Some Questions for State Attorneys General and Boards of Pharmacy

- Is a pharmaceutical manufacturer allowed to own or effectively control a pharmacy in your home state?

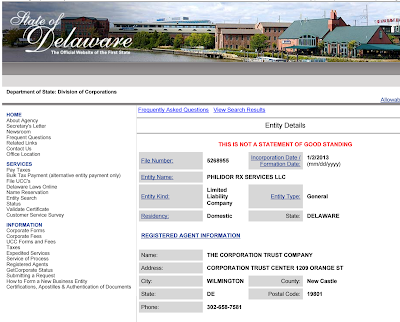

- If a third party obtains effective control over a pharmacy licensed in your state, is a new registration filing required?

- If a pharmacy owner sells all or a portion of its economic interest in a pharmacy in your state, is it required to update its registration?

- Is it a violation of state law in your state to fail to disclose the ultimate holder of control and/or economic interest in a pharmacy? That is, if Valeant exercises control or holds an economic interest in Philidor, and Philidor is a regulated owner of a Pharmacy, has Philidor violated your state registration laws by failing to mention the ownership and/or control of Philidor by Valeant?

- May two pharmacies “share” a National Provider Identifier when dispensing medications in your state, as it has been alleged R&O and Philidor have done?

- Does the law in your state allow a pharmacy to seek reimbursement for prescriptions filled from government or private payers using an identifier such as an NPI#, NDPCP#, or NABP# not assigned to it? If not, what potential legal consequences and penalties would attach?

- For the California Attorney General: as Philidor Rx Services LLC is not licensed as a mail-order pharmacy, is it allowed to purchase directly or indirectly, the equity of or an option to purchase the equity of a pharmacy (R&O) that is registered in California?

- For the California Attorney General: if we interpose another entity into the prior question—Valeant owns and controls part of Philidor that owns and controls part of Isolani that owns and controls part of R&O Pharmacy—has R&O complied with California licensing and disclosure laws, on penalty of perjury?

- For the Pennsylvania Attorney General: as Isolani LLC is not registered as a foreign corporation in your state but owns an interest in a pharmacy (R&O) that is registered in Pennsylvania, how is it able to operate based in Hatboro, PA?

- May two pharmacies “share” a National Provider Identifier when introducing medications into interstate commerce, using the telephone and mail, as Philidor and R&O are alleged to have done?

- Does federal law allow a pharmacy to seek reimbursement for prescriptions filled from government or private payers using an identifier such as an NPI#, NDPCP#, or NABP# not assigned to it? If not, what potential legal consequences and penalties would attach?

- It has been alleged in documents filed with the court in a lawsuit by Isolani against R&O Pharmacy that Philidor encouraged the owner of R&O to falsely certify the results of a prescription audit by one of its payer clients. It has also been alleged that Philidor used identifiers (such as NPI#, NCPDP#, and NABP#) belonging to other pharmacies to send invoices to payers for prescriptions filled.

- Will you investigate whether the actions of Philidor Rx Services to constitutes “health care fraud” under 18 USC § 1347, which applies to public and private providers of health benefits and does not require actual knowledge or specific intent?

- Similarly, if proven, will you investigate what is alleged to be a specific intent to deceive payers in this way could potentially constitute mail or wire fraud, as defined in the federal statutes?

- What steps are pharmaceutical manufacturers and/or their wholly-or-partially owned pharmacies required to take to ensure that persons eligible for government-paid prescriptions are not offered waivers, coupons, or charity assistance, in whole or in part, for prescription co-payments? Will you investigate whether such steps have been taken by Philidor and its affiliate pharmacies?

- Will your staff investigate and will you convene a hearing of the Senate’s Permanent Subcommittee on Investigations to discuss these issues and others related to Valeant's business practices and their compliance with state and federal laws?

- Have you - as alleged in some internet posts by disgruntled employees - failed to reimburse drugs distributed by Valeant but then been shopped by Valeant to other "seemingly independent" pharmacies. [Philidor it is alleged tried switching distributor codes to fool your controls.]

- Will you continue to accept claims for payment from Philidor Rx Services LLC, R&O Pharmacy, West Wilshire Pharmacy, Safe Rx Pharmacy, Orbit Pharmacy?

- Will you undertake an audit (or re-open past audits) of these pharmacies to determine their continued eligibility to seek reimbursement from you for prescriptions dispensed?

- Will drugs manufactured or marketed by Valeant in the future require more stringent pre-clearances or other restrictions?

- Are there any other entities with whom Valeant has relationships like Philidor Rx Services LLC or its affiliates that haven’t been disclosed yet?

- Are there any other entities for which Valeant holds an option to acquire ownership that have not yet been disclosed?

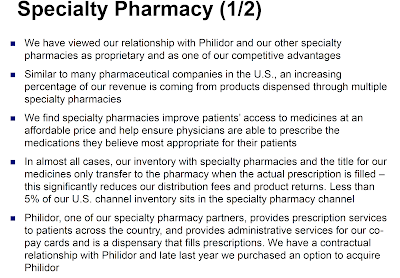

- You have stated that Philidor administers Valeant’s patient co-pay assistance programs. In the last conference call, Mr. Pearson indicated that spending on these programs has grown at a compounded rate of 128% annually, rising from $53M in 2012 to a projected total of over $1 billion in 2016. (In your letter to Senator McCaskill, Mr. Pearson indicated that spending on such assistance programs totalled $544M in 2014 and an estimated $630M for 2015.)

- What portion of these annual amounts does Philidor administer?

- What instructions have you given Philidor in administering these programs?

- What criteria have you instructed Philidor to use in determining patient eligibility for these programs?

- How do you monitor Philidor and other entities to ensure that patients meet the criteria you have established?

- How do you reward (or punish) Philidor and other entities for adhering (or not) to these criteria?

- What controls do you have in place to ensure that Philidor administers these programs legally? Systematically waiving co-pays for claims that would otherwise be paid by Medicare or other government programs is illegal.

- Have you ever, prior to the arrival of subpoenas from US Attorneys, disciplined Philidor or withheld or otherwise delayed payment because individual staff of Philidor have broken these laws? If so, what actions were taken? In what amounts, when and why? How have you ensured that any such problem has not recurred and will not do so again in the future?

- How many Valeant employees, contractors, or agents (whether full or part-time) are responsible, in whole or in part, for monitoring Philidor’s compliance with your guidelines and state and federal law? How often do you and your executive team review Philidor’s adherence to your guidelines and to state and federal law regarding co-pay assistance?

- How is Philidor compensated for operating this program on your behalf? Is any portion of their compensation based on prescription volume dispensed or revenue generated?

- In the conference call Mr. Pearson stated that Valeant funds multiple outside foundations that have multiple donors. What are the names and locations of these foundations and what portion of its operating revenue do Valeant donations represent? Who are the five largest donors to each?

- Presumably these foundations fund copays for medicare and other government sponsored pharmaceutical insurance. Which outside institutions? How much money?

- How are these donations accounted for in your GAAP accounts? Where do these donations appear in your audited financials reported on form 10-K?

- How do you determine the amount of assistance to provide each year? How did you select the $1B projected total for 2016?

- How do you assess whether you are getting value for money for your charitable deductions?

- What controls do you maintain to ensure that shareholders receive value for the $1B in contributions? Have your auditors inspected those controls?

- Who (which individual or group of individuals) determines which patients will receive co-pay assistance, and for which products? Are the individuals making such award determinations employees of Valeant, Philidor, or a third party? (If a third party, who?) How are these individuals compensated?

- Of the billion dollars of patient assistance expense that you expect in 2016 how much is administered through Philidor and how much is through other parties? Who are the other parties and for what amounts of this expenditure do you expect each will be responsible?

- Can you provide a detailed breakdown of patient assistance costs by product or business line? How much for instance is neurology, dermatology, ophthalmology, etc.?

- It is our impression that Philidor is heavily focussed on dermatology. Is that correct?

- If so, who administers the patient assistance outside dermatology and how do you control them?

- What proportion of your dermatology products are sold with patient assistance?

- What proportion of your products (in dermatology or not) are sold to government-insured patients?

- What proportion of your products (in dermatology or not) are sold to government-insured patients with patient assistance programs?

- How is it the case that Philidor administers your co-pay assistance programs, yet you indicated that Philidor is responsible for only certain of your products, most of which are dermatological in nature?

- You indicate that the form of assistance ranges from capped co-pays to subsidized prescriptions to referrals to a foundation (for patients in federal programs) to which you contribute. What was the total amount of assistance awarded for each category?

- Which foundations received such grants from Valeant, and in what amounts, over the past three years? How much did each of those foundations dispense as part of the assistance programs for drugs produced and or marketed by Valeant? What portion of each charity’s total funding does Valeant represent in each case?

- What portion of this and prior years’ “patient assistance” programs funding was used to reimburse prescriptions filled by Philidor or other affiliated pharmacies? What portion went to non-Valeant affiliated “specialty pharmacies?” What portion went to non-Valeant affiliated “traditional” pharmacies?

- For each of the products that you indicate is covered by your patient assistance programs, how much assistance has been provided for each, in what form, and by whom?

- How do you ensure that patients who receive a reduced co-payment, in whole or in part, do not subsequently submit reimbursement requests to government-paid programs for which they may be eligible?

- Before you received the subpoenas from two US Attorneys had you been having ongoing dialogue with them or did the subpoenas come entirely by surprise?

- I know that you are not disclosing the detailed questions in these subpoenas but can you answer one question: in aggregate, how long are these document requests by number of pages? Are they five pages, fifty pages or five hundred pages?

- Do you know if any of your independent administrators of your patient assistance programs have received subpoenas? Has Philidor (or any of its affiliates) received subpoenas?

- How is Philidor compensated for the services it provides to you? Is any part of Philidor’s compensation based on the volume of prescriptions filled, revenues or co-pay assistance (of any type) awarded?

- You have stated that Philidor will dispense a drug in advance of an insurer’s commitment to reimburse you for the cost of that drug, and that Valeant thus bears the risk that the insurer billed by Philidor will not pay.

- If a co-pay is waived, diminished via a coupon, or paid in whole or in part by a charity, how do you ensure that prescriptions filled by Philidor will ultimately be approved by the insurance company?

- Are Philidor employees given any sort of incentive to ensure that the prescriptions are indeed reimbursable?

- What portion of insurance claims submitted by Philidor over the past several quarters were disputed or went unpaid?

- To your knowledge, has Philidor ever failed an audit by a payer? If so, who, when, and why?

- How often do senior staff members of Valeant meet with senior staff of Philidor?

- Will Valeant file copies of its contracts and agreements with Philidor Rx Services LLC, its owners/members, and its affiliates with the Securities and Exchange Commission?

- It has been reported online by individuals purporting to be former Philidor employees that Valeant had its own employees on-site and that Philidor employees were instructed to deny any link to Valeant. To your knowledge:

- Do any Valeant employees, contractors or agents presently work full- or part-time in any Philidor office? Have they previously?

- Has any employee of Philidor been instructed to deny or otherwise obfuscate the relationship between Valeant and Philidor? Has any Valeant employee, contractor, or agent so instructed any employee or member of Philidor?

- In your relationship with Philidor, past and present, what was and what is the role of Gary Tanner?

- Why does Gary Tanner, upon belief an employee of Valeant until recently, have an internal email at Philidor in the name of a “Super Hero?” Can you tell us which “Super Hero” Mr. Tanner uses for his “avatar?”

- Will the Board of Directors capable law firm/forensic accounting firm be hired to independently assess the situation? When?

- When were members of the Board of Directors first informed of your commercial, operational, and/or financial relationship with Philidor, its owners, or its employees? What were they told? What such information have they been provided since?

- When were your auditors, PriceWaterhouseCoopers LLP, first informed of your commercial, operational, and/or financial relationship with Philidor, its owners, or its employees? What were they told? What such information have they been provided since?

- Had it not been for press reports regarding the relationship with Philidor, the lawsuits between you and R&O, and the lawsuit between Isolani LLC and Russell Reitz, what plans did you have to disclose your relationship with Philidor and R&O? If you had no plans, why not?

- There are reports online of doctors suggesting that their patients fill prescriptions at Philidor to save money on co-payments.

- How do doctors know about Philidor? Do you or your salespeople inform them? If not, how are the doctors finding out about Philidor?

- Are your sales representatives aware of your relationship with Philidor? When were they so informed? Was Philidor or its affiliates mentioned as part of your representative training?

- Are your sales representatives instructed to or in any way compensated for informing the prescribers they visit of Philidor’s existence or its ability to waive or diminish, in whole or in part, co-payments for products produced or marketed by Valeant?

- Do your sales reps carry literature of any kind that mentions Philidor?

- How does Philidor compensate Valeant for such referrals, if any?

- Alternatively, how are patients made aware of Philidor’s existence? If it is by prescribers, why? Are any incentives or materials provided by Valeant or Philidor or its employees or contractors to make patients aware of such pharmacies’ existence?

- You have stated that Valeant takes reimbursement risk on prescriptions filled through Philidor, which is patient-dependent. To your knowledge, have patients filled prescriptions for drugs other than those sold by Valeant at Philidor pharmacies? [On belief this may happen if a Valeant prescription is written along with a prescription for a non-Valeant product. Does it happen when there is no Valeant product on the script?]

- What is the total amount of revenue from Philidor that is consolidated on your financial statements that is derived from cash co-payments Philidor received for prescriptions it filled?

- You stated on your 3Q2015 conference call that “[Philidor] does not restrict prescriptions it fills to any particular manufacturer.” What portion of Philidor’s revenue that is consolidated on your financial statements is from sales of non-Valeant products?

- You also stated that “[Philidor] dispenses generic products as specified in the patient's prescription or as requested by the patient.”

- What portion of prescriptions filled by Philidor are for non-branded generics? What portion of total prescriptions filled with non-branded generics were written on the prescription and what portion were requested by the patient?

- If a patient does not request a generic but a non-branded generic is available, will the Philidor pharmacist suggest such a generic?

- To your knowledge has Philidor or Philidor staff ever written a dispense as written code on the script without being specifically directed to by the doctor or the patient?

- To your knowledge, are pharmacists at Philidor pharmacies allowed to suggest generic alternatives when available?

- If not, why not? Who gave the pharmacists you employ such direction? And if not, what gives you legal comfort that the states in which Philidor is licensed allow a non-pharmacist to give such instruction to a pharmacist?

- Have Valeant officers or employees, whether full or part-time and present or former, given any direction to pharmacists employed, whether current or former, full or part-time, as to whether to suggest substitution of generic drugs? To your knowledge, have officers or senior staff at Philidor or its affiliates so instructed the licensed pharmacists they employ?

- What portion of the revenue from Philidor that you consolidate on your financial statements is derived from products not produced or marketed by Valeant? What portion of such revenue is for generic substitutes for prescriptions written for brand-name products, and for which products?

- In its rejected filing in California, Philidor indicated that its upstream wholesale supplier was Kinray, a division of Cardinal Health.

- To your knowledge, is that correct? To your knowledge, has Philidor purchased your products from any other wholesalers? If so, whom? Do you now, or have you previously, shipped products produced or marketed by Valeant directly to Philidor?

- Do you include inventory held at Kinray or any other wholesaler used by Philidor or its affiliates as part of the consolidated inventory of Philidor held on your balance sheet?

- Were you aware that Philidor’s application for licensure as a mail-order pharmacy had been rejected by the state of California? How were you so informed and when? What actions did you take or communications did you have with your employees, the management, or the owners of Philidor, if any, upon learning that information?

- To your knowledge, did Philidor ship any prescriptions to consumers in California or other states in which it was not licensed?

- If so, when were you so informed? What corrective action did you suggest if any?

- If not, what impact did Philidor’s inability to legally fill prescriptions in California have on its relationship with you and/or the entries consolidated on your financial statements?

- What steps did you take, if any, to ensure that Philidor was licensed in each of the states to which it shipped prescriptions for your products?

- Before you acquired an option to purchase Philidor, did your employees or agents perform any sort of audit or inspection of Philidor’s state licensing status? Did they inquire as to whether Philidor had ever had a license denied or revoked, or if Philidor had improperly shipped product to states in which it was not licensed?

- Were any Valeant officers, employees, agents, or contractors aware, as Philidor CEO Andy Davenport indicated in an email to Russell Reitz and filed in a court proceeding, that Philidor had a practice of using an identifier (such as an NPI, NCPDP, or NABP number) belonging to another entity to bill payers for prescriptions it filled? Did you inquire about this in your diligence process as part of the option to acquire equity in Philidor? If not, why not?

- Was any officer, employee, agent or contractor of Valeant involved in the acquisition of R&O Pharmacy from Russell Reitz by Isolani LLC?

- To your knowledge, as you consolidate its results, when was the last inventory audit at Philidor or its affiliate pharmacies?

- To your knowledge, as you consolidate its results, has a payer ever ceased accepting prescriptions from Philidor or so threatened? If so, who and when?

- Did you investigate Norma Provencio’s co-investment in Recom/Signalife alongside Mitchell J. Stein before renewing her position on the Audit Committee? If not, why not?

- According to online sources, several employees at Philidor Rx Services formerly worked at Unitek, a Blue Bell, PA, company that was alleged to have experienced a fraud. Before they were hired, did you determine that these employees were not in any way involved in the alleged fraud? Are these employees involved in any accounting function at Philidor?

- You failed to inform shareholders of the nature or purpose of KGA Fulfillment Services Inc., the entity that holds secured interests over the owners of Philidor. There are a few other such entities about which you have mentioned little. For instance, you registered many Delaware entities, some on roughly the same day in 2012, by the names of Audrey Enterprise LLC, Emma Z LP, Erin S LP, Katie Z LP, Kika LP, Stephanie LP, and Tori LP.

- For what purpose were these entities established?

- What is the nature of these partnerships and what assets do they hold?

- Who besides Valeant has or may potentially receive an economic benefit from these entities? Is Valeant the sole member or limited partner?

- Prior to the lawsuit in California Central District Court, had you or your employees had any direct communication with officers or employees of R&O Pharmacy?

- Why did Robert Chai-Onn identify $69 million at R&O as owed to Valeant? Is any money owed to Valeant by R&O additional to monies owed to Philidor - or is Philidor just an arm of Valeant.

- Have you or any of your employees had direct communication with officers or employees of Brighton Way Pharmacy (d/b/a West Wilshire Pharmacy), Safe Rx Pharmacy, or RAAS Pharmacy (d/b/a Orbit Pharmacy)? If so, when and on what topic?

- Are the payers Philidor invoices for prescriptions filled aware that Valeant has the option to acquire an equity stake in Philidor? Are they aware that, as you stated, you bear the reimbursement risk on prescriptions filled by Philidor and presumably by these related pharmacies.

- Several of your competitors have indicated that they have arms-length relationships with their specialty pharmacy channel, and that they do not own any equity or equity-like stake in such pharmacies. Yet you own an option to acquire Philidor, and when I called them, a Philidor representative said they deal almost entirely in Valeant products. Why do you believe your competitors not chosen to replicate your arrangements with Philidor (and its affiliates) with their own semi-captive specialty pharmacies?

- Philidor was incorporated in early 2013. When did your relationship (of any type) with Philidor begin? What was the first quarter in which Philidor was consolidated into your financial statements? Since that time:

- Has your accounting treatment of Philidor on your own financial statements changed? If so, how and when? If not, do you believe the acquisition of an option to acquire the equity of Philidor require a restatement of any prior year’s filing before the Securities and Exchange Commission? Why or why not?

- By quarter, what was the total amount of your revenue (gross and net) for products that have been dispensed by Philidor?

- By quarter, how much inventory have you had on your balance sheet on consignment with or related to Philidor? Is that inventory held at Valeant or at a distributor?

- By quarter, what was the total amount of receivables from payers generated from prescriptions filled by Philidor (and its affiliates)?

- By quarter, what was the total amount of your provision for potentially uncollectible receivables from payers generated from prescriptions filled by Philidor (and its affiliates)?

- How did your relationship with Philidor develop? Who brought them to your attention?

- Were any Valeant or Medicis employees or agents, current or former, whether full or part-time, involved in launching Philidor?

- How many days worth of R&O's revenue does the $69M you sought to recover represent? How many square feet is R&O pharmacy? How does a small pharmacy generate that substantial an amount of business?

- If Philidor holds an option to acquire R&O or other pharmacies, are those pharmacies' results consolidated on your financial statements as well?

- Are Philidor owners, executives, or employees eligible to receive any form of monetary incentive from Valeant? Have any such incentives been delivered? If so, in what amounts? What are the criteria for receiving such compensation? Have such amounts been disclosed to the Board?

- Mr. Pearson, have you ever met with or communicated with Philidor executives or employees? If so, how often? For what purpose?

- In addition to Robert Chai-Onn, which other members of your executive team were aware of the Valeant's relationship with Philidor, R&O, and its other possibly-affiliated pharmacies, such as West Wilshire, Safe Rx, and Orbit Pharmacy?

- Which executive at Valeant has responsibility for the relationship with Philidor? Which executive has oversight and profit-and-loss responsibility for Philidor's operations?

- What direction have you given your employees, contractors or agents with regard to discussions of the existence of Philidor and its relationship with Valeant, if any?

- Why did you decide to purchase an option to acquire Philidor? What did you pay for that option? When did you purchase it, and when does the option expire?

- Before the most recent disclosures, was the Board of Directors aware of your commercial and financial relationship with Philidor, its owners, and its affiliate pharmacies? Were these relationships discussed by and/or approved by the Board of Directors, the Audit Committee, and your external auditors?

- Did the Board of Directors approve the acquisition of an option to acquire Philidor? If so, when? What due diligence did you perform on Philidor, and what was the investment case presented to the Board?

- Are the insurance companies whom you/Philidor invoice, and from whom you bear reimbursement risk, aware that patients have been offered co-pay coupons, waivers, and/or charity assistance for the co-pay portion of the claims submitted?

- Regarding your auditor, PriceWaterhouseCoopers LLP:

- Are they aware of your relationship with Philidor? What information did you provide to them about this relationship? When?

- To your knowledge, have they audited Philidor, its operations, or its financial controls?

- To your knowledge, did they inspect Philidor to determine whether it maintains effective internal controls?

- Were there any disagreements with PWC over how your relationship with Philidor should be disclosed in your filings before the Securities and Exchange Commission?

- What portion of the operations of Philidor and its affiliates were included in the audit scope on which you and PWC agreed for your 2014 Annual Report?

- What evidence did you provide to your auditors to convince them that Philidor Rx Services constitutes a variable interest entity that meets the tests for consolidation on your financial statements?

- Did you have any discussions with your auditor regarding the need, if any, to disclose your relationship with Philidor and its affiliates?

- Which products were fulfilled through Philidor (and its possible affiliates), and what has been the rate of growth in prescription volume and revenue for those products?

- You have stated that Valeant takes reimbursement risk for products fulfilled by Philidor. Does this extend to Philidor's affiliates as well? So if an insurance company in California declines to cover a prescription shipped by R&O or West Wilshire, who is out the money for that prescription?

- Have you established a reserve for prescriptions dispensed by Philidor for which the payer refuses to pay? If so, what is the present level of that reserve and how has it changed over time?

- Is the inventory held at R&O and West Wilshire (and other Philidor affiliates) consolidated on your balance sheet?

- Why did you purchase an "option to acquire" Philidor rather than the equity itself? At any point in your internal discussions of such a transaction did anyone, whether an employee or agent of Valeant or Philidor, indicate that pursuing a transaction in this form would perhaps avoid the need to file updated pharmacy registration forms in any state in which Philidor or its affiliates operate?

- How many of your former employees, contractors or agents work at Philidor? What are their names and titles and what is the nature of their responsibilities?

- What was Valeant's role in establishing Philidor or its affiliates, if any?

- As suggested online by Probes Reporter:

- What communications, if any, has Valeant had with the SEC’s Division of Enforcement, the US Attorney/DOJ, or Canadian regulators, regarding any matter, in the past 30 days?

- If such communications exist, what was the purpose and date of those communications?

- Last week the company said it received a subpoena from the U.S. Attorney's Office for the District of Massachusetts and a subpoena from the U.S. Attorney's Office for the Southern District of New York. Who they were sent to?

- Have you received any as-yet undisclosed subpoenas, requests for documents, or notices of the commencement of investigations by any other government entity since your prior disclosure?

- Who owns and has owned Philidor?

- Do you fill prescriptions for patients living in California? When we phoned, your representative indicated that you ship to "all 50 states." How are you legally able to ship products to states such as California, where you are not licensed?

- What advice did you obtain, and from whom, that you could legally fill prescriptions and mail them to customers in California, a state in which you are not licensed?

- Why did you, as the California Pharmacy Board found, omit required information from your filing to become licensed in California?

- For what products (and from what manufacturers) do you fill prescriptions? What is your annual prescription volume and revenue from each product?

- Has Philidor Rx Services ever submitted a claim for reimbursement to a payer, whether government or private, using an identifier (such as NPI, NCPDP, or NABP) assigned to R&O Pharmacy, West Wilshire Pharmacy, or any another entity?

- Your CEO said in an email to Russell Reitz, filed in a court proceeding, that you no longer do so. For how long did you do so? From when to when?

- How many prescriptions were filled using another entity’s identifier? What was the total amount of revenue from these prescriptions, at wholesale cost and net to you?

- What advice did you obtain, when, and from whom, that made you comfortable, as your CEO Andy Davenport indicated, that such practices were legal and did not constitute insurance fraud or “health care benefits fraud” as defined in 18 USC § 1347?

- Did you switch as was alleged for the purposes of reducing the scrutiny of insurance companies on your claims?

- What portion of your prescription volume and revenue is for products sold by Valeant and its subsidiaries?

- When did you first form a business relationship with Valeant? What has been the nature of your relationships (financial, legal, commercial) with Valeant over time? What is the nature of that relationship today?

- Does Valeant provide your owners, officers, or employees with any incentive derived in whole or in part on the volume, type, or price of prescriptions filled?

- What are your responsibilities for administering Valeant’s prescription access programs? How are you compensated?

- What happens if an insurance claim for a prescription is denied? Does Valeant compensate you for the wholesale cost of the medication you dispensed?

- From which wholesalers do you purchase products? Are these products physically located in and dispensed from premises owned by or leased by Philidor?

- What procedures do you have in place to ensure that patients receiving co-pay waivers do not subsequently submit claims for reimbursement to government-funded programs such as Medicare, Medicaid, TriCare, and the VA? What portion of your customers (and what portion of your revenue) is from customers eligible for such government-funded programs?

- How much investment capital, working capital, or other funding has Philidor Rx Services LLC received since inception? Who provided that funding?

- Did Valeant or any of its subsidiaries, current or former, provide any equity, debt or other form of financing to Philidor, now or in the future?

- It has been reported by several sources that patients have received calls from Philidor to refill prescriptions, whether they requested such a refill or not. Do your employees or automated systems place outbound phone calls to patients for the purpose of or with the effect of generating refill requests? Have your employees offered to waive co-pays on prescription refills generated through outbound phone calls? Were any of these calls made by automated means, commonly known as “robocalls?” If so, did you secure your customers’ prior permission to place such automated calls, as required by the Telephone Consumer Protection Act?

- If such reminder calls are indeed placed, who is placing them? Are these persons licensed pharmacists, pharmacy technicians, or pharmacy interns?

- Do any of your employees have quotas or other volume-based incentives, monetary or otherwise, for generating prescription refills from prior patients?

- Do any of your customers have their prescriptions refilled automatically, whether requested or not?

- If a prescription that you mail is returned as undeliverable, is the claim cancelled and the payment refunded to the insurance company?

- Who are the largest customers for your services and how much revenue do you generate from each?

- How are your employees compensated? Are any employees required to meet quotas in terms of numbers of prescriptions filled (or refilled), claims filed, or reimbursements obtained over a specified period? Are any employees rewarded through incentive compensation for exceeding such targets?

- What is the nature of your relationship with BQ6 Media and its employees, who are members of Philidor Rx Services?

- Are any executives, employees, contractors, or agents, whether full or part-time, of Valeant or its subsidiaries, current or former, assigned to, resident in, or commonly present in your offices in Pennsylvania or Arizona? Who? How much time did they spend in your office? What was the nature of their responsibility?

- How many of your employees, current or former, are or have been employees of Valeant Pharmaceuticals and its subsidiaries, current or former?

- How many employees do you have? How many hold state licenses as pharmacists, pharmacy technicians, or pharmacy interns?

- Are any of your employees subject to quotas or other incentives (positive or negative) for number of phone calls or prescriptions filled over any period? If so, what are the terms of the quotas and/or incentives and to whom do they apply?

- How many prescriptions do you dispense per day? What has that total been, per quarter, for the past three years?

- Have any payers ceased to cover prescriptions filled by Philidor Rx Services or its affiliates? If so, who, when, and why?

- Did you solve this by changing the pharmacist identification number to as small pharmacist that you had purchased for the person of diversifying the distributing pharmacy.

- Have you at any time failed an audit by a payer? If so, who, when, and why?

- Has any payer ceased to do business with Philidor, including withholding payment for prescriptions filled? Has any payer so threatened? Who, when and why?

- What portion of your revenues from drugs sold by or produced by Valeant Pharmaceuticals and its subsidiaries?

- What was the total amount of co-payments collected, by quarter, for the past three years? What was the median, average, and total co-payment amount collected, by drug?

- Are the operations of any other entity consolidated on the financial statements of Philidor Rx Services LLC?

- At any point was the work or performance of any current or former employee, whether full- or part-time, or member of Philidor Rx Services subject to direction or review by any other person or entity currently or formerly employed or retained by Valeant Pharmaceuticals and its subsidiaries, current or former?

- Has Philidor Rx Services LLC or any entity other entity in which it owns an economic interest or exercises operational control received an audit from a PCAOB-registered accounting firm? If so, whom?

- How often did you meet with executives, employees, or agents of Valeant Pharmaceuticals or its subsidiaries, current or former?

- Did Valeant’s auditors, PriceWaterhouseCoopers LLP, conduct an audit of your operations and financial results before your operations were consolidated into Valeant’s financial statements? If not, why not?

- When did Valeant purchase an option to acquire an equity interest from the members of Philidor Rx Services LLC? What did they pay for that option? What were the terms of the agreement? Why did you choose to sell an option rather than your membership interests directly?

- When your members sold an option to Valeant to acquire your interests, did you update your registration with any state or federal authorities, such as Boards of Pharmacy, the DEA, VA, DOD/TriCare, HHS, or CMS? If not, why not?

- You stated in your press release that “Philidor does not currently have a direct equity ownership in R&O Pharmacy or the affiliated pharmacies, but does have a contractual right to acquire the pharmacies now or in the future subject to regulatory approval.” As court documents filed by Isolani LLC indicate that it is Isolani LLC that would own 90% of R&O upon consummation of the transaction with Mr. Reitz, how is it that you came to own an option to acquire R&O?

- Do you believe that an entity that has been denied a license to operate a mail-order pharmacy in California can purchase—either directly or through an option to acquire—a licensed pharmacy in California?

- What is the nature of your relationship (commercial, legal, financial, operating) with R&O Pharmacy now and over the past three years?

- What is your role in R&O’s pharmacy operations?

- Why did you send invoices, as filed with the court, from Philidor to purchase products from Valeant Pharmaceuticals, to the attention of the R&O Pharmacy finance department?

- Why did your employee send emails suggesting to Russell Reitz

- Why did you use and then discontinue the use of, as the email from your CEO Andrew Davenport filed with the LA County court by R&O Pharmacy indicates, the various identifiers (NPI, NCPDP, NABP) assigned to R&O Pharmacy?

- As you are licensed in many states, why did you desire to use such identifiers assigned to R&O Pharmacy?

- As the acquisition agreement filed with the LA County Court indicates that such identifiers were to be assigned to Isolani LLC as part of the purchase of R&O, how did Philidor Rx Services obtain the right to use such identifiers itself?

- To your knowledge, have any of your employees—including licensed pharmacists or pharmacy technicians—resigned due to reservations about the conduct they observed and/or in which they were asked to participate? What did you do, if anything, to learn of those concerns and/or ameliorate those of which you were informed?

- What information did Russell Reitz provide you that made you agree to stop using identifiers such as NPI#, NCPDP# or NABP# belonging to R&O Pharmacy?

- Are you aware that this document - that you filed in State Court in California contains a putative list of products distributed by R&O but in fact fulfilled by you. Moreover are you aware that the identification numbers in that document correspond to UPS tracking numbers and hence you have provided evidence that product was shipped to areas where you or R&O were not licensed?

- Are you aware that changing the pharmacist identification number for the purpose of deceiving the payer is wire fraud against a financial institution? Are you aware that the fine is $1 million per instance and the instances are cumulative?

- What is the nature of your relationship (commercial, legal, financial, operating) with Isolani LLC? What services does Philidor provide, if any, to Isolani LLC?

- Is Eric Rice an employee or has Eric Rice ever been an employee, contractor or agent of Philidor or its affiliates? If so, what are/were his responsibilities? What are/were his dates of employment, title, and assigned office location?

- What is the nature of your relationship (commercial, legal, financial, operating) with Lucena Holdings LLC? Are its operations reported on Philidor’s financial statements? How?

- What is the nature of your relationship (commercial, legal, financial, operating) with Brighton Way Pharmacy (d/b/a West Wilshire Pharmacy) now and over the past three years? Why was such a relationship formed? What was the genesis of such a relationship and what benefits did it provide to you? Are Bright Way Pharmacy’s operations reported on Philidor’s financial statements? How?

- What is the breakdown of prescriptions filled by Philidor (and its affiliates) by dispensing code? Where no DAW code has been supplied, do pharmacists in your employ (whether full or part-time) offer a generic alternative to the patient when available?

- Does Philidor report data on the prescriptions it fills to IMS Health or other third-party supply chain reporting services?

- What reports does Philidor provide to Valeant management and on what schedule?

- Why are all the entities related to Philidor (BQ6, Isolini, Lucena, Philidor itself, KGA) named for chess moves?

- What other pharmacy relationships does Philidor have that have not yet been disclosed? What is the nature of those relationships?

- Why did a member of Philidor, Fabien Forrester-Charles, register a second domain name for R&O Pharmacy? Similarly, why were domain names created for West Wilshire Pharmacy, Orbit Pharmacy, Safe Rx Pharmacy, and dandapharmacy.com?

- What exactly is your relationship with West Wilshire Pharmacy today and over time?

- Why is Sherri Leon, a pharmacist you employ, listed as the Registered Agent in CA state filings for Brighton Way Pharmacy, the legal name of West Wilshire Pharmacy?

- Is Philidor Rx Services LLC your full-time employer, as indicated on your LinkedIn profile? If not, who is?

- Did you form Isolani LLC of your own volition, or were you directed to do so by another party? If so, whom? If not, why did you personally decide to acquire a pharmacy in California?

- By name and amount, who has ownership of, or the right to acquire ownership of, an economic interest in Isolani LLC?

- How many employees does Isolani LLC have and what are their names, titles, and dates of employment? Are any of them now, or have any of them been, employees of Philidor Rx Services LLC or Valeant Pharmaceuticals (and its subsidiaries, current or former)?

- Were you the sole provider of initial start-up capital for Isolani LLC? If not, what other person or entity provided capital? Were Philidor, Valeant, or their subsidiaries (current or former), or employees (current or former) among those who provided capital?

- Did you personally provide the $350,000 to purchase R&O Pharmacy from Russell Reitz, as outlined in the purchase agreement you filed with the court in your lawsuit against R&O? If not, who did? Did Philidor, Valeant, their subsidiaries, or their employees provide any capital to you personally or to Isolani LLC to facilitate this purchase?

- As Isolani LLC is entitled to all of the profits and losses of the operations of R&O Pharmacy according to the purchase agreement you filed with the Court, do you personally receive such profits and bear such losses? If not, who does? Are any of the persons who are entitled to receive such profits or bear such losses current or former employees or entities currently or formerly associated with Philidor Rx Services LLC or Valeant Pharmaceuticals in any respect?

- Have you signed any agreement governing the operations of Isolani LLC or the assignment of its profits and losses to any other entity, including Philidor Rx Services LLC, Valeant Pharmaceuticals, their subsidiaries (current or former), or their employees (current or former)?

- Who is providing the funds to pay attorneys and other expenses in your lawsuit against R&O Pharmacy in California? Are any of these funds provided by Philidor Rx Services LLC, Valeant Pharmaceuticals, their subsidiaries, or their employees?

- Why was Isolani LLC formed to purchase a 90% stake in R&O Pharmacy rather than having Philidor Rx Services LLC or Valeant (or its subsidiaries) purchase it directly?

- Why did you request, as part of the purchase agreement you filed with the LA County Court in your lawsuit against R&O Pharmacy, that Russell Reitz transfer, at your request, his NABP/NCPDP and NPI numbers into Isolani LLC’s name? In using such identifiers, do you believe that Isolani LLC, itself not a registered pharmacy in any state or with the federal government, be in compliance with pharmacy registration requirements?

- Are you based in Pennsylvania, from whence you direct the operations of Isolani LLC? If so, why are you not registered as a foreign corporation in Pennsylvania?

- Why, according to emails filed with the court, did a controller for Philidor Rx Services LLC undertake to assist R&O Pharmacy with its compliance audits by a payer customer, when the 90% owner of R&O is Isolani LLC?

- Philidor Rx Services indicated in a press release that they own an option to acquire R&O Pharmacy, of which Isolani LLC owns 90%. What are the terms of this option? When did Philidor acquire this option and for what compensation? Did you receive any proceeds from this sale personally? If not, as you were the sole member of Isolani LLC, why not?

- Have you mailed any prescriptions to patients outside of California, the only state where you are licensed?

- What is the nature of your relationship (commercial, legal, financial, operational) with Philidor Rx Services at present and historically?

- To your knowledge, has anyone not a direct employee of Brighton Way Pharmacy caused any identifier assigned to Brighton Way Pharmacy (such as an NPI, NCPDP, or NABP number) to invoice a payer for a prescription or other services?

- What is the nature of your relationship with Lucena Holdings, a Delaware LLC?

- Have any employees, contractors or agents of Valeant or its subsidiaries, current or former, been physically present on your premises in Los Angeles? For what purpose?

- Have any employees, contractors or agents of Philidor Rx Services or its subsidiaries, current or former, been physically present on your premises in Los Angeles? For what purpose?

- How many persons do you employ? How many are licensed pharmacists, pharmacy technicians, or pharmacy interns?

- How long has Aisan Zagarian been licensed as a pharmacist in California? Is West Wilshire Pharmacy her first employer as a registered pharmacist? How many prescriptions has she filled in the time she's been employed at West Wilshire?

- For what products do you fulfill prescriptions? Do you fill prescriptions for any products not manufactured or marketed by Valeant Pharmaceuticals or its subsidiaries, current or former?

- You know it's always the guy named “Fab” who gets blamed for the whole mess, right?