that is great news. anyone in NY want to buy a 2003 mazda protege with 55k miles really cheap? i bought it to commute to my hedge fund job and don't need it any more.

Sunday, March 8, 2009

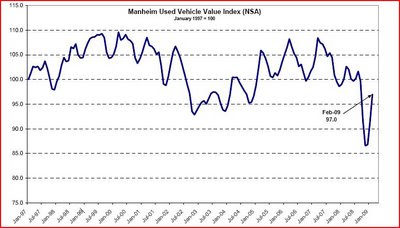

Optimism Porn – used car prices

Friday, March 6, 2009

Voodoo maths and GE

Mr. Sherin said he expects the financial services business to be profitable for the first quarter and full-year 2009, and he addressed questions on the Company’s position on cash generation and loss reserves: "Over a three-year period here, we expect GE Capital to be profitable, even after $35 billion of losses and impairments. We're looking today for GE’s total cash flow to be around $16 billion for the year. In our stress case we could be down in the $14 billion level. In either scenario, we can fund the company. If conditions were to deteriorate beyond what is in our stress scenario, we also have the option of scaling back originations in GE Capital to conserve cash and capital." Emphasis added.

Weasel words from Keith Sherin

"We have an incredibly strong liquidity position," Sherin told CNBC. "We've got $45 billion of cash; we have no triggers that we could see that would have any call on our cash in the short term."

Thursday, March 5, 2009

Polish hookers don’t cost too much

Good behaviour and General Electric

An uncomfortable observation for GE common

- The industrials business which – as GE points out – makes about 17 billion in cash a year and requires only 3 of capital expenditures, and

- NBC Universal – which happens to own a few nifty (and well watched on Wall Street) cable channels.

At December 31, 2008, GE Capital had issued and outstanding, $21,823 million of senior, unsecured debt that was guaranteed by the Federal Deposit Insurance Corporation (FDIC) under the Temporary Liquidity Guarantee Program. GE Capital and GE entered into an Eligible Entity Designation Agreement and GE Capital is subject to the terms of a Master Agreement, each entered into with the FDIC. The terms of these agreements include, among other things, a requirement that GE and GE Capital reimburse the FDIC for any amounts that the FDIC pays to holders of debt that is guaranteed by the FDIC.

Hey guys – you can make a much better investment than Warren Buffett

Wednesday, March 4, 2009

From the wonderful vaults of General Electric

Memo to Jeffrey Immelt – if you are going to lie you have to do it more convincingly than this

- GE sold its mortgage insurance business before the crisis broke. That was high quality risk aversion.

- They sold their bond insurer (FGIC) to a combination of private equity and PMI Inc. I figure the private equity buyers are hurting – PMI trading at less than a dollar surely is. Again this is the mark of superlative judgement.

- I know the guys who run the Australian mortgage business. They started cutting back risk very early. The staff who used to get paid on volume are very unhappy indeed because – well – as credit standards tightened volume dropped. Another mark of superlative judgement.

- They sold their life reinsurance business to Swiss Re. I suspect Swiss Re is hurting - and indeed Swissy had to sell a big stake in itself to Warren Buffett - I suspect to partly cover those losses.

- They sold their P&C reinsurance business as well. That is probably doing OK – but it carries a long tail risk.

- They sold their long term care insurance business. That player – now part of Genworth – is the best company in the world in one of the worst businesses in the world. The risks were high.

- The customer stops paying full interest. They do this because they have had a hiccup in their business or life that is temporary or semi-permanent. If they are an electrician and fell of a ladder you can bet that once their broken leg is healed the non-performing loan will again perform. But if they are an auto worker who loses their job they might not get another one for a year or two. You are probably going to foreclose. The chance of a non performer defaulting goes up with unemployment.

- Then once the loan defaults you need to sell the property. If you haven’t noticed the loss given default has gone up sharply.

General disclaimer

The content contained in this blog represents the opinions of Mr. Hempton. You should assume Mr. Hempton and his affiliates have positions in the securities discussed in this blog, and such beneficial ownership can create a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance and are subject to certain risks, uncertainties and other factors. Certain information in this blog concerning economic trends and performance is based on or derived from information provided by third-party sources. Mr. Hempton does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and Mr. Hempton is not obligated to, and may not, update it. The commentary in this blog in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this blog is not directed for investment purposes at US Persons.