This blog has demonstrated a bunch of bizarre transactions in Focus Media's accounts. In particular I have focussed on transactions during 2009 in which vast sums appear to have been lost in businesses that were acquired from companies formed only months before acquisition. In each of these cases the business was sold or mostly given back to the original owner.

Here is the disclosure I focussed on (but there are other strange disclosures I could pick):

2009 Disposition

Acquisitions

| Date of acquisition |

Business segment

| Proceeds paid | Date of Disposal | Loss on disposal | |||||||||||||||

1.

|

Catchstone(1)

| 2007-4-16 |

Internet advertising

| $ | 14,489,647 | 2009-12-22 | $ | 11,560,617 | ||||||||||||

2.

|

WonderAd(2)

| 2007-9-15 |

Internet advertising

| $ | 14,926,003 | 2009-11-30 | $ | 14,926,003 | ||||||||||||

3.

|

Jiahua(3)

| 2007-8-15 |

Internet advertising

| $ | 7,659,158 | 2009-12-1 | $ | 7,659,158 | ||||||||||||

4.

|

Wangmai(4)

| 2007-9-1 |

Internet advertising

| $ | 2,749,158 | 2009-12-14 | $ | 2,749,158 | ||||||||||||

5.

|

Jichuang(5)

| 2007-12-1 |

Internet advertising

| $ | 366,032 | 2009-8-24 | $ | 366,032 | ||||||||||||

6.

|

1024(6)

| 2008-3-1 |

Internet advertising

| $ | 3,397,124 | 2009-12-18 | $ | 3,397,124 | ||||||||||||

7.

|

Dongguan Yaya(7)

| 2007-10-1 |

Mobile handset advertising services

| $ | 1,540,612 | 2009-2-28 | $ | 1,588,110 | ||||||||||||

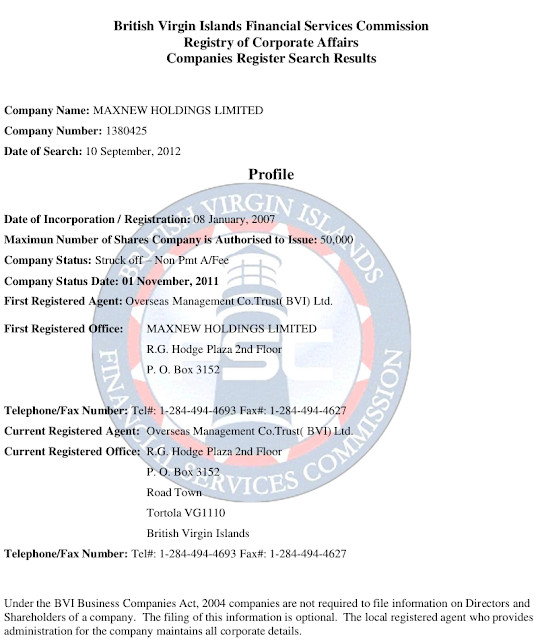

| (1) | The original sellers which subsequently repurchased Catchstone were Only Education Holding Limited and Maxnew Holdings Limited, BVI companies owned by a single PRC individual unrelated to our company. |

| (2) | The original seller which subsequently repurchased WonderAd was Megajoy Pacific Limited, a BVI company ultimately owned by seven PRC individuals unrelated to our company. |

| (3) | The original sellers which subsequently repurchased Jiahua were two PRC individuals unrelated to our company. |

| (4) | The original seller which subsequently repurchased Jichuang was Richcom International Limited, a BVI company owned by a single PRC individual unrelated to our company. |

| (5) | The original sellers which subsequently repurchased Keylink Global Limited were four PRC individuals unrelated to our company. |

| (6) | The original sellers which subsequently repurchased 1024 were two PRC individuals unrelated to our company. |

| (7) | The original sellers which subsequently repurchased Dongguan Yaya were Sinoalpha Limited and Max Planet Limited, BVI companies each of which is owned by a separate single PRC individual unrelated to our company. |

The main thing demonstrated was that all the British Virgin Island (BVI) companies above:

* had the same address despite being explicitly unrelated parties,

* had the same phone number despite their non-related status,

* in all cases except one had been formed only a few months before they sold a business for millions of dollars to Focus Media

* in the exception had been formed after they sold the business to Focus Media

* had in all but one case later been struck off the register for non-payment of a fee.

Moreover the companies given back in 2009 were given back with a lot of cash (some 27 million dollars) embedded in the companies as they were given away. Focus Media on the disclosed accounts appear to have given away cash.

Three interpretations

I originally had three interpretations of this disclosure. These were

(a). The accounting statements absolutely straight, Focus Media really did buy all these businesses, lose a huge sum of money on them and gave them back to their original owners,

(b). Focus Media used these transactions facilitate the mass looting of the company. That is the money was not really lost, but rather the business were purchased and given back to their original owner as part of some scheme to steal from the company.

(c). That the losses were fake - a form of profit washing. In this interpretation Focus Media reports fake earnings (say inflated revenue or deflated cost, most likely inflated revenue) and this loads the balance sheet with fake cash. The fake cash needs to be removed (or the auditors will find it or shareholders demand it) so the fake cash gets removed from the balance sheet with fake losses on rubbery transactions.

Two interpretations left

On the information as discovered so far interpretation (a) above requires one to believe that all these seemingly unrelated parties found the same lawyer to register their BVI entities and that these businesses generated millions of dollars in net worth in a few months before they were sold to Focus Media.

Indeed you need to believe that Richcom, which was not even in existence, had a business that Focus Media was happy to buy for millions of dollars.

There are scenarios where interpretation (a) remains possible. For instance if all the Chinese entrepreneurs had the same lawyer and hence all the addresses are the same, and that lawyer was sloppy and forgot to actually register Richcom. They might have the same lawyer because they socialize at the same Karaoke bar.

However interpretation (a) requires this unlikely combination of circumstances.

This leaves two remaining interpretations (b) and (c) above. Either the company was being looted or there were fake profits and the losses described above were fake losses whose accounting function was to make the books balance when there were fake profits elsewhere.

These two interpretations have wildly different implications for the future of Focus Media

The main response to my posts is to say that all I have demonstrated was that Focus Media prior to 2009 was a very dodgy company. Bill Bishop - one of the more sophisticated China watchers - tweeted as much:

Indeed this was also the response to Muddy Waters who alleged fraud at Focus Media about a year ago. There were just a bunch of dodgy transactions.

But my interpretations (b) and (c) above have wildly different outcomes for the stock.

If the company was being looted - as say Bill Bishop and many others imply - then there was something there to loot.

Something there to loot suggests the company really is valuable.

Once the looting stops (and you would presume it would stop after being taken private) then the cash flow is real and can service lots of debt and make the PE buyers rich.

If however (c) is true then the losses recorded in 2009 were fake losses - then the profits recorded were fake profits. If this is the case then the company can't service lots of debt (the profits were fake and you can't service real debt with fake profits) and the PE deal will collapse.

Indeed if the profits were not real then there is nothing there to loot, nothing of any real value - and an end value for the stock is below $2 (and I think probably below $1).

The accounts since 2009

The accounts since 2009 have shown a fairly steady build up of cash and financial assets. The two interpretations have something to say about that.

In interpretation (b) the company was heavily looted in 2009. However it is a valuable company and since then that value has accumulated as cash on the balance sheet. To believe this you have to assume that the management were evil but they somehow turned good.

In interpretation (c) the company was not looted in 2009, just a huge pile of accumulated fake cash was removed from the balance sheet by having fake losses. Since 2009 the company has continued to accumulate fake cash. Eventually that fake cash will also need to be removed from the balance sheet. This situation is just like at the end of 2008 where this interpretation would imply the company had also accumulated a bunch of fake cash only to have it removed by fake losses in 2009. To believe this you have to believe the company is currently accumulating fake assets (including some fake cash).

It is of critical importance to the stock to work out which is true. If (b) is true this deal will close and you will get $27 a share. If (c) is true the deal is likely to fail - and the downside is to maybe a dollar or two a share. [There are reasonable scenarios where the downside is to zero...]

Indications that it might be C and the shares are nearly worthless

There are several things that indicate that it is more likely to be (c) than (b). Here are a few.

The company had a Renminbi shortage in 2006

I know it is a long time ago - but this is a startling disclosure:

In March 2006, Weiqiang Jiang, the father of Jason Nanchun Jiang (the CEO/controller of Focus Media), provided a short-term loan to the Group of approximately $2.5 million to relieve a temporary shortage of Renminbi the Group experienced at that time. The loan is unsecured and was provided to us at no interest. The loan will become due and payable in full on June 30, 2006.

The company disclosed a "temporary shortage of Renminbi". At the time the balance sheet showed plenty of cash and cash generation. The only way that there could have been a Renminbi shortage is if the cash was fake. And the cash was only fake if the earnings were fake. Moreover a Renminbi shortage implies almost no net cash generation - consistent with a worthless or nearly worthless share.

The disclosure of a Renminbi shortage is consistent with interpretation C.

The company appeared to pay cash to a company that did not yet exist

In August 2007 Focus Media purchased a business from Richcom International for over $2 million. The only problem is that Richcom International was not formed until October 2007. In other words it appeared to pay cash to a company that did not exist.

A company that does not exist has a very hard time opening a bank account and hence has a hard time receiving cash.

But it has no problem receiving fake cash (you don't need a bank account for that).

This is consistent with interpretation C. Fake cash paid comes from fake profits.

In 2009 the company essentially gave away almost all the subsidiaries it disposed of, but the accounts showed that those subsidiaries had 27 million in embedded cash

Above there is a list of companies disposed of in 2009. All of those were given back to their original owners. In some cases a small consideration was paid.

However the cash flow statement for the year shows that in excess of 27 million dollars was embedded in the companies that were given back to their owners in 2009.

This could be looting - but is particularly blatant - just giving away cash.

The alternative hypothesis is that the cash embedded was fake. This appears more reasonable to me than actually blatantly just giving away cash.

The company used to overstate its number of movie screens

Overstating things like numbers of movie screens is consistent with overstating revenue. Overstating revenue will give you fake cash as per (c) above.

The company used to say that it had 27,164 theatres on which it displayed averts. There were less than 1600 in all of China at the time. This sort of overstatement leads one to question whether other things are being overstated - and hence fake cash is being produced.

That is supportive of interpretation (c) above.

The company claims extremely high revenue per movie screen

The company later restated down the number of movie theatres it displayed in - but it never restated down the revenue from those theatres. Revenue per theatre ran at over $27 thousand average last year - above the average and near the high-end of US revenue per theatre.

Moreover it was running at roughly a $40 thousand per theatre run-rate in the fourth quarter of last year. That is above the peak in the US.

Advertising rates in China are substantially lower than the US. Moreover my independent inquiries suggest the revenue per screen in China is closer to $7,500 per year.

Overstated revenues means fake earnings and fake cash as per interpretation (c) above.

The company overstated and restated down the number of LCD screens it has

The company recently reclassified a whole lot of screens in the LCD business to the poster-frame business. The reason given was that they were originated by the LCD business and hence counted as LCDs. Perhaps plausible but also consistent with generally overstating things and hence overstating revenue.

Overstated revenue leads to fake cash as per explanation (c) above.

The company claims to make huge margins from a business that nobody finds profitable elsewhere in the world

How many 17 inch displays showing adverts have you seen in residential buildings in countries other than China? They do not exist in Australia. I have not seen them in New York. Sometimes in office buildings or hotels (usually advertising the facilities of the hotel). Never in residential buildings.

That is because nobody can make them profitable in residential buildings outside China.

However they claim over $3000 per screen of revenue in China. If you could get that much revenue in China (where advertising rates are low) you could get more elsewhere and the screens would grow like mushrooms in dark elevator lobbies all over the planet.

They are not.

Either China is really different or the revenue and profits are overstated in China as per interpretation (c) above.

Summary

Most of the evidence is consistent with (c) above. The strange transactions are not looting as the bulls in the stock would suggest. Interpretation (c) is that these transactions are the washing of fake profits by producing offsetting fake losses.

In that case the business earnings are not real and the business cannot support all the debt that the PE firms will laden it with. The private equity deal will fail as the debt defaults.

It is hard to tell what the stock is worth absent a PE bid. However as nobody can make an LCD business substantially profitable in (say) America what is it worth in China where advertising rates are lower?

John

PS. There is someone associated with this deal who has been arrogantly telling friends that they love this blog. They say I am keeping the pricing pressure down and making this deal easier.

If interpretation (c) is right this deal will collapse spectacularly after it closes (the debt will default, the PE buyers will get nothing). And you were warned and continued regardless.

The explanation for your recent arrogance is probably "deal fever". But as I said at the beginning of this sequence of posts private equity has the ability to due diligence and your limited partners will be expecting rigour over hubris.

If you do the deal and it fails spectacularly (despite ample warnings) your limited partners and the regulators will believe something worse than hubris. Probably far worse.

My guess for what they will believe: that you did this deal knowing it to be fraudulent and that you got kick-backs for doing it. They will believe you looted your own funds. That belief may or may not be true - but that is what they will suspect.

If interpretation (c) proves correct and you close this deal your career (and possibly your whole life) will get very difficult indeed.

Of course if I am wrong and interpretation (a) or (b) is true this will be a great deal. Go for it.

J