New Zealand accent. [I used to live in Wellington New Zealand, love the place and miss the strange way they count to "six"...]

She told me that every single New Zealand fund manager they used had underperformed the index because they had not held Xero, something they thought was absurdly valued but which had gone up sharply and then up some more.

About this time three separate New Zealand fund managers contacted me (a known Antipodean short-seller) and suggested I short-sell Xero. I told at least one I owned it which somewhat shocked him. I have also had this conversation with some smaller Australian fund managers. Notably none of these fund managers had tried to use the product or had talked to anyone who did use the product.

As I said, I have, and the product is life-changing good. I feel stronger about this product than (say) the first smart-phone I used.

Its a dead-easy, simple to set-up version of Intuit or Sage or MYOB. It does your accounting, links to your bank accounts and allows you to manage your transactions. The set-up makes Intuit look ungodly-complicated. And, most tellingly, it winds up superior in every way to the "in-the-server-box solution".

One example suffices.

Bronte Capital Management by law has to pay roughly 10 percent of my salary to a superannuation plan (that is a private, regulated pension plan). I chose to put it in a plan set up for me by my old employer simply because it was there and I was comfortable with the way it was invested. When setting up the payment I tested deliberately putting in the wrong bank account numbers for the recipient. The computer immediately knew I had put the wrong number in. Why? Because maybe 50 people had previously put the right number in. The error systems were crowd-sourced.

This sort of thing happens all the way through Xero. The system gets better and better. Changes developed for one party who has say an issue (cross border taxation complications for instance) wind up being available for all new parties.

And the excellence shows in the growth rate for the company (revenue grows well over 100 percent) and fervour of the users. This is an accounting app and it gets Twitter comments like this:

--

For a New Zealand fund manager (or a short-seller) the possible end valuations of a Xero are frightening. Because of the crowd-sourcing aspects of cloud accounting there is a reasonable chance the business winds up as a sort of global natural monopoly. [This is not that unusual in technology. Tech produces powerful global natural monopolies which are vulnerable to disruptive new players with radically different technology.]

The market cap of Intuit is 21 billion. Sage is a further 6 billion. Add in MYOB (which is now private) and you get a global market cap for the sector well north of 30 billion.

But the near-monopoly cloud player should be able to capture more value than this because they also displace the servers and computer support needed for an "in-the-box" solution. My guess is that fifteen years from now there will be a totally dominant cloud accounting software company with a value north of $50 billion.

I have no idea whether Xero is the eventual winner of this game - but with the backing it has and its current head start it is as likely a winner as any. I would not want to be short this. [Long I admit is also a risky proposition. The valuation is absurd versus any current revenue or earnings metrics. This is the most expensive stock I have ever owned - and there is a reason we own it in tiny quantity.]

--

Needless to say Xero stock has continued to go up and its putting New Zealand fund managers on the spot. Their underperformance has gone from notable to embarrassing.

Because they can't win this game they want to redefine victory: they are lobbying to get Xero taken out of the index. After all Xero is dramatically different from the rest of New Zealand which has an economy based on soft commodities (dairy, meat, wool and timber).

And I understand their problem. It is the problem Canadian fund managers have had. Canada has had two globally important technology companies with huge market caps and a huge percentage of the index that have imploded. These were Nortel and Blackberry respectively. The former actually went to zero having been a quarter of the index.

If a Canadian fund manager was underweight Nortel or Blackberry they had embarrassing under performance on the way up. If they were long for the collapse they had terrible absolute performance. For Canadian fund managers it was a tricky situation.

But I am not going to cede this argument to the precious (under performing) petals of New Zealand funds management. Indeed I want to argue the opposite.

New Zealand has produced many great people over the past century but until recently all the great ones had to leave New Zealand to show their greatness. Arguably the greatest three never went via Australia (Sir Ernest Rutherford, Sir Keith Park, and Sir Edmund Hillary) however most the rest went via Sydney and we claim them as Australians because it was the Australian infrastructure and social settings that allowed them to thrive. [Example: most people think that Russell Crowe is an Australian actor.]

But the internet and globalization have flattened the structure. It is possible to become a world leader and stay in Wellington or Christchurch these days. See Peter Jackson for an example. And it is possible to run a world-beating software company from Wellington too, but only if it can be funded from Wellington and only if the local market is outward focussed enough to make this possible.

Xero is not the only example. Jade is an important company based in Christchurch but it is privately held.

In arguing for taking Xero out of the index the New Zealand fund managers are demanding that the globally aware outward looking and creative people leave New Zealand to get funded.

As an Australian I like that idea. The best of New Zealand talent will continue to come here to our great benefit. Kiwis can (vainly) claim them as their own - but it won't matter. Their economic contribution will be to Australia.

What the New Zealand fund managers are arguing for is an insular old New Zealand. A startlingly beautiful but somewhat backward place for Australians to visit when we can bother to put up with the inferior Kiwi weather.

My recommendation

Those that determine the mix of the New Zealand index should simply ignore the hurt-feelings and lame excuses of under-performing fund managers.

And to the Sovereign wealth fund. If your fund manager had underperformed the index because they did not own market weight in Xero (ie all of them) and they have not explored the software extensively themselves fire them. You should also fire them if they have argued for removing Xero from the benchmark. They are representative of the old, inward looking New Zealand that you should be leaving behind.

John

PS. At the rate the New Zealand tech industry is growing, especially with companies like Xero, there is a chance than Kiwis will start to see Australia as a slightly backward place with good beaches and sunny weather. Personally I like it when the really entrepreneurial Kiwis come here. So maybe, for Australia's sake, I should reverse the recommendations above.

For accuracy sake: there is no such thing as a NZ Sovereign Wealth Fund, but there is a large managed government pension fund which - to confuse anyone not from the Antipodes - is called a "superannuation" fund.

General disclaimer

The content contained in this blog represents the opinions of Mr. Hempton. You should assume Mr. Hempton and his affiliates have positions in the securities discussed in this blog, and such beneficial ownership can create a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance and are subject to certain risks, uncertainties and other factors. Certain information in this blog concerning economic trends and performance is based on or derived from information provided by third-party sources. Mr. Hempton does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and Mr. Hempton is not obligated to, and may not, update it. The commentary in this blog in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this blog is not directed for investment purposes at US Persons.