I am close friends with the major investor in a small but well placed online travel business. If you ever need a modestly priced hotel in Australia by far the best site is www.checkin.com.au. It does not have the best range – but it fulfils the function of the discounter – running on the thinnest margin and being a place where hotels can (quietly) shift their excess inventory. If you want a business hotel in Sydney don't bother with anything else – checkin.com.au is the best deal. If you want a romantic getaway in the Blue Mountains there are plenty of other suggestions though you might get lucky with the discounter.

Travel booking companies have – for the reasons stated above – interested me. And – being in my business – I like a cheap stock.

So a fast growing online hotel and airline booking company in China trading at a PE ratio of about 5 caught my eye. I can't resist a bargain. Here is the company description from the footer of their press releases.

Universal Travel Group is a leading travel services provider in China offering package tours, air ticketing, and hotel reservation services via the Internet and customer service representatives. The Company also operates TRIPEASY Kiosks, which are placed in shopping malls, office buildings, residential apartment buildings, and tourist sites. These kiosks are designed for travel booking with credit and bank cards, and serve as an advertising platform for Universal Travel Group. The Company's headquarters and main base of operations is in Shenzhen in the Pearl River Delta region of China. More recently, Universal Travel Group has expanded its business into Western China, opening a second home base in the Chongqing Delta region, and other attractive, under-penetrated tier-two travel markets throughout the country. For more information on the Company, please visit http://us.cnutg.com .

But we at Bronte insist on at least some due-diligence and so we spent some time fiddling about in their website. I will cut to the chase. We will not be buying the stock. Too Jabberwocky for us.

Background: the claims made by Universal Travel Group

The Universal Travel Group (NYSE:UTA) is a consolidation of small-scale travel agents and group tour companies in China. None of these are very attractive as a stock investment. The real appeal is in an online-booking travel company that company presentations compare to Priceline, Expedia and CTrip. (CTrip is the dominant Chinese online-booking service. It trades on the Nasdaq, has a market capitalization just below $6 billion and has a price-earnings ratio just above 50.)

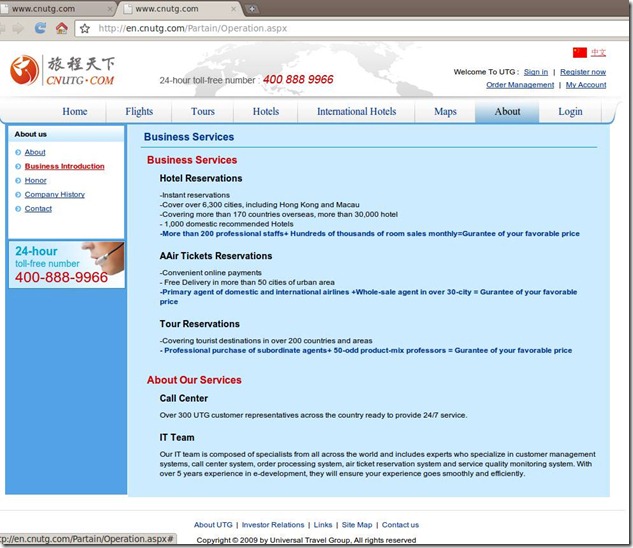

The UTA website gives a business description. I have included in here the screen-shots from the website in case the websites change in response to this blog. Here is the screen-shot.

I should quote this because it is worth coming back to. They claim to have “convenient online payments”, “more than 170 countries overseas, more than 30,000 hotels”, “more than 200 professional staff”, “over 300 UTG customer representatives across the country ready to provide 24/7 service”, “primary agent of domestic and international airlines” and an “IT Team … composed of specialists from all across the world [which] includes experts who specialize in customer management systems, call center system, order processing system, air ticket reservation system and service quality monitoring system. With over 5 years experience in e-development, they will ensure your experience goes smoothly and efficiently.”

This sounds – at least by this description – as a competent standard hotel-and-flight booking engine. The website you see above is a little strange because it does not have a tab to book cars and on a business trip I normally take a car – but that seems a small omission. [CTrip does have a car-tab on their website but it is small and you discover that all rental cars include a driver which is probably a necessity for a gweilo like me driving in China.]

So far – so good.

Alas when you start to use this site you wind up going down a rabbit hole of Lewis Carroll proportions.

Trying to book a flight: Beijing to Yichang

I most certainly was not going to buy an online travel company without checking out their IT – and what better way to do that than by using it.

Fortunately UTA has an English language travel booking site (http://en.cnutg.com/). On it I tried to book a one-way flight from Beijing to Yichang. That is a trip I made largely by rail in the early 1980s which was – I can assure you – a different time in China. Anyway fairly quickly it gave me three options. A screen-shot is here.

This is fairly convincing. They are the same flights that I found when I did the same search on CTrip.com. Indeed the prices were identical – and the main advantage of CTrip was that it also told me the pricing on alternate days in a neat graphical format. CTrip also gave me some neater phone options – including skype.

There were some oddities – the site had no box (pop-up or otherwise) which explained ticket conditions. You did not know whether these were non-refundable tickets or whether flight times could be changed and under what terms. Those conditions were clearly available on CTrip.

This gets really surreal when you try to actually book one of these flights. Here is what happens when I try to book a ticket on flight CA1823 on Universal Travel Group's website. First I get taken to a page where it asks me to identify myself by passport or ID card. I chose an Australian passport (but used a fake number). It also asked me how I wanted to pick up the ticket: at the company, the airport or onsite delivery. I chose the airport. It gives me a payment option – being cash or credit. The screen-shot is below.

Now there are again some odd things about this – most notably the airport address they want me to pick the ticket up at. It is Counter 42, 43 Terminal B, Bao'an International Airport, Shenzhen. Now remember I am booking flight from BEIJING to YICHANG. There is no indication that I will ever be in Shenzhen. It is 1200 miles from Beijing to Shenzhen – it might be a little out of my way to collect the ticket. In the American context this is like flying from New York to Greensboro North Carolina and being asked to pick up the ticket in Miami.

We did the same search in Chinese and we got the same bizarre result.

By contrast – when I did the booking button on CTrip.com it made me register as a customer – and then took me to a much more sensible page with options to give addresses and mobiles both inside and outside China and with payment options including credit cards and Paypal. It also had highly sensible pop-up boxes which told me the conditions of the ticket (for instance under what terms I could change my flight times).

But – just to be convinced – I needed to see whether I could book a ticket for delivery at an airport 1200miles from my starting airport. So I tried it using the cash booking option. It would let me – but when I finally pressed finish it gave me this auto-generated page:

Being a sucker for punishment I translated the Chinese and found a standard set of error codes. I got the same when I tried to buy with credit – and at no stage was I given a box to put my credit card in or a link to Paypal. I did these screenshots using chrome browser. I reproduced them all except the above error using Firefox. In Chinese I gather there is slightly more browser-choice instability.

Ok – it looks like this travel site is all front-end, no-back end – there is no actual booking, no mechanism of collecting payment – no nothing really.

The company in its stock-promotion spiel says that it allows for “convenient online payments” but there was no mechanism here for making any payment. In this day-and-age it is not difficult to take PayPal. That payment option can be set up very quickly.

Could all this be just because we are doing this in English and this is a Chinese company?

By this stage we wondered if we were going insane – was this a real company at all? We had a friend repeat precisely this experiment in Hanji. His results differed in one important way – which is when you actually gave a phone number and confirmed a booking they said a consultant would ring you back.

Also – the prices were consistently 2 percent cheaper than if you were querying in English. Finally – and this was to my view key – there was a SKYPE ME button just like on CTrip.Com. You could not pay online – but this was lead generation for an off-line travel company. There was something there – it just wasn’t “instant reservations” and “convenient online payments”.

Note: no international airlines

There is one more strange thing about this website – there is no opportunity to book international flights. The web page pictured above however describes the company as a Primary Agent for international airlines.

Hotels

The bit of this business I have thought most about is hotel booking. That is my close friend's business. If a Chinese travel company is compiling inventory in foreign hotels they must be obtaining that inventory from someone. I thought I might book a hotel near home and check the company that way. Fortunately on the front page they had an “International Hotels” option. I thought I might book something in Sydney and take my wife somewhere nice. And having done that I might even work out whose inventory they were selling. (That would be of interest to my friend's business – which is after all – a business of sourcing and trading in hotel inventory.)

Here is the International Hotel booking page.

Ok – so I tried to pick a Sydney hotel for next Friday night – which seems like a nice time to take my wife out. Alas my precious darling will be disappointed. They do not have a hotel in Sydney that night. Nor any other night I tried.

So let’s try somewhere else – how about New York, NY? Same result.

But if you look at the site it advertises rooms at St Giles The Tuscany – which is a quite nice hotel in New York – so I pressed that link.

It brings up something that looks like the right hotel (albeit with a bad and blurry photo). But the buttons that say “hotel description” or even the button that says “book” do not work. Here is a screen-shot.

I am inquiring to book a hotel. I have got to the right page – and – yes – the button that says “book” does not work. Have you ever known a shop that will show you all the inventory but not let you buy?

But it is worse than that – I tried half a dozen other hotels that they advertised on the left hand side of their page. Every time it bought up the same indistinct photo. All the hotels were identical. I know that one business hotel is more or less like another and when you are cocooned in one it does not matter whether you are in Auckland or Helsinki – but this is ridiculous. The photos were literally identical. No wonder the picture naming the hotel is blurred.

We did the same queries in Chinese and found the same thing… for instance we were unable to find any hotels in Sydney or New York on any night we tried.

Maps

The website has a maps tab. This is a really useful feature for a travel booking company because you can make a lot of money booking travel at short notice to people on the road. I wanted to fiddle with that. Alas it did not work – it mapped a small area around Shenzen – which is not much use picking a hotel in Yichang.

But it was far worse than that – the website was far-from-optimized for use on a mobile phone (running on an iPhone it produced two error codes in presentation which the iPhone asked if I wanted to ignore). This is serious for a travel website which people often want to refer to on the road. It is doubly serious for a travel website in China because in China more than most places people interact with the internet through their phone.

Talking about phones

Well I thought that maybe their website was dysfunctional – but at least I might be able to book on the phone. There was a phone number (400 888 9966). I rang it using the trusty Google Voice which would have represented me as ringing from within China. There was a message to press “6” for English – which I pressed – and then they fed me through an endless Chinese menu. I pushed buttons at random and was left on music on which I waited for 30 minutes.

I figured I needed a Chinese speaker to do this – so my friend came to my rescue. After some dropped lines and the like he found that – underlying this and at the other end of the phone was a real travel agency. You could book both domestic and international flights on the phone. Indeed the website has an international flights tab in Chinese – and when you get through to the booking screen they indicate that they will phone you. Do not think for a minute that this company is entirely fictional – we are sure that there is a travel agency underlying this company but it is not an internet travel agency with “air ticketing and hotel reservations via the internet”. It is an old – limited dial up travel agency – precisely the type that is being disintermediated by the CTrips and Pricelines of the world.

The phone was answered in Cantonese. This company purports to be a nation-wide service and my friend expected a conversation in Mandarin. When my friend was talking in Mandarin the conversation changed. If this were a national company (as it purports to be) it would have answered in Mandarin.

By this stage I was more than a little intrigued by this company. I dug around their website a little further – and found beta versions of their website. One site was even labeled as such – it was http://beta.cnutg.com/ . Here is a screen-shot of that page.

The copyright date at the bottom (2009) suggest this was not done very long ago. The page itself is sketchy and dysfunctional. The bookings tend to go nowhere (surprise) and the English language tab does not work at all.

Customer Management

This company claims it has IT experts who specialize in customer management systems. They too are strangely missing. For instance in the main website in the top corner are four options - “Sign In”, “Register Now”, “Order Management” and “My Account”. They lead to the same page – so there is really no distinction between them. Once you sign in there is no “Order Management” because they are as noted unable to take an order. But before that there is something which stands out like a sore-thumb. There is no “forgot my password” option. The cookies on the site do not remember your ID. (CTrip remembers your ID and remembering your ID is key to getting repeat business.)

My travel-business entrepreneur friend will tell you that repeat business is the key to profitability in one of these travel booking businesses because the customer acquisition is very expensive. Google (or in China Baidu) really do take their cut as key words are very expensive in travel. This company has not even got the basics of customer retention right.

But I want to bring you back to core claims of the company which I repeated above. They described their “IT Team … composed of specialists from all across the world [which] includes experts who specialize in customer management systems, call center system, order processing system, air ticket reservation system and service quality monitoring system. With over 5 years experience in e-development, they will ensure your experience goes smoothly and efficiently.”

Now look at their English Language IR site

The business behind this can't book any travel on any website we found.

According to the investor relations website the core business of Universal Travel Group (the flight booking service) apparently has 248 employees at the end of 2007 and presumably many more now as they have (at least according to the accounts) grown like a weed. For starters I will stick with 248 as a minimum number. Here is the website screen-shot.

|

The woman sitting in the center is the CEO/Founder – her name is Ms. Jiangping Jiang and strangely for a hyper-successful travel executive she speaks no English. That said – the text here says that they have entered into sale agent agreements with all the domestic airline companies and “over 30 international airline companies”.

UTA is – according to their (stock) promotion the fastest developing air-tickets agency in the domestic civil aviation industry...

It all looks very professional but only at first glance…

The NYSE drops its guard

I would not be surprised if this stock were listed on the Pink Sheets or even the AMEX. This sort of stuff you can find on the UK's AIM board – but the New York Stock Exchange is special. They have higher standards! To date the SEC has only forcedly delisted a single NYSE listed company for fraud – and that was ACLN.

The NYSE must be pretty sure of itself. UTA has received one of the highest honors in capitalism... they opened the floor of the NYSE. It is an honor I doubt will ever be bestowed on me.

How the company represents all of this in their accounts

By my reckoning this is a company where you can almost not bother looking at the accounts – you could short it off the website. But – being an accounting junky I am going to look at the accounts anyway.

First I want to look at the 10K. There they break down the business by section -

You can see why the stock is sold on the Air-tickets and Hotel booking business. Air-tickets it seems have an 84 percent gross margin. Hotel bookings a 67 percent margin. Tours have a 13 percent gross margin.

There is one thing which jumps out like a sore thumb in this table - and that is there is no elimination line in the revenue break-down. Surely the Tours business buys stuff from the air-tickets or hotel businesses?

That lack of an elimination line is enough to question the company’s accounting. If they don’t trade with each other at all then they do not belong together – and there is no reason to have them within one corporate structure.

However I am less concerned with the revenue line than with the cost line. Look at the cost of services in the air-tickets and hotel business. The air ticket business had cost of services of 2.7 million dollars – and this is for a business that claims to have 24/7 offices all over China, delivery in over 50 cities and an IT Team of specialists across the world.

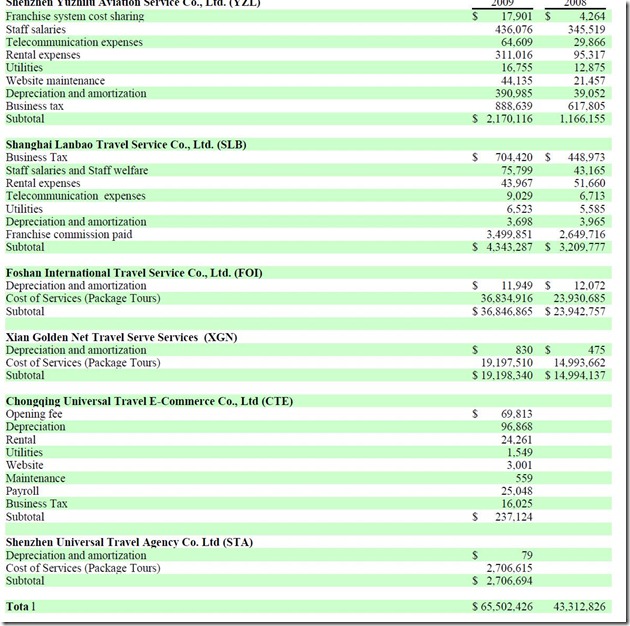

The company fortunately even gives us a break-down of costs in various sections.

This global team of IT and CRM specialists comes cheap – website maintenance for the core airline booking company comes to $44 thousand. No website maintenance is listed for the hotel business at all.

It is of course consistent with my discoveries about the website. There is no functional website, no booking system, no payment system, no international airline tab except in Chinese, no rental car tab, and photos of all the international hotels being identical.

As it is impossible to pay (despite them claiming “convenient online payments”) it is likely that there is no substantial revenue in that business.

The company is however not entirely fictional – there was a real kiosk travel business – and there is an underlying travel agency.

The company claims in its core business to have 248 employees at YZL as of the end of 2007 – but given growth and acquisitions that number has grown. This business claims staff costs of $436 thousand. That is about $1800 per person per year using the low 248 employees number. This business would normally include some IT staff and other above-average wage earners – indeed one of the slides above says that the hotel booking business has “over 200 professional staff”. The minimum wage in Shenzen is 1100 Remimbi per month which is $162 per month or $1940 per year. At a first cut this company is paying under minimum wages. In the claims at the top of this post they claim over 300 UTG customer representatives in just the call center. I guess a lot of people might be part time and there are very few higher-wage staff such as IT workers. But whatever – either they don’t have the staff or they are very lowly paid or the accounts are wrong.

Total salaries are just over $500 thousand – and the company has claimed to have IT staff around the world, a 300 seat call center and over 200 professional staff.

The company also claims to have telecommunications expense of about $75 thousand annually. With over 300 people in the call center (as per their stock promotion quoted above) these call centers would be the cheapest in the world to run bar none.

However here I am comparing the salary bill to minimum wages. A quick Google search tells you that sales managers in Shenzhen are very highly paid by Chinese standards. Here is an article from 2007 that suggests the average salary for a Shenzhen sales manager is over USD40 thousand. There has been wage inflation in Shenzhen since then. Average salaries in Shenzhen are only a fraction of those lofty levels but still roughly 4 times minimum wage. It seems impossible that there is a 300 person telephone center function here at those salaries and the cost base detailed in the annual financials – however I can only point out inconsistencies – I cannot verify whether the annual filing (10K) or the 300 person phone center statement is correct.

But hey – I am being kind to them. I am using the end 2007 employee numbers. The 10K has the following employee disclosure:

Employees

At the current time, including our officers, we have approximately 780 full-time employees, including 80 administrative employees, 200 marketing employees and approximately 500 employees working at our three call centers. None of our employees is a member of a union and our relationships with our employees are generally satisfactory. In accordance with Chinese Labor Law, we provide social security and medical insurance to all our employees.

Total staff and salaries costs are – as I noted – just over $500 thousand. And for that money – less than $700 an employee per year – they not only pay them but they provide social security and medical insurance. (I don’t think I need to go through the proxy, work out costs of the executive staff and hence – by subtraction – work out the costs of the non executive staff. If you do it though you will conclude that – if there really are almost 780 non-executives and they are only paid that then they must have a truly miserable existence. Whatever – it is unlikely that their relationships with “780 employees” at that total staff cost would be “satisfactory”.)

Thinking about the costs from a business perspective

I want to think about these costs from a business perspective. There is almost no customer acquisition cost in the accounts. In this business getting customers in is really expensive. Travel related click fees are amongst the most expensive clicks on Google – and I presume that they are on Baidu too. Indeed in a thin-margin business like www.checkin.com.au if you aggressively seek additional customers you grow quite nicely but eventually with negative margins. You will make money only if the customers return and book more flights/hotels without paying additional click fees to Google. This is a company that – at least in its accounts – is growing like a weed with zero customer acquisition expenses – and with an entirely dysfunctional website.

Is there any case for owing this stock at any price above zero?

I want to head this one off at the pass. It is pretty clear from this analysis that the main reason for owning the stock of Universal Travel Group is dubious. The online booking engine is dysfunctional – and the massive margins that it claims (84 percent for plane tickets) are thus also dubious.

All the profits that the company claimed it made out of the travel booking business (by far the bulk of its claimed profits) are similarly dubious – though there is a real travel company which might be making some profits.

The company claims in its most recent quarterly balance sheet to be carrying 43 million in cash and accounts receivable of almost 20 million. If the airline and hotel business are dubious then the profits generated that cash are dubious. In that case the cash itself is dubious.

I know people will buy this as Ben Graham net-net stock if it collapses. Unless this company can get a big four audit firm to sign-off for them I think you can – at least for the moment question the entire balance sheet. They have however just appointed a new auditor. I quote the press release: the Board of Directors, in consultation with its Audit Committee, has appointed Goldman Kurland Mohidin ("GKM") as the Company's independent auditor to replace Acquavella, Chiarelli, Shuster, Berkower & Co., LLP, effective September 1, 2010. I don't know who GKM are – and I will be thrilled if any of my readers can – off the top of their head – name three other companies they audit. Whatever: I think that GKM can take it as read that this is a higher-than-normal-risk audit assignment. And the first thing to do – confirm the existence of that $43 million cash stash.

How the company is behaving?

The company is not behaving as if this is a cash rich company. The company has one real business – 1523 travel kiosks which appear in company promotional literature as electronic booths. I think this was (at least at one stage) a real travel booking business and remains one albeit off the internet. The kiosks were places that people without a computer or phone could book travel online using a touch screen. I have not seen any of these kiosks but have spoken to people who have. They just sold them for 40 million CNY – or about $5 million. They proudly note however that they get to keep the travel-related revenue from these kiosks for the next two years. As this was the foundation business for the company it seems unlikely they would sell it especially as the accounts suggest they are awash with cash.

They did not announce whether they had a gain or loss on the sale of that business – but someone I know was told (last year) by the company that the cost base of these kiosks was about $6000 each. On those figures they are taking a largish loss. This is not the behavior of a company with a strong business swimming in cash.

The company has however been buying other businesses – such as a hotel booking business in Chonquing. But the other company websites including this one http://www.cba-hotel.com/ have – when worked on – a similar Alice-in-Wonderland character. That site produces similar errors when it gets around to payment time. It is however browser sensitive. If you use Firefox or Microsoft Internet Explorer you wind up at pages which are gibberish – not even recognizable Chinese. (I relied on Chinese friends to tell me that though – I can't tell the real Chinese from the gibberish Chinese.) Whatever browser you use you wind up with the strange inability to book anything.

The CBA-hotels.com site however does have a forgotten password option – they will text your password to your mobile phone. If someone has a Chinese mobile phone I would love them to test that.

Still – other people have a different impression of this website. One broker (Emissary Capital) report described this website as follows:

In August 8, 2007, UTG acquired Shanghai Lanbao Travel Service Company Limited, a centralized real-time booking system that provides consumers and travel related businesses with hotel booking services via the internet and mobile phone text-messages. The company owns and manages the award winning China Booking Association website, http://www.cba-hotel.com/, which receives approximately 200,000 visitors daily. The network is open to more than 200,000 hotels, 5,000 booking centers and 8,000 travel agencies and tourist companies throughout China. Its intra-hotel network includes more than 3,000 franchise hotels and 800 hotel booking businesses and agencies across China. The company’s China Booking Association website, http://www.cba-hotel.com, receives about 200,000 visitors daily and, in 2006, made about 500,000 hotel reservations.

Maybe the good analyst at Emissary had a different experience on the website to us. They paid cash and stock for that business. The stock I presume has found its way to the NYSE and hence to retail and institutional investors in America.

Did we find that there was anything real about the company in our investigation?

Yes. There are non-fictional elements here. As far as we can tell the company really does run tours. The margins for this tour business are higher than most tour businesses report – and given the accounts are clearly more generally questionable I would not put much store in its value – but there is some value here.

More to the point there is a real telephone based travel agent here – one that does not present as a national agent (the phone is answered in Cantonese). But as there is a travel agent there will be some sales.

We also were surprised that some things we found on Google and Baidu in Chinese that were more supportive of this company than most of this blog post. The company press released that it had received some awards:

Universal Travel Group (NYSE:UTA) ("Universal Travel Group" or the "Company"), a leading travel services provider in China offering package tours, air ticketing, and hotel reservation services online and via customer service representatives, today announced that it was presented with three awards at the 16th Annual Asian Tourism Golden Travel Awards Ceremony, held in Beijing on August 29, 2010.

Universal Travel Group was honored with the Top Ten Golden Asian Travel Agency and Top Rated Travel Agency in Greater China Award, and Ms. Jiangping Jiang, Chief Executive Officer of UTA, received the Most Influential Figure in the Travel Industry in Greater China Award.

"We are honored to receive these awards which recognize the strides we have made in building a leading travel service business in China," stated Ms. Jiang. "We are committed to providing excellent service and a wide variety of travel offerings to our customers and look forward to continuing to expand our air ticketing, hotel reservation and package tour business across China."

Now awards are – by their nature – public and tourism awards are doubly promoted – so we thought we might find some references to these awards on the web. Alas – there is not a single reference in Google to these awards without the word “universal” in it. A Google Search which insists on the phrase “Annual Asian Tourism Golden Travel Awards” and the absence of the word “universal” presents no results. We thought that the company might have made up the awards. But alas searches using Chinese characters pulled up a few additional references. We can find a 16th annual award and a 15th annual award but no 14th annual award. Here is a link to a press article we found... http://www.chinadaily.com.cn/hqzx/2010-09/04/content_11257208.htm. Indeed we have found some pictures of this award ceremony – and they include photos of executives at UTA... http://travel.sina.com.cn/news/2010-02-02/1523126027.shtml#page_pic.

Relationship with Priceline

The company claims a relationship with Priceline in their conference call. They claim that Priceline entered this to strengthen their position in China – and that 8000 hotels will be available for online booking through this relationship. We have not found them.

But then I encourage readers to fiddle with the website and see if you get something better. And if you are travelling in China and you want to use their services I would love to hear back from you.

John

PS. Disclosure: when we find something like this we tend to go short. We remain true to tendency. Oh, and in keeping with the Lewis Carroll theme throughout this blog post, if you are long this I have a single piece of advice: “Beware the Jabberwock my son”.

![clip_image002[9] clip_image002[9]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi1kt8TqONLLXzoj_fp7XerHNIQ1cvO865O3gQ6NoX9J1VeO609q2FP0gCqG5d13g7oD0exDx7rJYROZryYemUQDQW3GjZIPLCU0LfzKCpfEJfwIef_K9wsEcrneFSD2EpK1YBOu5hOlr0/?imgmax=800)

John,

ReplyDeleteDue diligence and the fascinating things that we discover. As someone who has looked at deals in China and in these same sectors, I am not surprised.

Background checks and accounting DD can throw even more funny stuff. Most HK and NYSE listed Chinese companies employ offshore-onshore structure -- if one were lending it could be a real problem to enforce as we would not have any recourse to the onshore entity.

This blog item brought back memories of sew such deals in this space. Fought one and won, fought the other and lost --- and we invested in this. Only time will tell, but my gut says that we'll get out at less than 50c to the $.

In my experience I would say that there is little capital discipline in general in such companies. And financial systems are weak at best.

Best

SPV

I don't have the constitution to be a short seller, so once again I won't be following you in, but a great read on how to do diligence!

ReplyDeletePS: speaking of websites not working, what happened to brontecapital.com?

What need is there for such a big accounts receivables line? In this sort of business, the customer usually pays upfront and cash payment can't make up $20 million. There must be a lot of tours going on! Wotif has receivables of $5.2 million, and it presumably does a lot more business in terms of total transaction value (TTV).

ReplyDeleteThere's a rotten fish in there waiting to be found.

Thanks, Mr. Hempton, very much.

ReplyDeleteWould you have interest in being named Regional Director for the SEC office in Sydney should the SEC ever expand its operations?

wow..stock opens down 25%

ReplyDeleteJohn, have any interest in an online booking company for tour and experience based travel products? Just launched one out of New York focused on youth travel (think hostelworld for activities). Looking for a seed investment which may be of interest to you. What's the best way to get in contact?

ReplyDeleteA fun read and I hope one of the more profitable writings (why do people still write books?). 27 percent down after yesterdays 7. Puts are still available, but surprisingly expensive for a maximum of 6 weeks. And I am doubtful this will go down to zero quite that fast. Which of course will leave the question as to when you will close this trade. What are your criteria? Would be nice to see a followup.

ReplyDeleteJohn,

ReplyDeleteCheck this article in Chinese. http://www.21cbh.com/android/news.php?id=195067. There are many frauds but the question is always how to short these stocks. Most of these stocks are thinly traded and held by insiders.

If there is a Pulitzer for investigative blogs this has to win!

ReplyDeleteI have been watching this company for a while now and could not understand for the life of me why it kept getting cheaper and cheaper.

The fact that this company traded so cheap to cash on hand and earnings just shows that people do know its a fake.

But the question is how are they still getting away with this and how in the world has the NYSE not done anything about this?!

Kudos, John. This would be funny if it didn't involve stockholders' money.

ReplyDeleteDubious companies with no purpose other than selling stock can last a long time if they stay within the letter of the law. Skillful fraud is indistinguishable from incompetence.

ReplyDeleteGreat investigative work. The company actually removed the option to pick up at the airport. The other two options remain. I tried many of the things you tried ( booking a flight giving an error), same image on all international hotels, blank page for international hotels ( not even the name shows up), maps etc.

ReplyDeleteI am a software developer by profession and I have built many websites in my life.

The amazing thing is if they wanted to be just a front end for their telephone based travel booking business, they could have done a better job at that. They could have made a fabulous website with CONTENT. They could easily take orders and save them in their database. They could have them show up in my bookings page. Then they could call the customer and say the online processing failed or something and they could complete it over the phone. However, getting errors for booking a flight and not able to book hotels. I dont know if there is any business behind this.

Great job on this. A real tribute to your business.

ReplyDeleteJohn Hempton is just like the other bloggers trying to take down chinese micros. No clue about the company, only checking the website and not understanding how China works. Idiotic. Maybe John hacked UTA's website?

ReplyDeleteJohn,

ReplyDeleteWhile your analysis is very detailed, I find it very odd that you did not contact the company and pose these questions to them and post their responses as well.

You provided a very one-sided view of UTA and I would like to see the other side of the story. As a prudent investor, it is important to not only look at your allegations, but also UTA's responses to your allegations.

The fact that you did not give UTA a chance to respond or even make the aware of your findings -- leads me to believe that you are merely advancing your own agenda against UTA.

So why DID you decide NOT to confront UTA with your questions or suspicions? Is it to help increase the profits on your short position on UTA?

down under,

ReplyDeletedid you cover your short today?

if no, i don't think you will make

monery later.

if yes, i think you maybe will be in jail one day.

Fascinating article! But, regarding the blurry hotel photo, there's no mystery there--it's the Iroquois. :-)

ReplyDeleteJohn,

ReplyDeleteGreat work. It's a shame that short-sellers are misunderstood. Shorts are amongst the most skilled fundamentally oriented investors out there... period. To respond to another comment, John has no duty to confront management. He (1) made a full disclosure of his position, (2) his facts and analysis are reasonable as well as thorough. Owners of this stock should have exercised the same discretion as John has in doing this public service.

I applaud you.

Best Regards,

Matt

Wow you guys are all idiots and John you are so screwed!

ReplyDeleteDo you realize that on page 30 of 2009's 10k they book COMMISSION of over $1,000,000 for the the 3 months ending Dec 2009?

So much for the, "but but the compensation doesn't add up!" Obviously does but you decided to trash the company before reading the 10k!!!! OOPS!!!

John, seriously you better recant or you WILL BE FORCED TO by UTA's lawyers

page 30 of the 10k.

ReplyDeleteEmployee comp is shown under Salary and Commission! and commission is large.

Observation: an internet travel agent pays no commissions. The commssions are ALL traditional travel agents...

ReplyDeleteI am never saying that there is no traditional travel agent here. I am saying that I cannot find an INTERNET travel agent.

you can't find an internet travel agent(cy) here.. i get it. . but that perfectly explains the 5x PE instead of 50x, doesn't it.

ReplyDeleteI assume your point is that 'they lied about their line of business while raising capital through the ~strict~ NYSE' .. then ok, maybe they'll be punished, that part I don't know.

But it seems they could have a brick/mortar business with a web presence that can justify some of their numbers.

Any experience traders and investors know fully well why you wrote the article which has left out many things. Your lack of understanding the Chinese culture is evident. Your lack of fully understand the 10k is also evident. I did not see anywhere where you reach out to the company and ask them questions(such as how salaries are paid). You also fail to mention to the readers that you loaded up the puts on Monday before you posted your finding on Wed. I do not own the stock but I found that you're unethical and have hurt a lot of investors for your personal gain. I am pretty sure all this will be cleared out soon but by then, you and your friends already banked it in. Great job. Mission accomplish.

ReplyDeleteJohn, their business isn't completely internet based obviously. How do you know how their commission structure works btw? Maybe their customer service reps are paid on commission depending on customer satisfaction. You don't understand their business; perhaps it would have been wiser to ask the company before ripping them apart and causing their stock to crash 25%.

ReplyDeleteYou defamed them and now they said they are looking for legal recourse. You either lied or made a mistake by saying UTA's staff salaries are only 500k, when there was over $1,000,000 paid in commission in the 3 months ending DEC 2009. Even if there is validity in some of your claims the compensation part of your rant is erroneous. That is a big problem because it's wrong.

You also claim their website doesn't work but it requires a Chinese based phone number to complete the sale. They actually provide better service this way by using human beings to confirm purchases

Might be an all nighter for you! I was in Syndey before the summer (best country IMO) and it was annoying staying up past midnight after the market opening.

I find it hysterical that the rabid Chinese nationalists and likely parties related to the company have decided to post here. It might be worth noting that when companies are not guilty of fraud they tend to deny it in the press release rather than saying they are seeking legal counsel. If the company thought these claims were baseless they would have said so.

ReplyDeleteGood work, John. A few disparate thoughts:

ReplyDeleteThe terms of the mergers are peculiar. See eg

http://www.faqs.org/sec-filings/100329/UNIVERSAL-TRAVEL-GROUP_8-K/v179028_ex10-1.htm

All of the recent (1 yr)acquisitions seem to share this rather comical guarantee: the acquired agencies and principals must work on behalf of UTA for five years and grow their biz (Article IX) or UTA can get a full refund of their purchase price (Article XII)! No risk for UTA- yay! ;-)

Besides the auditor change, of course the CFO's brief tenure was of no consequence.

Some years ago, I believe I was the first person to publicly state the ACRT fraud. Rather than blog about it, I contacted some journalists and the SEC. Though I provided much detail (more than your original UTA post), no one responded. So I broke the news on the Yahoo board (since vanished), with similar responses to what you are now experiencing.

My cynical takeaway was basically that the powers that be don't care, and there's no point in trying to save the true believers. So henceforth, I just quietly short and keep the details to myself.

Too much time and frustration for me, and your skin seems to be thicker.

Am working on a concept about regarding when to BTC: perhaps when the longs are somewhere between the third and fourth stages of grief.

An RIA in USA

The reaction to your post certainly reminds me of the reception to David Einhorn's expose on Allied. It is alway intriguing when companies respond with legal threats in response to adverse comments. Maybe Einhorn and yourself should compare notes and collaborate on a further book. Perhaps the children's charity will get a further donation from the proceeds of the short trade.

ReplyDeleteNice piece John. May I make a suggestion? Don't go to China for a few months.....

ReplyDeletebk

jeeze I wonder how many of these "anonymous" posters are shills from UTA.

ReplyDeleteJohn, you are doing a service for the investing world. And I hope you make 100% on your capital.

As for UTA, if it is indeed fraudulent, it is defrauding not just its own investors, but also all Chinese companies. US listed Chinese microcaps routinely trade for 5x PE, because people are automatically baking in "fraud risk". This makes it hard for really worthy companies to raise capital and grow and improve the Chinese economy... which is the real tragedy here.

As for UTA, the people who bought the stock with little DD should lose their shirts. It's only fair.

Well done John.

ReplyDeleteTwo years ago I thought shortsellers were just wolfpacks.

The market is really only the present day wild west.

Shortsellers are only doing the Authorities failure to attend items.

Keep it up !

Very Interesting!

ReplyDeleteWell! Thanks for this buddy. Owners of this stock should learn from John as he has doing this public service.

ReplyDeleteThere's been a lot of comments on UTA but nothing on Check-in. I'm wondering if it is as attractive an investment as UTA. You give it a good wrap but I'd never heard of it. When I look at the site I see a layout that looks similar to Wotif.com but not as slick. The few hotels I checked were the same price as Wotif and the only difference I saw was a A$3.50 booking fee as against A$4.95 for Wotif. If they do have an advantage over Wotif its not obvious and the internet is a brutal winner take all game. Visits to websites, websites within a category and pages within a website usually follow a Zipf distribution i.e number 2 gets half the traffic of number 1 number 3 a third etc. Most of the costs are fixed for a web service and there is probably not much difference in quality between the first few, therefore costs for the first few are similar but revenue for number 1 is 3 times number 3. Number 1 is creaming it and after the top few everyone else is going hungry. To put this in perspective, Check-in was up to 200,000 room bookings in 4 years according to the last press release on their site in November 2006. They have probably increased a bit in the last 4 years but Wotif does that in 12 days using the numbers from their Dec 2009 annual report. I checked them against Wotif and a few others on Alexa and its bad for Check-in. Wotif has 12 times the 3 month reach and has doubled it in the last two years while check-in is about the same. The other Alexa statistics suggest less bookings per visitor as well.

ReplyDeleteYou said Check-in operates on "the thinnest margin" but compare this to Wotifs fat Profit Before Income Tax of 55% of Total Revenue in the 6 months to Dec 2009.

The harsh reality of Zipf is that you can be almost as good as the rich guy and starve.

I cant wait for you to get slapped in your mug with a lawsuit, its going to be great.

ReplyDeleteCheck-in is privately held. It is the DEEP discounter. Wotif is the mass market leader.

ReplyDeleteCheck-in is not as slick. It is just cheaper. It has relationships with hundreds of hotels who trust it to sell excess inventory.

You do not go there if you want to pay top dollar. You go there to look for bargains. Different business model.

I'm thrilled to get a response.

ReplyDeleteI think you are wrong on check-in's "DEEP" discounts. I can't find evidence that check-in is cheaper than Wotif. On the front page "Todays Hot Deals" shows one hotel in Sydney, Glenferrie Lodge. Wotif has the same hotel with all the same packages. Looking at the first four on Sydney CBD "hot deals" page I see Amora Hotel Jamison, Four Seasons Hotel, Hilton and Quay Grand Suites and all are exactly the same as Wotif, even for availability.

Wotif started life using the model you describe but they took so many bookings they became mainstream. There was a time when Wotif had everything cheaper than elsewhere. I had a bizarre experience once when I wanted to stay an extra night in a hotel and the clerk wanted twice the Wotif price. I stood at the counter with the clerk and booked the next night on Wotif so I didn't have to check-out and back in. He didn't even need the confirmation from Wotif he was happy to see it confirmed on my laptop.

But those days are past. I've noticed that hotel pricing has become much more dynamic than it used to be and I think this makes more sense than trying to partition websites into different markets. People migrate to better web sites in no time so a business model that relies on few people knowing about you is doomed.

ReplyDeleteWotif takes 10% (is check-in any cheaper?) so a lot of hotels want to cut them out. I've also had two occasions when the hotel didn't want to honour the Wotif prepaid booking, sorted in the end, but a pain because you've already paid and all the angst is with you. They've already got the money, so if you don't check in that's even better and they wont hesitate to send you away and keep the money if you don't have your credit card or can't meet some pedantic criteria they've dreamed up.

These days if you can be bothered to put in the effort you make a short list from Wotif and contact the hotel direct either by phone or through the hotel website. You often get a lower price but more often, particularly with small hotels, get much better terms. Like sometimes I finish early and go home and don't want to pay for an unused hotel room if I can help it or things change and I don't turn up.

A small hotel was recently trying to get me to cut out Wotif on the next booking for a discount and I asked them how they managed their inventory across all these web booking services. They told me they use recently developed software which manages it automatically. It spreads the inventory across the services, monitors sales and shifts inventory from one site to another as required. It is probably this software rather than human intervention that is responsible for the offerings on every booking service being identical.

Zipf dooms check-in in their current form. Their only chance is to define a new category and own it. The problem I have with my strategy of using Wotif for reference then going direct is the extra effort (too much usually). Can check-in find a way of making this easier? They've already got the inventory data feeds, so its a good start. Get hotels on side by feeding customers into their systems, letting them bill the customer direct and helping them with dynamic pricing which only big hotel chains do well. I've colleagues trying to do something similar to check-in in Indonesia so we've debated this a few times.

ReplyDeleteIf they can find a better model, the Wotif margins show there is money to be made and in the web space a new model quickly kills the old.

Ken

ReplyDeleteSend me an email if you want. There is stuff here which is (a) not related to UTG and (b) stuff on which I can talk knowledgeably - but not in this forum...

But check-in has something valuable - albeit a small niche. It is a deep discounter but only when they can find inventory... they have relationships with a lot of hotels.

This post is by-and-large not about check-in which has a small niche which may or may not be sustainable. Check-in is not listed and is not rightly the subject of a stock-picking blog.

It is about CNUTG which has no niche at all...

Anyway send email.

J

graft

ReplyDeleteJohn,

ReplyDeleteI've enjoyed your skewering of this clearly dodgy Chinese travel company.

But I have to say your mates Aussie online hotel booking company check-in.com.au ain't all that flash either.

My wife just had a horrendous experience booking a hotel in Melbourne for this coming weekend (Nov 29 and 30). She found the hotel and rate she wanted (The Rialto) but got some weird 'code 505' error message when she tried to complete the credit card booking via the website.

At that point she had no idea if the booking had been successful or not.

So she phoned the check-in.com.au contact number and was told that not only had the booking not gone through to the actual hotel - but that our credit card has been charged TWICE for the transaction. They then asked her to phone the hotel directly herself to make the booking (great service eh!). This she did. But the sucker punch is that they have told here it will take 6 days to reverse the credit card transaction.

In some ways it would have been better if it worked liked the UTC site and didn't take any credit card booking at all!!

Cheers

Mark Leydon

I'm new on this blog

ReplyDeleteI own UTA ... and as a matter of fact I want to thank J. Hempton since he allowed me to buy it in low $4 and it would not be possible without him.

------

I have some internet marketing experience so here is my comment

UTA website has a global traffic rant of 12,000 now that's a bit to much for fraud don't you think so? Also when you type in the website in goolge it returns 30,000 results. Again that’s a bit to much for a fraud company, isn’t it?

And to make my point more clear lets compare that traffic to Bronte Capital website traffic which is 3,963,955.

The way I see it Universal Travel is 330 (3,963,955/12,000) times more legit business than Bronte Capital

When you go to Bronte Capital site and click on performance and client letters http://brontecapital.com/Letters.html

ReplyDeletewhen I clicked on the PDF files guess what I got an error message....

This guy John Hempton is absolute looser

It's fun watching the Anonymous longs freak out here in the comments. Good for a laugh.

ReplyDeleteKeep up the good work, John.

Nice

ReplyDeleteDubious companies with no purpose other than selling stock can last a long time if they stay within the letter of the law. Skillful fraud is indistinguishable from incompetence.

ReplyDeletewww.chanukkah2016.com