that is great news. anyone in NY want to buy a 2003 mazda protege with 55k miles really cheap? i bought it to commute to my hedge fund job and don't need it any more.

Sunday, March 8, 2009

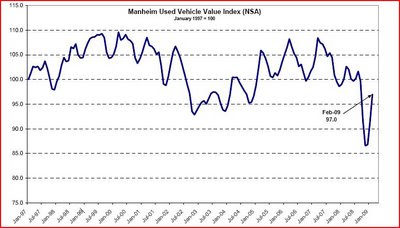

Optimism Porn – used car prices

General disclaimer

The content contained in this blog represents the opinions of Mr. Hempton. You should assume Mr. Hempton and his affiliates have positions in the securities discussed in this blog, and such beneficial ownership can create a conflict of interest regarding the objectivity of this blog. Statements in the blog are not guarantees of future performance and are subject to certain risks, uncertainties and other factors. Certain information in this blog concerning economic trends and performance is based on or derived from information provided by third-party sources. Mr. Hempton does not guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Such information may change after it is posted and Mr. Hempton is not obligated to, and may not, update it. The commentary in this blog in no way constitutes a solicitation of business, an offer of a security or a solicitation to purchase a security, or investment advice. In fact, it should not be relied upon in making investment decisions, ever. It is intended solely for the entertainment of the reader, and the author. In particular this blog is not directed for investment purposes at US Persons.

7 comments:

Yes, one should also note that default rates in auto securitisations have held up so far and very very few of them got downgraded (and even those that did, got re-graded mainly due to counterparty exposure to the Detroit 3 rather than due to default problems). So, this is a relatively healthy segment of the markets.

this can be spinned as bad news as well, no? i wonder what the price trends are, instead of sales trend. i bet the price trends would show deflation.

That is a price trend and it is doing just fine.

If you need a pessimistic explanation it is that the supply of used cars - usually trade-ins - has declined.

J

On a completely different note, seen this?

http://www.businesswire.com/portal/site/google/?ndmViewId=news_view&newsId=20090306005273&newsLang=en

As I understand it, Swedbank can now make up their own asset valuations.

that is great news. anyone in NY want to buy a 2003 mazda protege with 55k miles really cheap? i bought it to commute to my hedge fund job and don't need it any more.

this isn't bullish or bearish....just an anecdote...

anecdotally, wholesale used car values tend to rise around tax refund season as people use refunds as a downpayment for their car.

yeah, i don't consider this as bad news since people who can't afford to buy expensive cars can now own one for cheap.

Post a Comment